IPL – Algo buy Signal

Our Algo Engine triggered a buy signal in IPL on the 23rd of May at $3.45.

The price action looks to have found support, at or near $3.50 and adding a long position with stops under $3.50 is worth considering.

Our Algo Engine triggered a buy signal in IPL on the 23rd of May at $3.45.

The price action looks to have found support, at or near $3.50 and adding a long position with stops under $3.50 is worth considering.

The ETF’s covered in this post are all ASX listed products, provided by iShares.

IAA covers the top 50 stocks in Asia. Our Algo Engine triggered a buy signal in November 2016 when the ETF was trading at $62, it is now trading $76

The chart below is the IHK – Hong Kong ETF

The Chart below is the IZZ – China Large Cap ETF

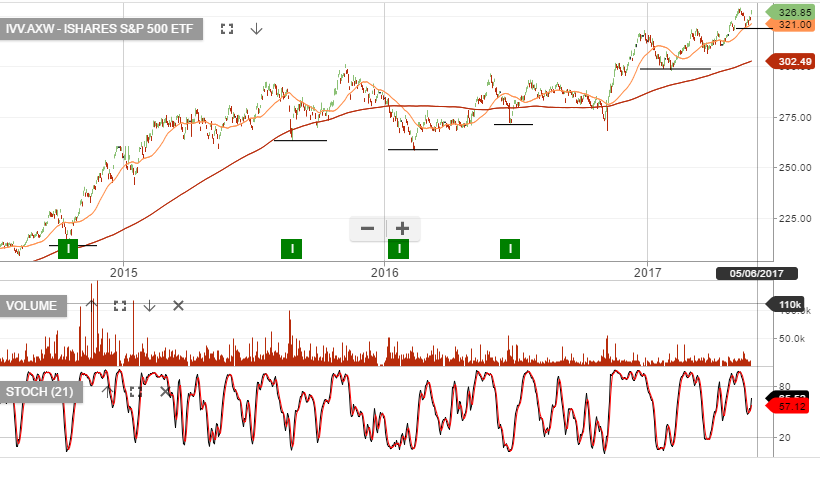

The IVV ETF is based on the S&P500 index in the US, the chart shows the market remains in a bullish higher low structure.

Investors continue to chase equity valuations higher as US GDP deteriorates.

The chart below is the BetaShares NASDAQ 100 ETF. Our Algo Engine triggered a buy signal in early 2016 when the ETF was trading at $10, it is now trading $13.50.

Aristocrat Leisure released 1H17 results with revenue and net profit beating analysts’ bullish expectations. Full year guidance was reiterated with profit growth likely to be + 20-30%.

North America and Digital underpin a strong earnings outlook and the company’s strong balance sheet, will likely see excess capital returned to shareholders and/or new acquisitions announced.

The company declared a dividend of $0.14 for the half-year, which was up from $0.10 in 1H16.

FY18 revenue is likely to increase 10%+ to $2.7b, EBIT $900m on EPS of $0.90, DPS of $0.36, placing the stock on a forward yield of 1.8%.

Our Algo Engine last generated a buy signal in October 2016 at $15.00

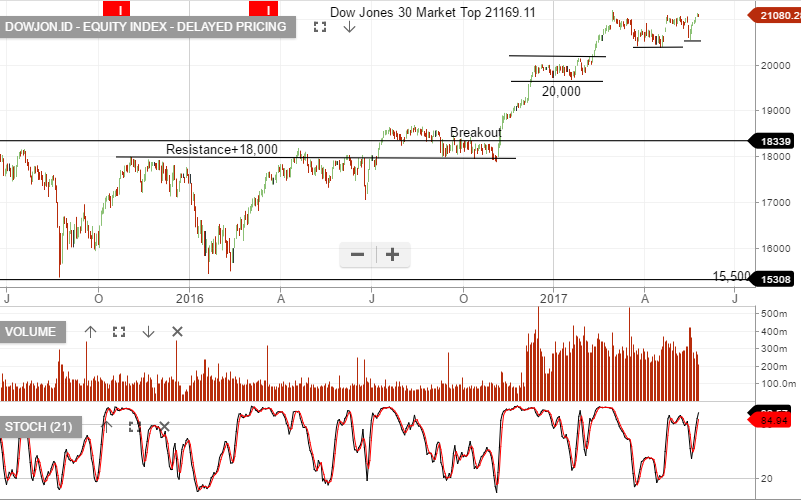

The Dow Jones continues to trade in a sideways consolidation pattern, which began in early March. With the index closing at 21080, the price is now pushing against resistance at the top end of the consolidation channel.

