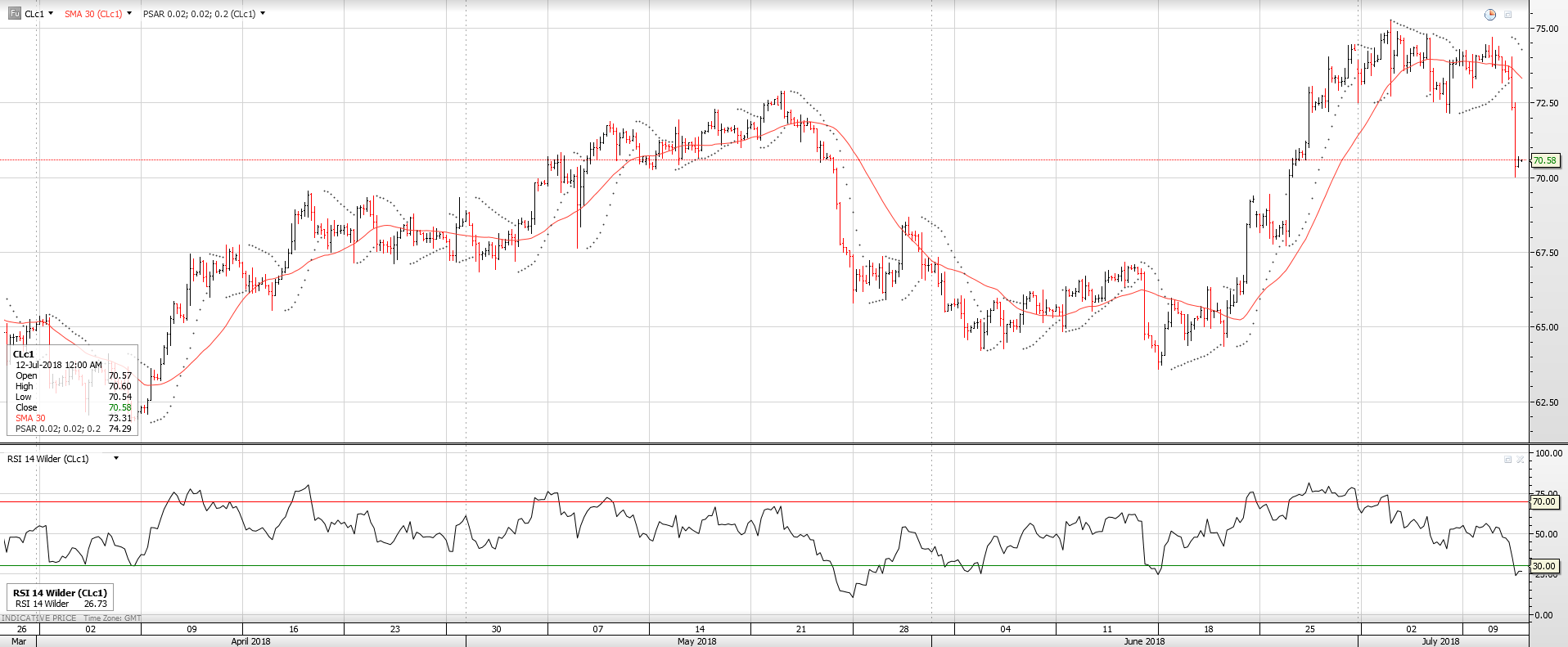

Over the past three weeks, the price of WTI Crude Oil has rallied over 12% and posted a four-year high at $69.35 in early NY trade last night.

However, WTI closed the session down 1.4% at $67.70 after the US and France announced they were close to reaching a deal to renew the Iran nuclear agreement, and a surprise increase of a million barrels in weekly API inventory data.

It’s worth noting that speculators have amassed a very large net long position in the WTI futures market. As of the April 17th report, the non-commercial net long position stood at 728,000 contracts.

This long exposure is just below the record high of 739,000 contracts set in early February when WTI peaked at $66.30.

Technically, the daily internal momentum indicators for WTI are stretched but not yet overbought.

The deadline for renewing the Iran agreement is May 12th. It’s likely that the ongoing negotiations of that agreement will have a strong influence on the near-term price action of WTI.

From a “cause and effect” perspective, any political hurdles in extending the Iran agreement will see WTI trade higher, while the perception of a successful agreement will likely push WTI lower.

