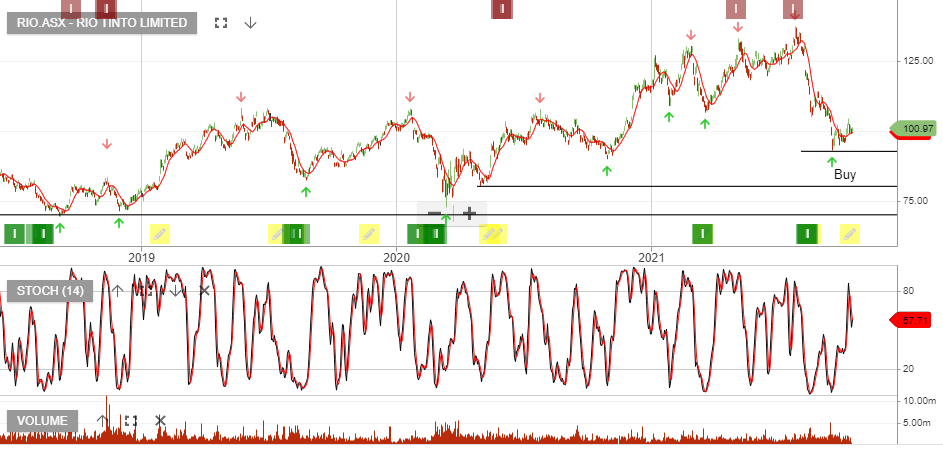

Rio – Rallies 10%

Rio Tinto is under Algo Engine buy conditions.

13/12 Update:

10/1 update: RIO remains our preferred iron ore exposure, we continue to hold the position whilst it remains under Algo Engine buy conditions. Traders may choose to focus on the momentum of the current rally and consider closing the short-term trade should we see a break below the 10-day average.