This month was the best August for the NASDAQ index since the Dotcom bubble 18 years ago.

Both the SP 500 and the DOW Jones 30 indexes posted their best August performances since 2014.

More specifically, Apple shares gained 20% and Amazon shares rose 12.5% during August. Together, these two names accounted for 25% of the entire NASDAQ gain last month.

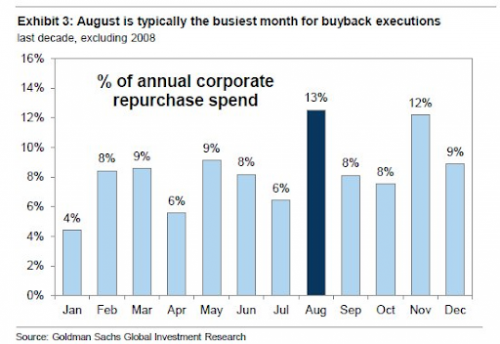

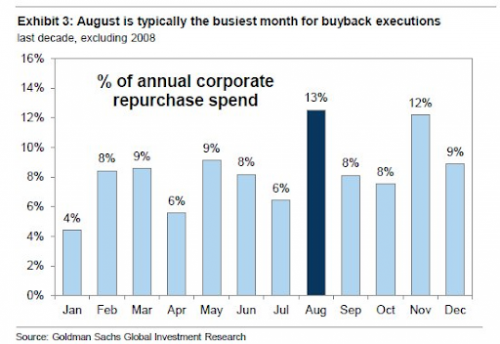

It’s worth noting that share buyback programs for US listed stocks have increased over the last three years and are on track to reach $800 billion this year.

As illustrated in the chart below, August is usually the busiest month of the year for repurchasing stock and the pace drops off during September and October.

With US stocks at record highs and the local ASX index near a 10-year high, we urge investors to approach the market with caution at the current valuations.

Using our ALGO engine, we employ technical indicators to identify stock specific opportunities across a broad market spectrum during all market conditions .

Give us a call on 1-300-614-002 to discuss our current model portfolio holdings.