Bank Royal Commission Update

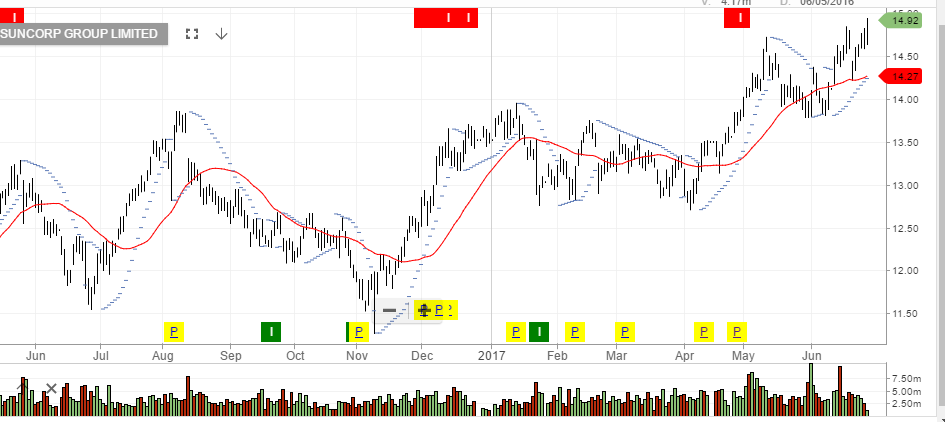

Local banking stocks have found a slight bid in early trade today. However, we expect more downside price pressure as the Bank Royal Commission proceeds.

So far, we’ve seen evidence of appalling behaviour by Australia’s major banks and financial planners from the past decade, including bribes, forged documents and repeated conflict of interest in insurance products.

It seems that the banks discovered long ago it was highly profitable to sell their customers financial advice and financial products.

If they could charge customers for financial advice, and if that “advice” consisted of purchasing their financial products, then they would enjoy a profitable feedback loop.

This model was called ‘vertical integration”, which is inherently a conflict of interest.

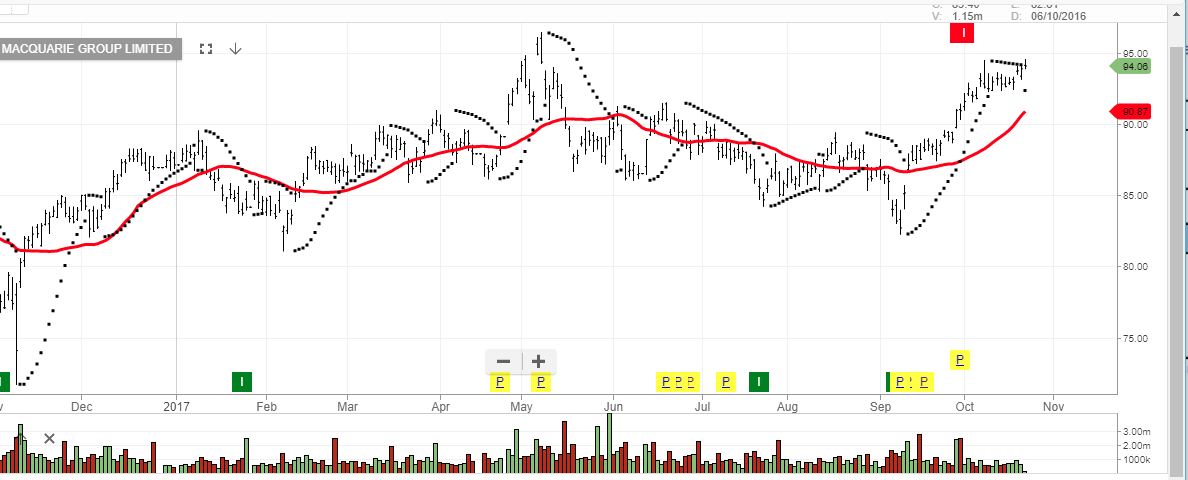

With earning season approaching, we believe there will be some buying interest from longer-term investors.

We will keep a close watch on banking shares and advise which names have met our ALGO price criteria to hold in investor portfolios.

