CIMIC – $44 Support Level

Our Algo Engine triggered a recent buy signal in CIMIC at $43.20 on April 12th.

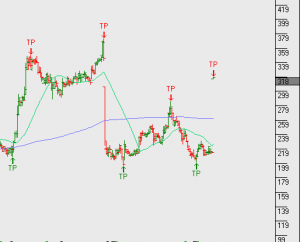

The chart below highlights the buying support developing at the $44 price level.

Cimic

Our Algo Engine triggered a recent buy signal in CIMIC at $43.20 on April 12th.

The chart below highlights the buying support developing at the $44 price level.

Cimic

Our Algo Engine triggered a recent buy signal in CIMIC Group and the price action is now finding renewed buying support near $44.

We’re comfortable with CIMIC’s s strong balance sheet, with $910 million of net cash on the balance sheet after the company added more than $500 millon in FY17.

CIMIC’s first-quarter FY18 result is due tomorrow and revenue growth is expected to be up 5 – 8% at $3.2 billion+ and profit growth up 10%.

CIMIC trades on a 3.8% forward yield into FY19

Our ALGO engine triggered a buy signal for CIM at $48.20 into yesterday’s ASX close.

Shares of the infrastructure contractor have dropped over 8.5% since posting an all-time high of $52.70 on December 19th.

With several large developments planned for domestic capitol cities, we see good fundamental support down into the $47.50 area.

Technically, the internal momentum indicators show the most over-sold condition in the last 18 months.

In addition, we point out that the limited share registry in CIM adds value at extreme price levels.

We see initial price resistance at the January 18th high of $49.70.

Cimic Group

Our ALGO engine triggered a buy signal in Cimic Group yesterday on the ASX close at $38.20.

After posting a new 52-week high of $41.10 on May 24th, shares of CIM had pulled back over 8% to 37.50 before recovering into Friday’s close.

A report that CIM is preparing to offload its 23% stake in Macmahon Holdings and restart its share buyback plan helped the stock find buyers.

This, combined with the credit rating upgrade from S&P in late May, gives CIM a positive outlook going forward.

At 23x earnings, the shares are mildly expensive, but the upside potential to $41.00 sets up a reasonable “buy/write” investment opportunity.

CIMIC Group

CIMIC Group

CIMIC reported Q1 NPAT of $160m which is up over 20% on the same time last year and re-affirmed full year guidance of between $640-700m.

FY18 revenue $17b, EBIT $1b, EPS $2.30 & DPS $1.38, places the stock on a forward yield of 4%.

CIM reported FY16 NPAT of $580m, slightly ahead of consensus.

We like CIM’s leverage to the infrastructure space and the recent acquisition of UGL is a positive.

Over the course of FY18, we see revenue at $17b, EBIT $1.b, EPS $2.30 and DPS $1.30, placing the stock on a forward yield of 3.5%.

The following group of stocks are in either established uptrends or, in recent months they’ve broken downtrends to begin building the early stages of a bullish “higher low” formation.

Many of these names have been mentioned previously in the blog and/or the monthly strategy video report. It’s worth loading these codes into your watch list and considering rebalancing your portfolio to include allocations towards some, or all of these names:

JHX, LLC, MQG, SHL, TWE, ANN, ANZ, ASX, CCL, CIM, COH, QUB, TAH, WOW & WPL.

With the lower growth names within the above basket, such as WOW & CCL, we compliment the position now with tight covered calls to enhance the yield to 10%+ per annum. With some of the other names, we give a little more breathing space as we expect 5 to 10% price appreciation before selling the call option overlay.

CIMIC (CIM.ASX) announced it intends to make a takeover offer for UGL at $3.15 per share. This is almost a 50% premium to UGL’s last traded price and values the business at $520m.

Pre UGL, FY17 EPS growth in CIM is forecast to increase by 5% to approximately $1.90, assuming they payout around $1.10 in dividends, it places the stock on a forward yield of 4%, (100% franking credit).

It’s worth adding CIM.ASX to your watch list as the UGL acquisition will help strengthen the investment case.

CIM.ASX

UGL.ASX

Or start a free thirty day trial for our full service, which includes our ASX Research.