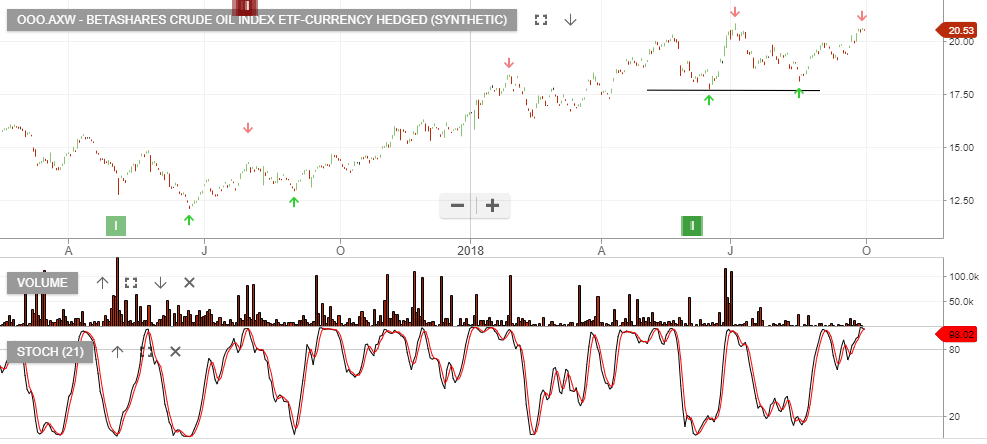

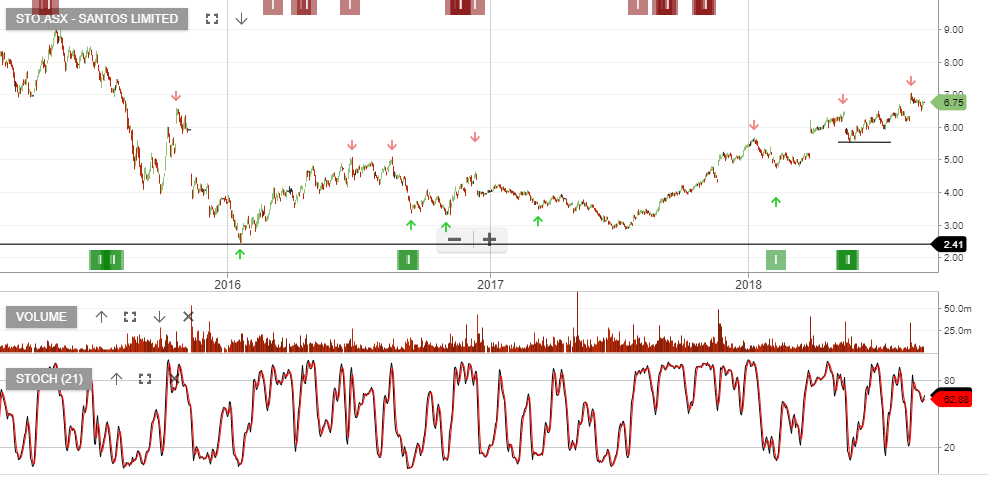

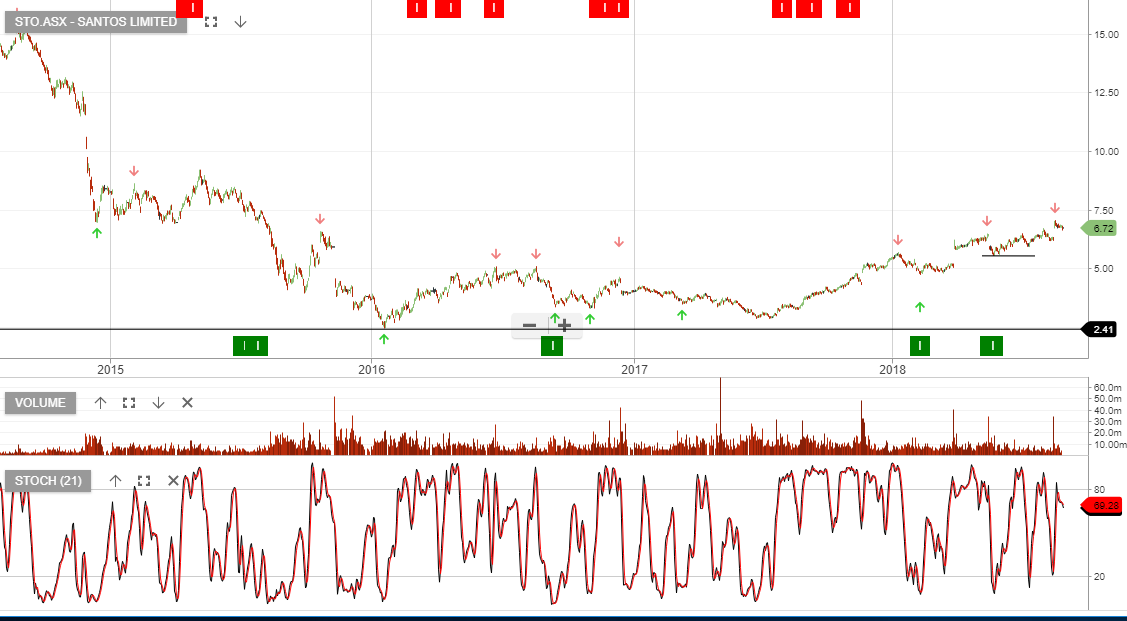

Local shares OSH, STO and WPL have all rallied sharply over the last three weeks and have a strong correlation to crude oil prices.

As such, we urge investors to be cautious of increased volatility in the crude oil market and how it could impact these local oil names.

