RIO – Approaching The Buy Zone

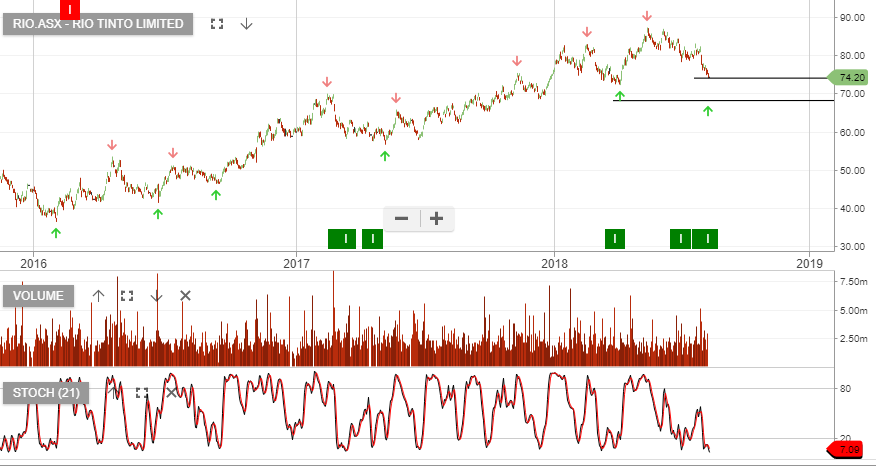

Our Algo Engine generated a buy signal in RIO and the chart below highlights the indicated “buy zone”.

Investors can look to accumulate within $68 – $74 range.

Rio Tinto

Our Algo Engine generated a buy signal in RIO and the chart below highlights the indicated “buy zone”.

Investors can look to accumulate within $68 – $74 range.

Rio Tinto

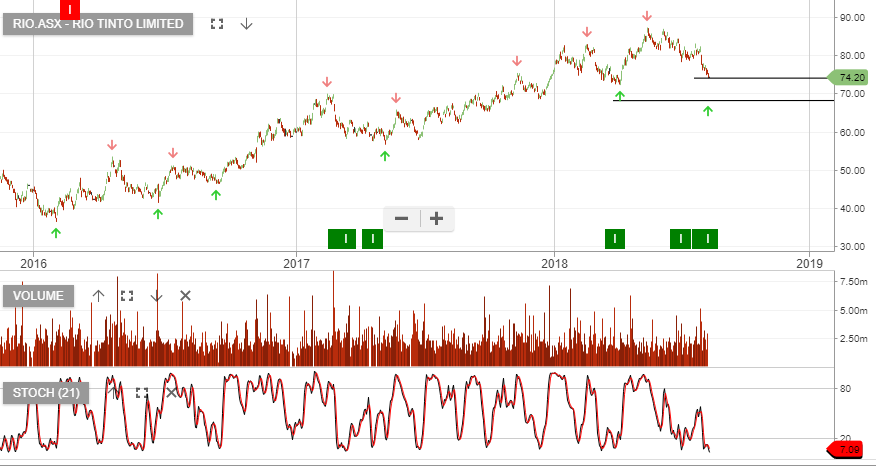

Our ALGO engine triggered a buy signal for RIO Tinto into the ASX close yesterday at $76.50.

This “higher low” chart pattern is referenced to the intra-day low of $72.30 posted on April 9th.

Despite the announced expansion of their share buyback program, RIO’s share price slid more than 5% last week to hit a 3-month low of $76.15.

We calculate that the stock is currently on a 4.5% yield and will go ex-dividend for US $1.70 on Thursday the 9th of August.

From a technical perspective, we see solid support in the $73.25 area.

Rio Tinto

RIO’s 1H 2018 earnings result was slightly below the consensus forecast with underlying EBITDA of US$9.2 billion.

If we assume flat earnings and dividend growth over the next 12 months, it places RIO on forward yield of 4.5%.

Returning cash to share holders through an increased share buy back program, (largely proceeds from asset sales), will help to underpin RIO’s current share price.

