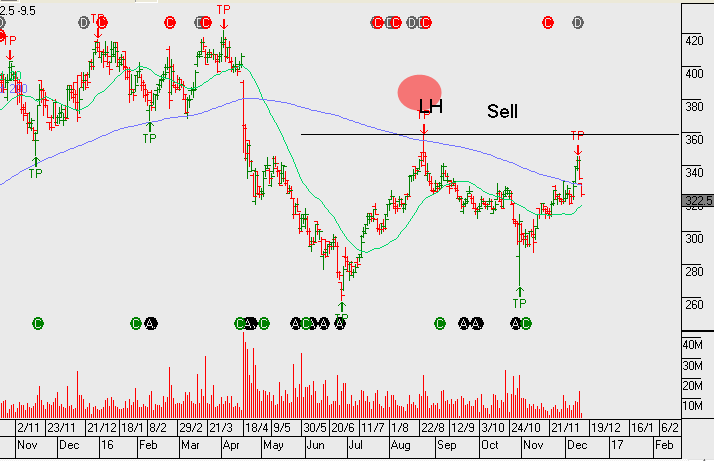

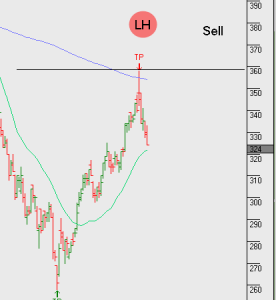

Qantas – breaking out

QAN has enjoyed strong share price performance since the release of its

1H17 results on 23 Feb 17. This has been partly supported by by the share buy-back program which at the current rates will end in the next week or two.

FY18 revenue is forecast to be $16b, EBIT flat at 1.6b, EPS $0.56 and DPS $0.26, placing the stock on a forward yield of 6%.

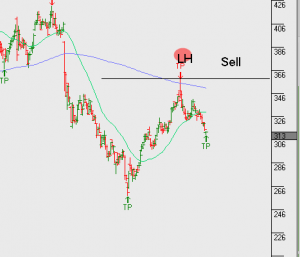

We’ll watch for the next Algo Engine buy signal on the structural higher low formation.