Colgate Shares Post 1-Year Low On Weak Guidance

Shares in Colgate-Palmolive had their biggest one-day drop since July 2010 on weak Q4 sales and negative forward guidance for low growth in 2017.

The company reported Q4 EPS of 68 cents per share on net income of $606 million compared to estimates of 75 cents per share.

Company sales were reported at $3.72 billion, below the year-ago number of $3.89 billion, and below the street’s estimate for Q4 sales of $3.9 billion.

The worst part of the report was the announcement that the company expects 2017 EPS to be flat and in the low single digits on an adjusted EPS basis.

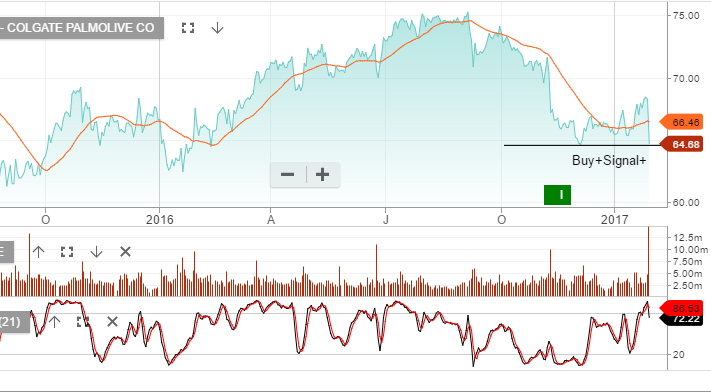

Our Algo Engine generated a buy signal at or near the recent $65 low and with the weakness in the overnight earnings result, we recommend running a stop-loss on a break below 63.50