We recommend investors add a covered call option to enhance the income returns.

RIO goes ex-dividend US$1.70 on the 9th August.

Rio Tinto

Our Algo Engine triggered a buy signal recently in RIO at $79.00.

We retain our “buy” bias on RIO heading into the 1H earnings result on the 1st of August. Half year forecast net profit after tax is estimated at $4.6b

The result will likely be ahead of analysts forecasts and the company should also announce an increase to their share buy-back program.

RIO goes ex-div $1.40 on the 10th August.

Rio Tinto

Rio Tinto

Shares of RIO are 1% higher at $79.90 in early trade as a recent broker note has reaffirmed their “outperform” rating and set a 12-month target of $94.00.

The report mentions that Iron Ore shipments of 88 metric tons were at the top end of 2018 calendar year guidance.

In addition, shipments of copper and bauxite were also slightly ahead of 2018 guidance.

The company is scheduled to announce their 2018 earnings on August 1st. The forecast numbers are NPAT of $4.6 billion and DPS of $1.36.

RIO was added to our ASX Top 20 portfolio in March of 2017.

RIO Tinto

Our Algo engine generated a buy signal recently in RIO at $80.00 and the stock remains in our ASX50 model portfolio.

In the next 12 months, RIO will generate over $10 billion in free cash flow on top of the $7 billion+ from asset disposals. We anticipate the excess funds will be returned to shareholders though an increased share buyback program.

Of the existing $2.9b buyback, RIO has now completed $1.7b.

FY19 revenue $38b, EBIT $13b supporting a forward dividend yield of 5.6%.

RIO has their June quarter production numbers out tomorrow.

Rio Tinto

Rio Tinto

Our ALGO engine triggered a buy signal on RIO Tinto into yesterday’s ASX close at $79.20.

The “higher low” share price pattern is referenced to the $77.40 low posted on April 17th.

The share price reached a 2-month low of $78.30 yesterday on continued downside pressure on both Iron ore and Copper.

However, a recent broker note from Credit Suisse included a an “outperform” rating with an upside target just over $89.00.

The report cited the recent sale of the miner’s Grasberg asset in Indonesia as providing additional cash to follow through on their $1.3 billion share buyback plan announced earlier this year.

Frequent Blog readers would have noticed that our ALGO engine has triggered buy signals on several resource names (as well as ETFs) over the last month. These include OZL and FMG.

In addition, several commodity and metals-based indexes are testing multi-year support levels as the combination of a stronger USD and threats of trade wars continue weigh on the sector.

In general, we believe a recovery in the broad commodity sector will take more time to form a sustainable base. As such, we’ll watch these resource sector names closely and update investors on specific entry level in future postings.

Rio Tinto

Rio Tinto

RIO reported mixed 1QY18 quarterly production results. Solid result from Pilbara iron ore, with production and shipments of 80+million tonnes in the quarter. This is equivalent to the top end of 330- 340 mt shipment guidance for the full year.

Copper production was largely in line and aluminium was mixed.

Capital management capacity remains high, with US$5bn in divestment

proceeds expected to settle in the next 12 months.

Resource market strength is likely in the last stages of the current rally and investors should look at selling call options or locking in outright gains.

