In December, we are conducting the following webinars. Please register your interest by using the register link below. We will email you, one hour before each Webinar begins, with the link to join in.

Register Now

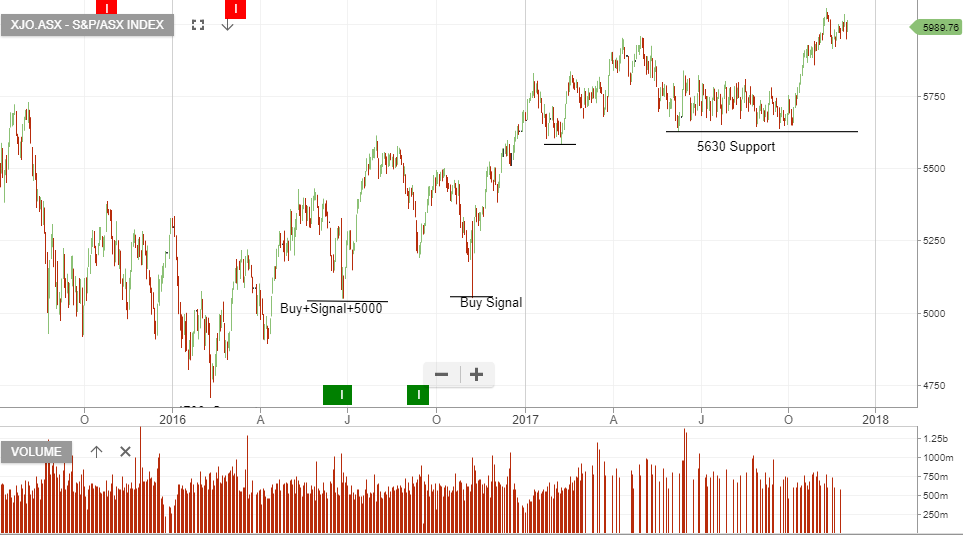

Global Equities Overview and ASX 2018 Market Outlook

Join us in this webinar as we recap on the major trends of 2017 and explore which ones will continue in 2018 and which ones have come to an end. Find out what stocks to add and what stocks to remove from your portfolio, before it’s too late.

- Host: Leon Hinde, Head of Equity Strategy at Investor Signals

- Date: 5th December 2017

- Time: 7pm Qld Time, 8pm NSW/Vic Time, 5pm WA Time

- Duration: 45 min

Don’t miss the opportunity to build your understanding of the big trends impacting equities and, more importantly, which stocks should and shouldn’t be in your portfolio heading into 2018.

Investor Signals – Charts & Algo Engine Explained

Join us in this webinar as we explain the new features and best ways to navigate through the research, charts, algo engine & new model portfolio features. You’ll also be invited to a 30-day free trial of the technology.

- Host: Leon Hinde, Head of Equity Strategy at Investor Signals

- Date: 7th December 2017

- Time: 7pm Qld Time, 8pm NSW/Vic Time, 5pm WA Time

- Duration: 45min

Don’t miss the opportunity to build your understanding on how to benefit from our new technology, as your window to the market.

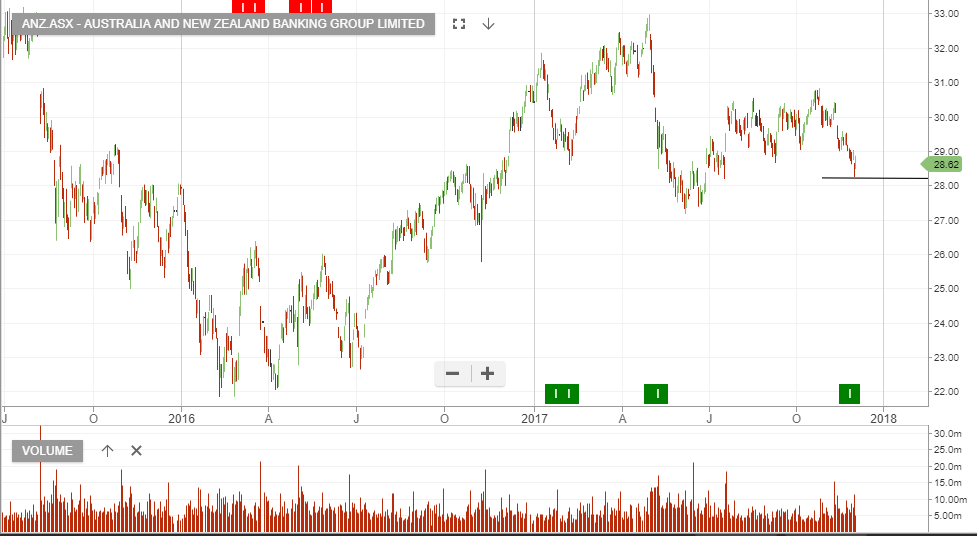

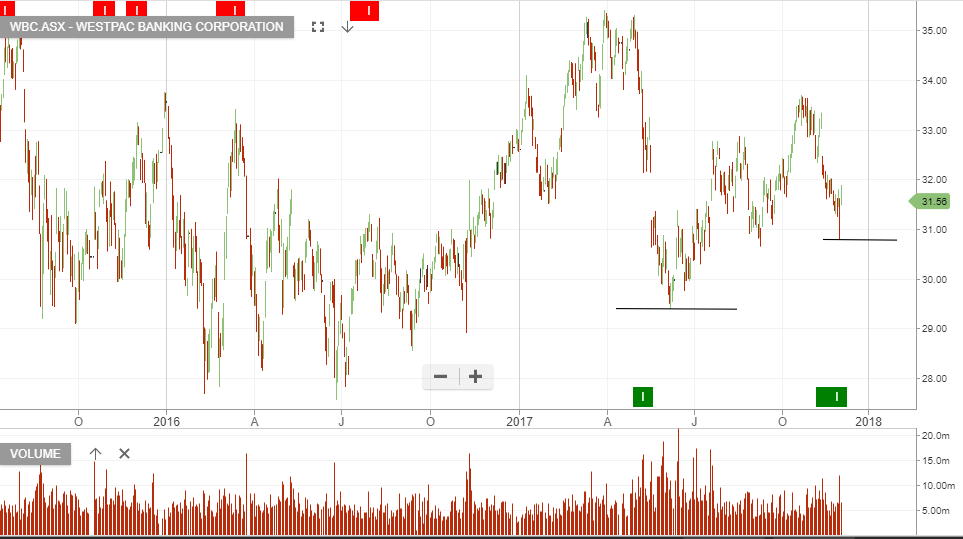

Trading ASX 50 CFD’s with Saxo Go

Join us in this webinar as we look at shorter-term trading strategies for both long & short positions & we review how we utilise the Saxo Trader Go platform to take advantage of trading opportunities within the ASX top 50 stocks. We explore the features, how to place and manage orders and look at how short term traders can use the Investor Signals’ research to trade both long and short signals using CFD’s.

- Host: Leon Hinde, Head of Equity Strategy at Investor Signals

- Date: 13th December 2017

- Time: 12:30pm Qld Time, 1:30pm NSW/Vic Time, 10:30am WA Time (Daytime Session)

- Duration: 45min

Don’t miss the opportunity to learn how we apply proven techniques to shorter term trading on ASX 50 CFD’s.

Register Now

Spot Gold

Spot Gold Newcrest Mining

Newcrest Mining Santa Barbara Mining

Santa Barbara Mining Evolution Mining

Evolution Mining