CBA

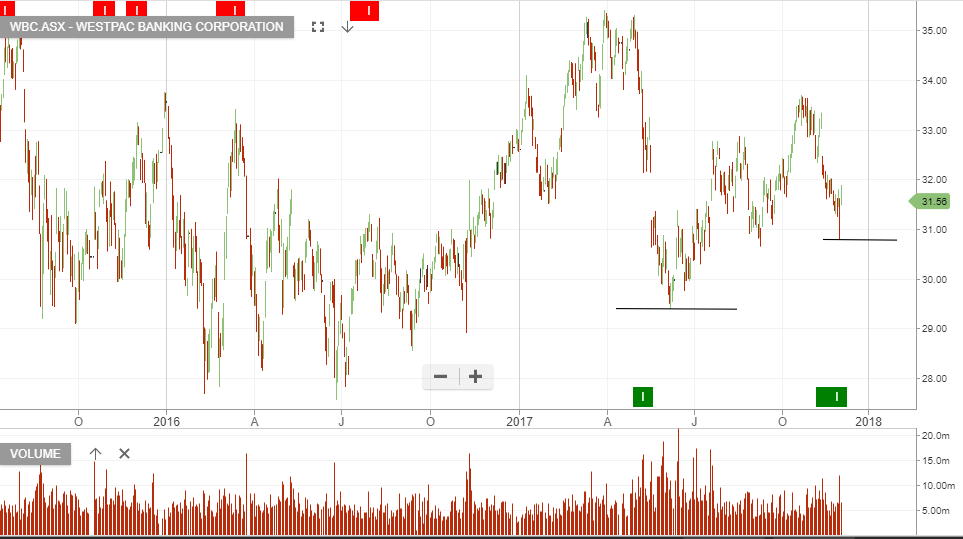

Westpac

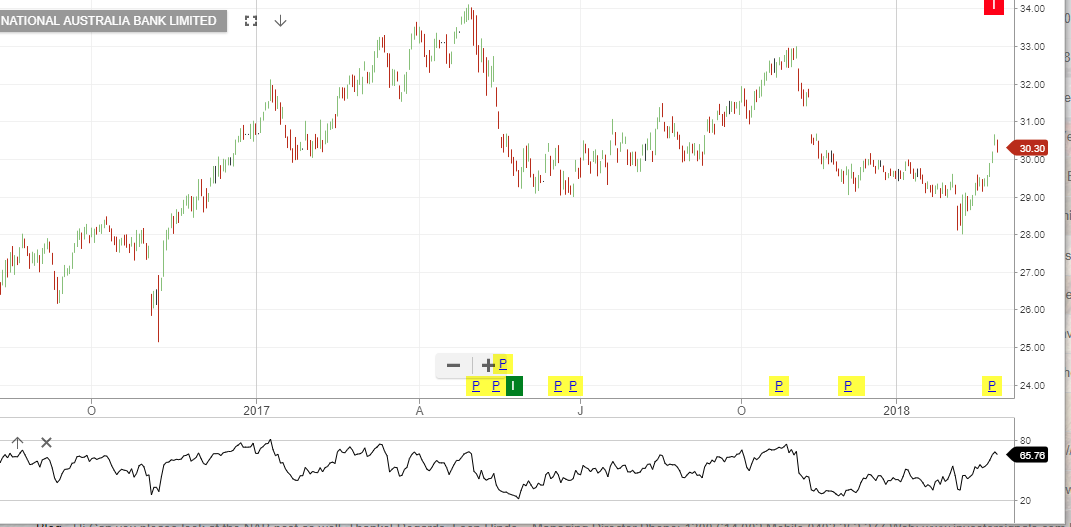

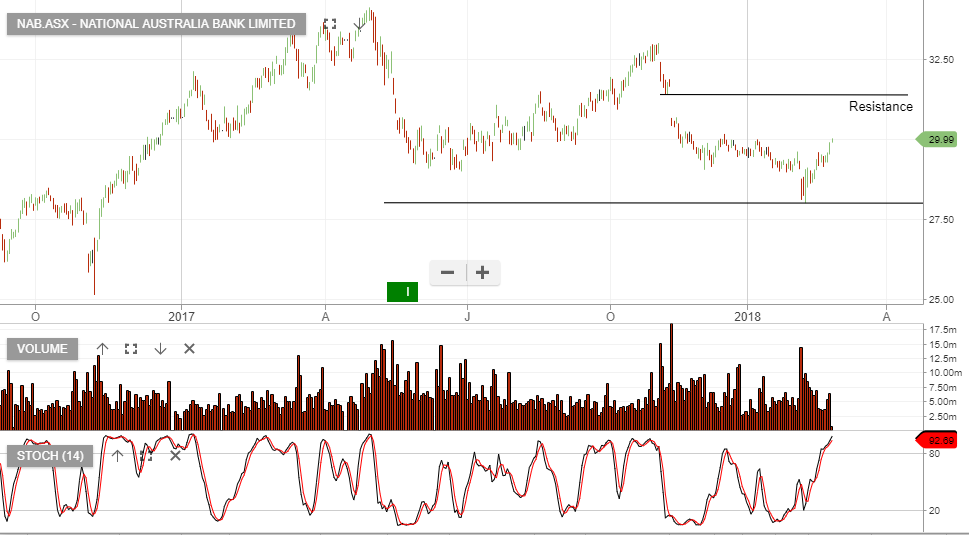

NAB