CIMIC (CIM.ASX) announced it intends to make a takeover offer for UGL at $3.15 per share. This is almost a 50% premium to UGL’s last traded price and values the business at $520m.

Pre UGL, FY17 EPS growth in CIM is forecast to increase by 5% to approximately $1.90, assuming they payout around $1.10 in dividends, it places the stock on a forward yield of 4%, (100% franking credit).

It’s worth adding CIM.ASX to your watch list as the UGL acquisition will help strengthen the investment case.

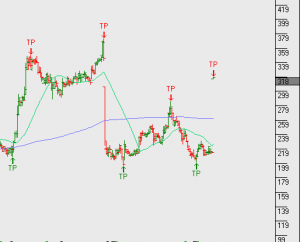

CIM.ASX

UGL.ASX

Garry says:

I remember learning a strategy from Rene’ Rivkin about Takeovers and it never let me down. Takeovers are negotations and the 1st offer is rarely the last. I am happy to aquire some UGL with a view to take profit from the takeover.

Leon says:

Hi Garry,

I was tempted to say something about a position in UGL, for the same reasons you’ve raised above. However, the downside risk to UGL is also greater if the deal doesn’t go ahead. CIM seems to be finding support with or without the UGL deal.