The US Government Is Back Open………….Until February 8th

The US Senate was able to agree on a short-term resolution to allow the Government to reopen until the 8th of February.

The US has not had a properly ratified budget since 2009 and these “stop-gap” agreements are now getting shorter in duration.

The DOW, S&P 500 and the NASDAQ all responded by making new all-time highs.

Interestingly, as illustrated in the charts below, not only are the 2-yr Treasury notes now yielding more than the SP 500 in the last 10 years, but the Index itself is the most overbought in history.

We suggest that the extreme valuations on Wall Street will soften US yields over the medium-term.

As such, we would expect to see buying interest in the ASX yield names such as TCL, SYD and WFD .

Our ALGO engine currently has flagged buy signals in TCL and SYD at $11.70 and $6.80, respectfully.

2-yr versus SP 500 yields

SP 500 Sentiment Oscillator

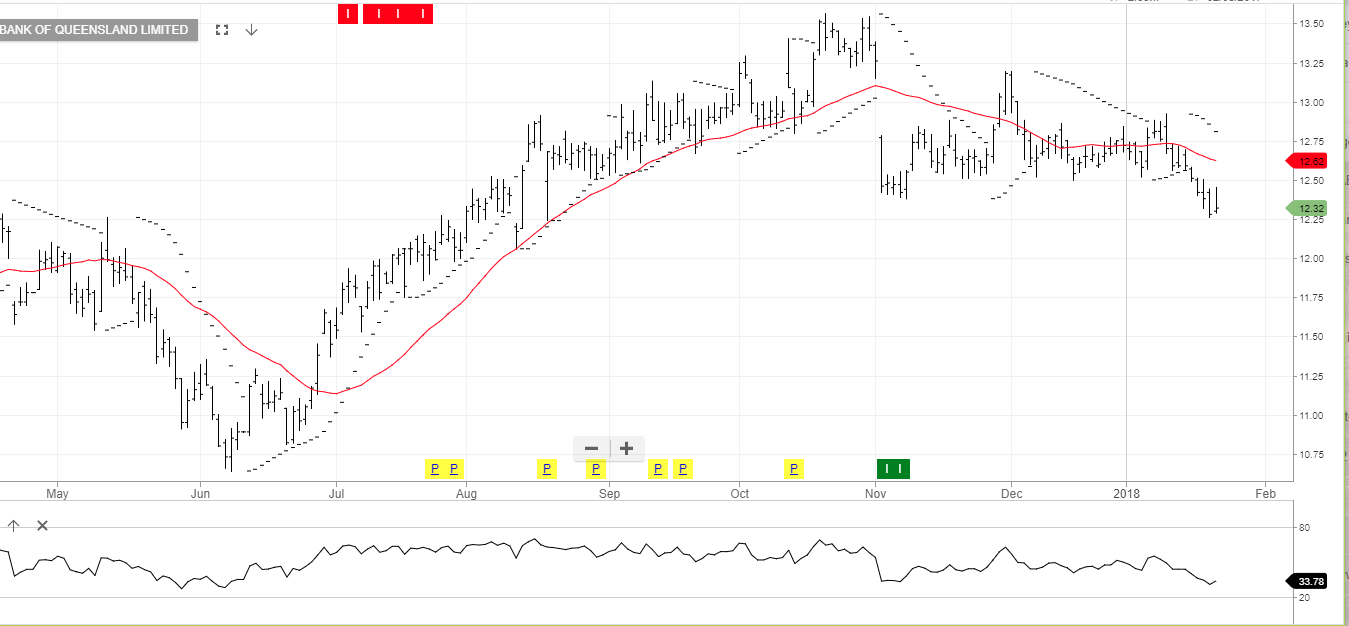

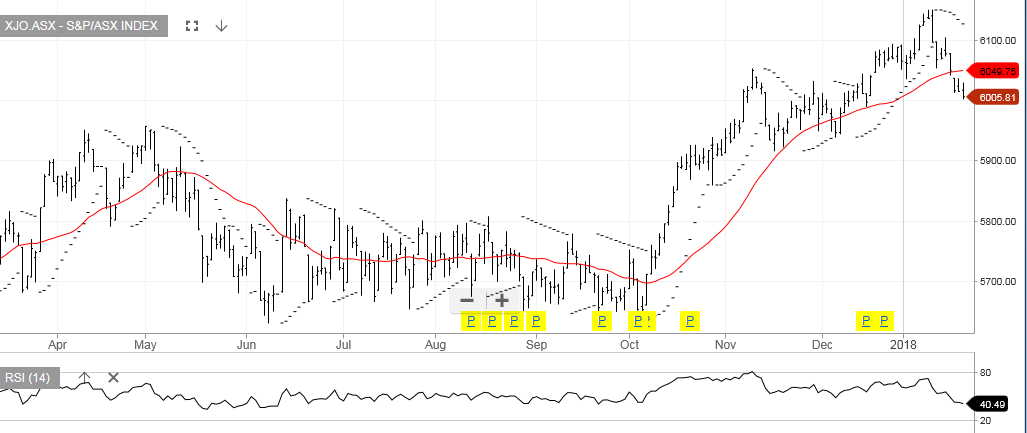

XJO Index

XJO Index