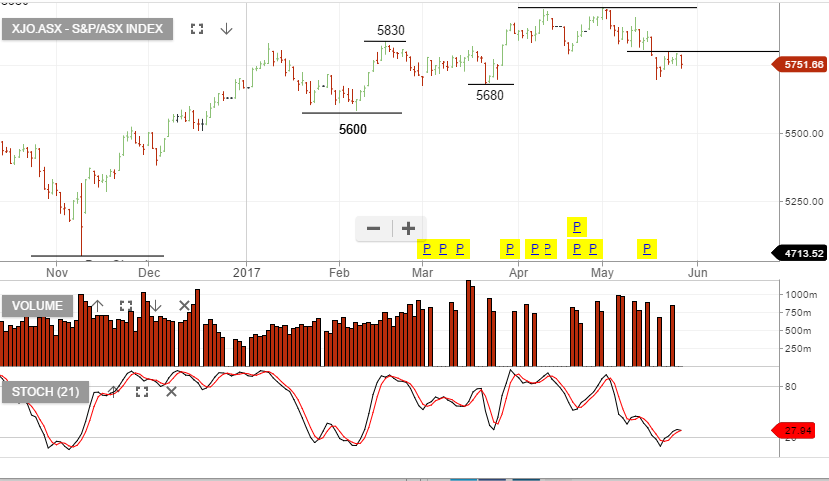

The XJO continues to find selling pressure below the 5795 high reached earlier in the week.

The AUD/USD ended the week with a softer tone at .7450, as S&P lowered the credit scores of 23 Australian financial institutions and Moody’s downgraded China’s sovereign credit rating.

This week’s retail sales and manufacturing data will have an impact on the next move in the Aussie.

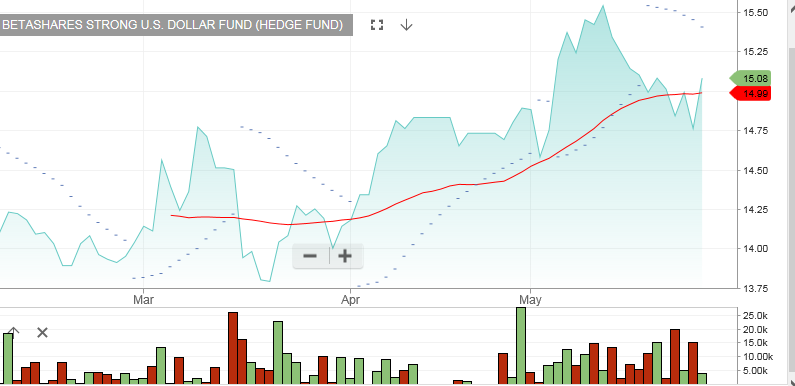

Investors looking to profit from a lower AUD/USD can buy the BetaShare inverse ETF with the symbol: YANK.

The current price of YANK is $15.08. When the AUD/USD fell to .7330 on May 9th, the price was $15.55.

We estimate that when the AUD/USD trades down to the January low of .7160, the unit price for YANK will be approximately $16.50.

BetaShare YANK ETF

BetaShare YANK ETF

Since the beginning of May, shares of the “Big 5” banking stocks have dropped between 8 to 10%.

We expect to see a bounce of some degree in the near-term, but it’s difficult to predict which name will see the most significant rebound.

For investors looking to take a step back into the long side of the banking sector, we suggest the Vaneck banking EFT with the symbol: MVB

This Exchange traded fund has dropped from $30.00 on April 27th the current price of $27.30. We believe a small allocation at these levels, for a bounce back to $28.75 would represent a solid “tactical” trade.

MVB Aussie Bank ETF

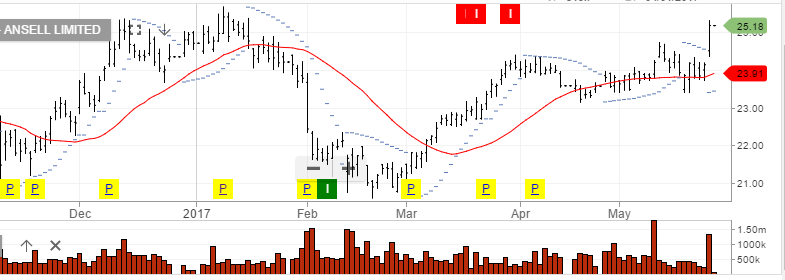

Shares of Ansell (ANN) reached a 5-month high of $25.30 yesterday as a Chinese consortium agreed to buy part of their non-core asset group for $800 million.

In announcement after the agreement, ANN officials outlined a plan to buyback up to 10% of the company’s common stock over the next 12 months.

We believe this development will underpin the share price to the downside. However, $26.00 could could be a difficult level to clear, even with the buyback.

With today’s sharp sell off into the $23.00 handle, ANN shares are a good candidate for a buy/write strategy. Selling the $26.50 calls into December will enhance the returns, and keep investors exposed to the August dividend of approximately 32 cents.

Ansell

Did you know, that as a subscriber, you can always take a sneak peak at Leon’s personal charts? It’s pretty easy…

If you’re not a subscriber, then register for our Free Trial to try it out today or get in touch with us.

If you are already subscribed, then try it out now.