Origin Energy – Valuation Review

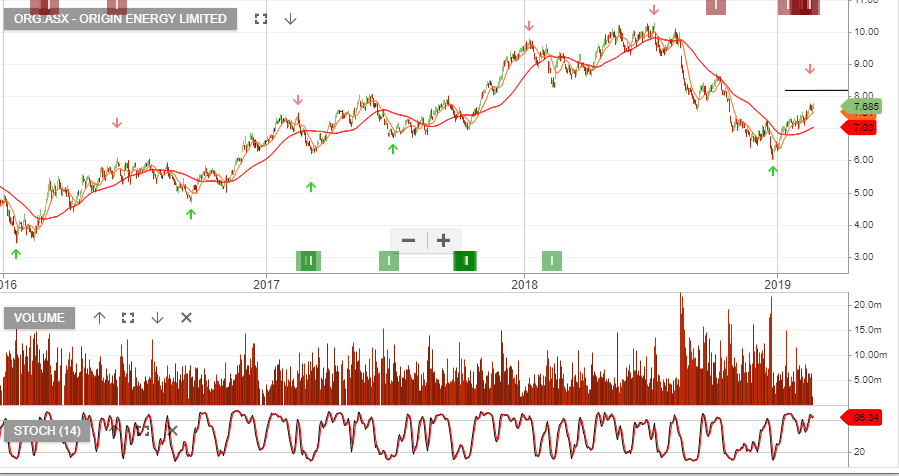

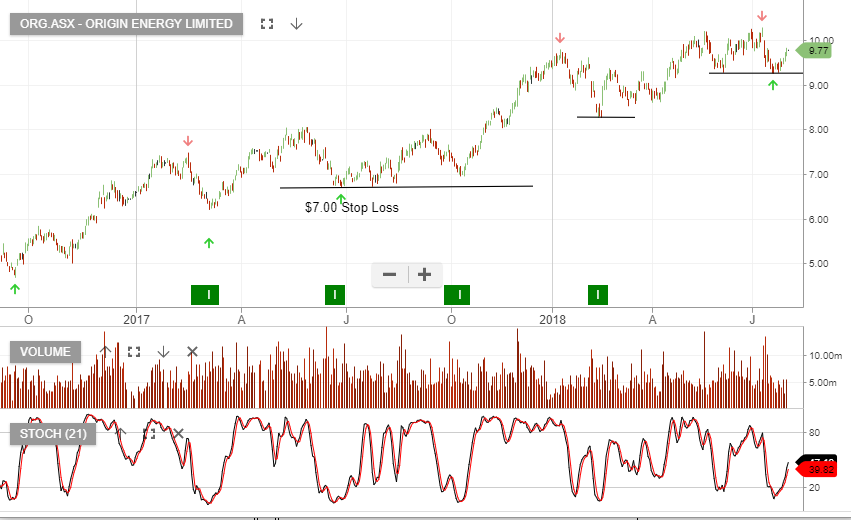

Origin Energy is under Algo Engine sell conditions, however, we see value emerging from a fundamental analysis perspective. This should lead to a switch in the algo model from sell to buy in the near future.

The key positive is the strong cash generation from the APLNG project, which has led to the de-gearing of the company balance sheet. The next key driver will be the reinstatement of the dividend policy which will have the stock trading on a forward yield of 4.5%.

We expect the future dividend payments to steadily increase, which will help support the share price.