Rio Tinto

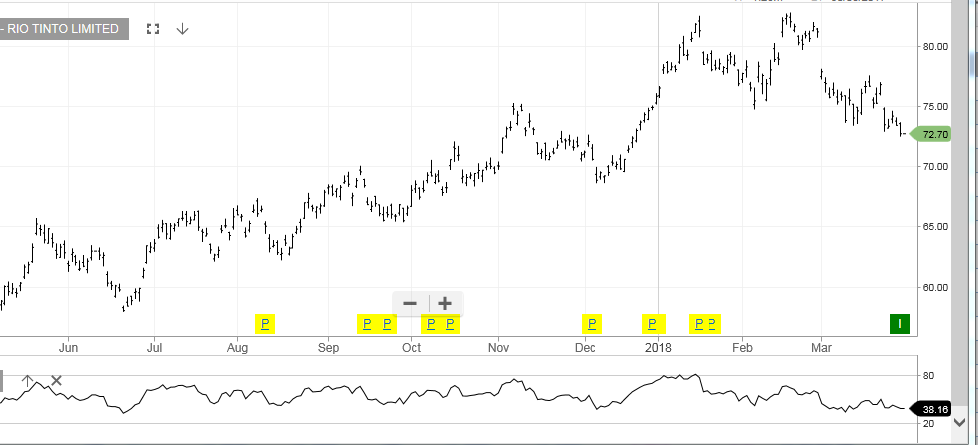

Shares of RIO are up over 1.5%, and have reached a two-month high at $79.40 as the mining giant announced solid growth in shipments across their mineral lines.

The company announced that shipments of Iron Ore from their Pilbara mines rose by 5% along with increased shipments of copper and bauxite.

Our ALGO engine triggered a buy signal in RIO on March 29th at $72.30.

And while the internal momentum indicators look positive, investors should be aware of a potential “triple-top” pattern in the $82.50 price area.

Rio Tinto

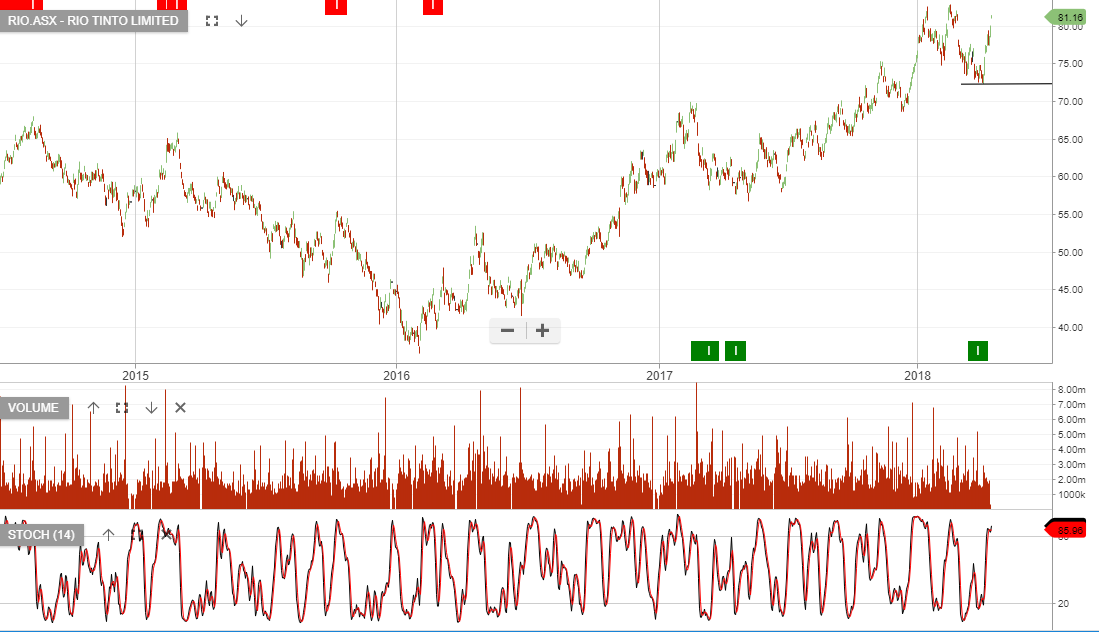

Our ALGO engine triggered a buy signal for RIO into the ASX close yesterday at $72.70.

The “higher low” structure is referenced to the $68.60 low posted on August 12th.

Analysts have retained their buy rating and $90.00 price target on the mining giant’s shares after it announced the sale of its stake in the Kestrel coal mine for US$2.25 billion.

RIO was added to our ASX top 100 Model portfolio last March at $61.40.

RIO Tinto

RIO Tinto

Or start a free thirty day trial for our full service, which includes our ASX Research.