AMCOR – FX Headwinds

After meeting price resistance at $15.00 yesterday, shares of Amcor have opened over 1% lower $14.80.

Earlier in the year, the firm’s multi-currency revenue stream was considered a tailwind. However, with the USD trading sharply higher against the AUD and the EURO, these trends are now seen as a headwind to market earnings forecasts.

This means that our 1H 2017 forecasts are expected to show a marginal fall in profits from US$ 310 million to just above UD$ 300 million, or about 6% lower on a reported USD basis. For the full year in FY 2017, our constant FX forecasts are unchanged at US$ 700 million, which implies 5% YoY growth.

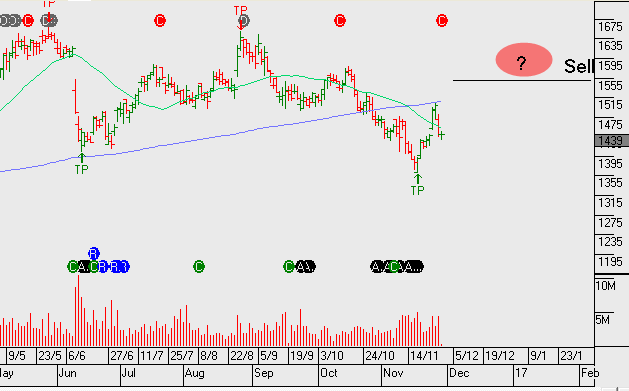