WTI Crude Oil

WTI Crude Oil

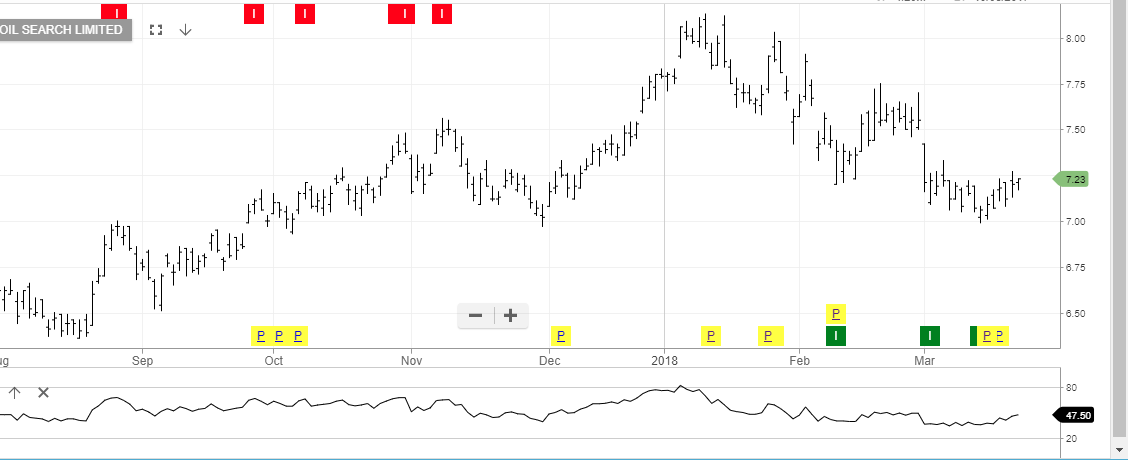

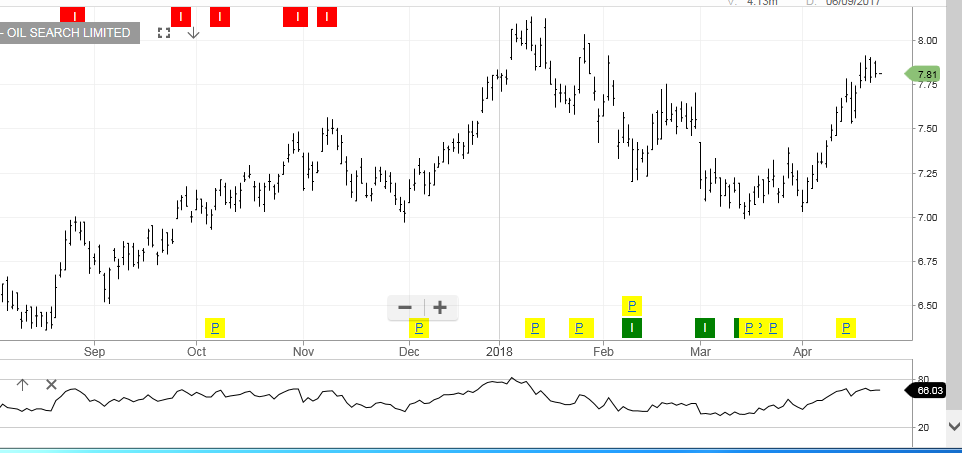

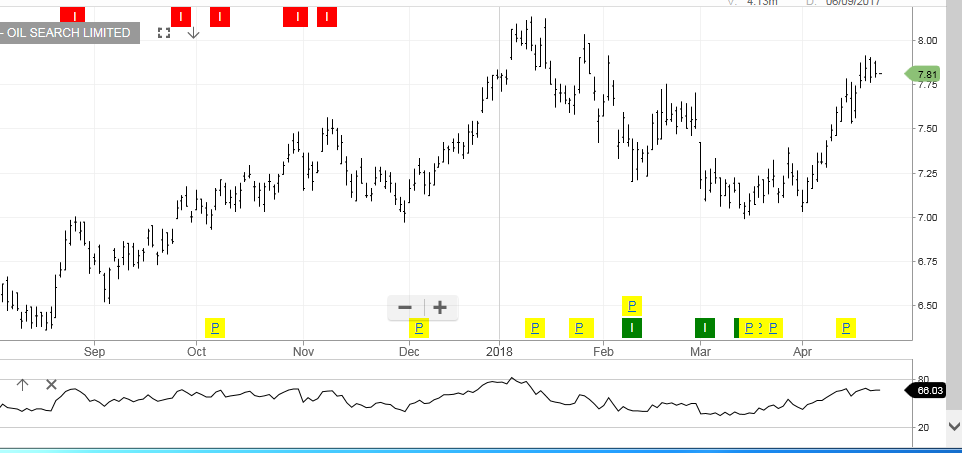

Oil Search

Oil Search

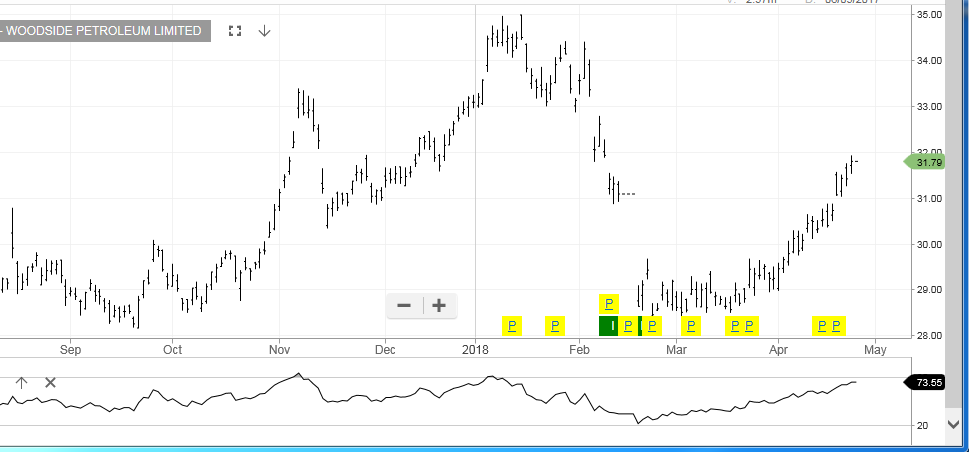

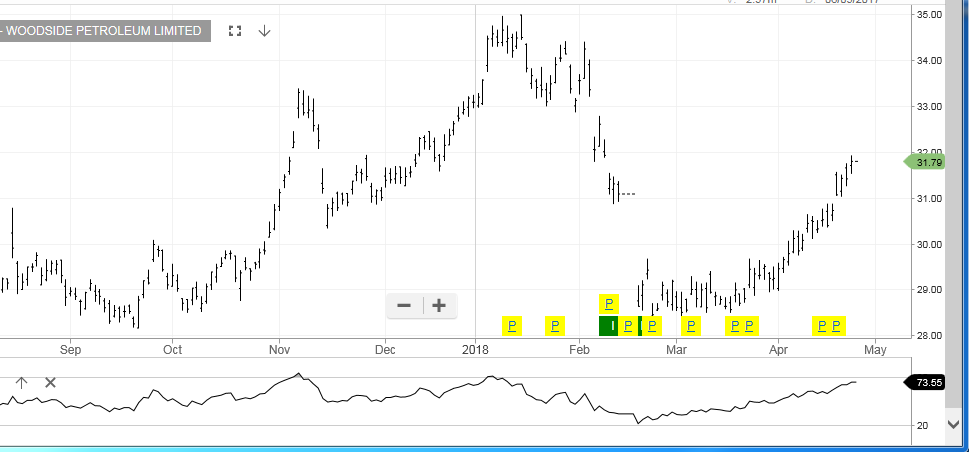

Woodside Petroleum

Woodside Petroleum

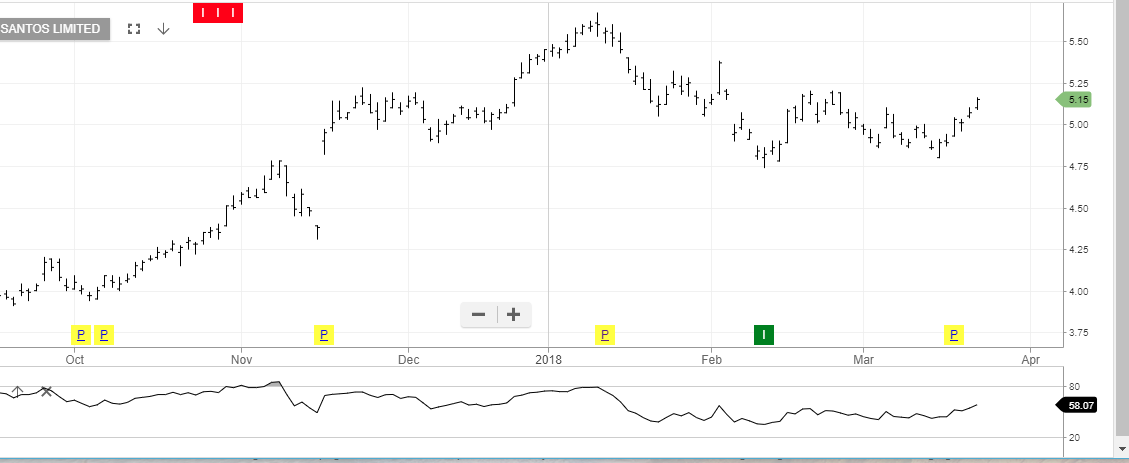