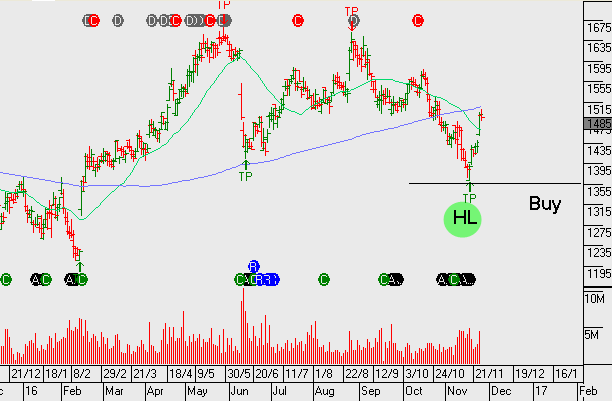

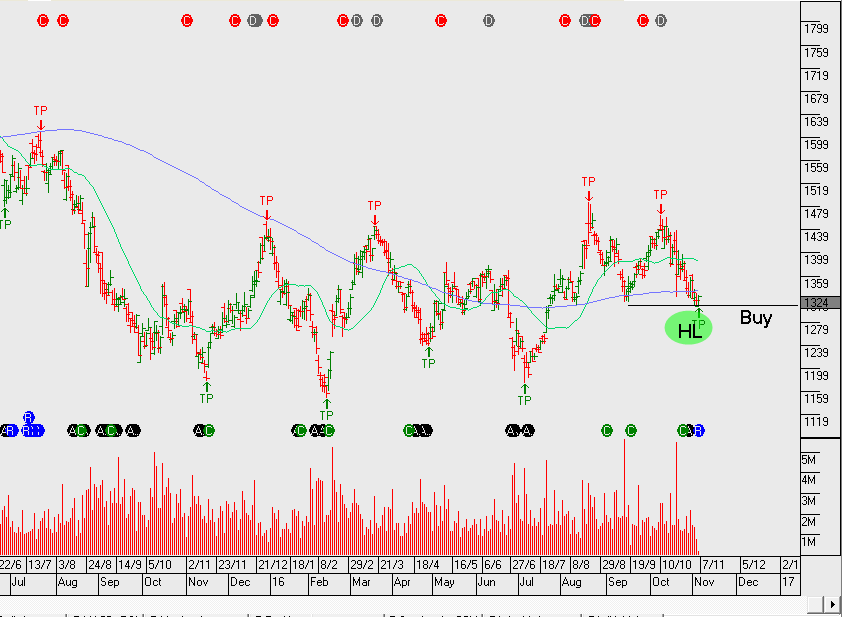

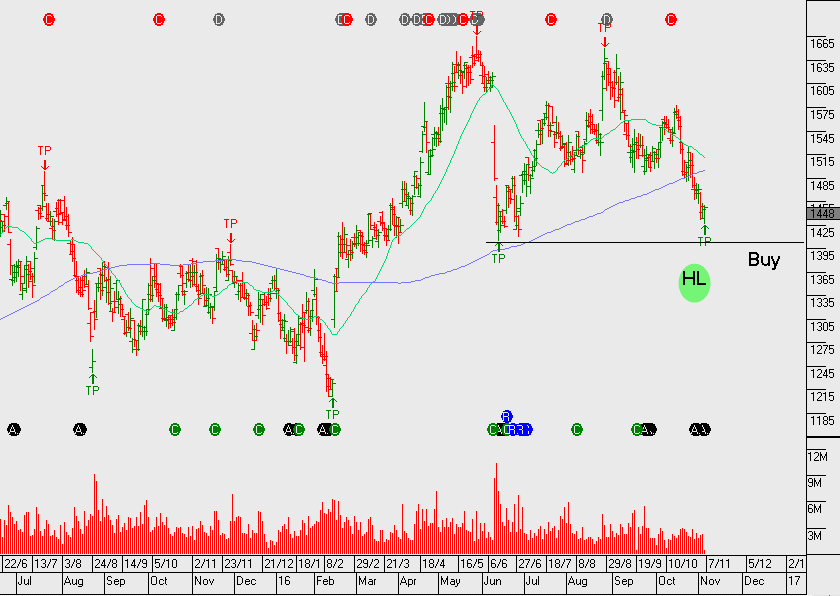

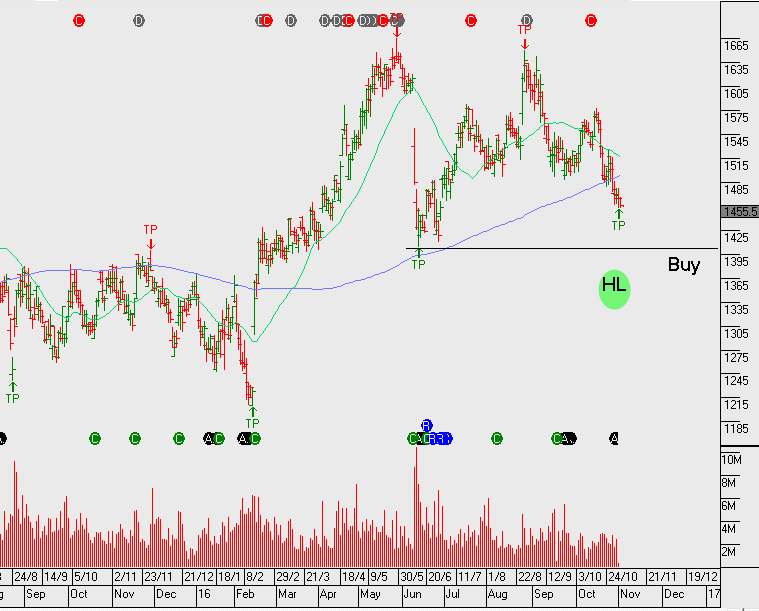

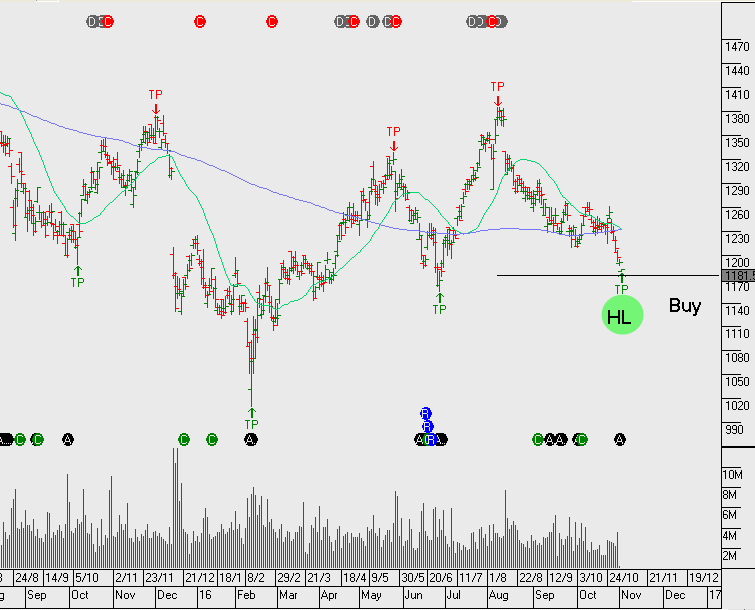

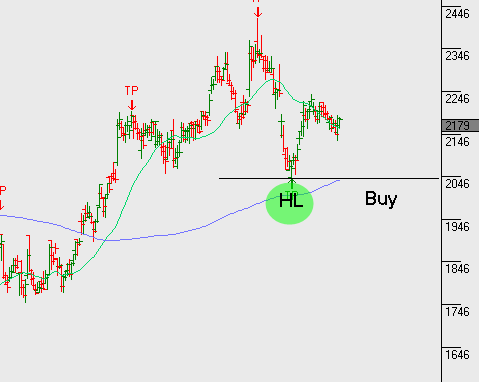

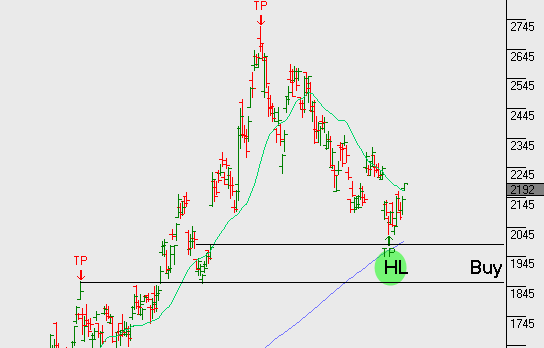

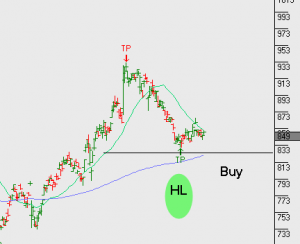

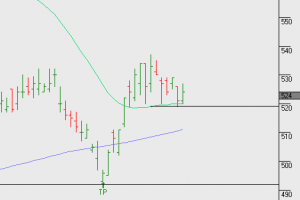

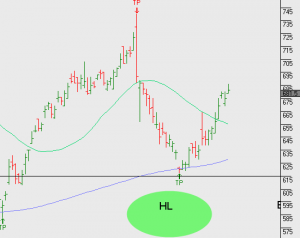

As such, we expect Amcor shares to trade in a sideways pattern over the medium-term and look to buy on a pull back based on the Algo signal alerts. At this point, with the share price in the upper band of the 6-month range, we will sell the covered call option to enhance yield and reduce volatility.