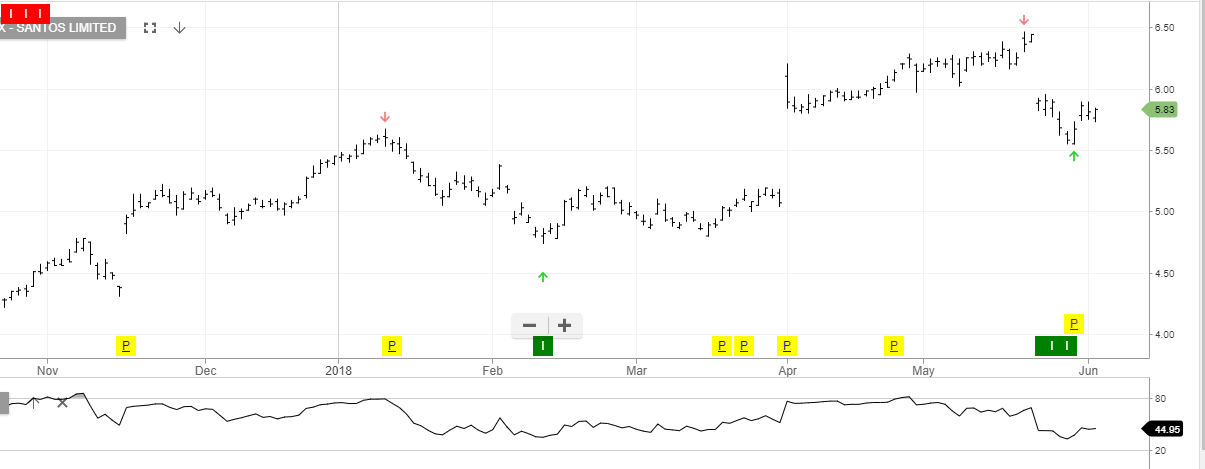

Santos

Santos

STO

STO

WTI Crude Oil

WTI Crude Oil Oil Search

Oil Search Woodside Petroleum

Woodside Petroleum Santos

Santos Santos

Santos