Following last night’s decision in the US to leave rates unchanged, yield stocks will begin their recovery as we forecasted. See our list of stocks and entry levels from the post dated the 2nd September for further details on specific holdings.

Our base case is for the market to remain stable and quality oversold names will revert back to higher price levels . In addition, our strategy includes earning income from companies with limited but stable earnings growth using covered calls.

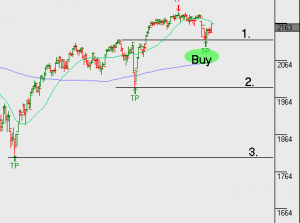

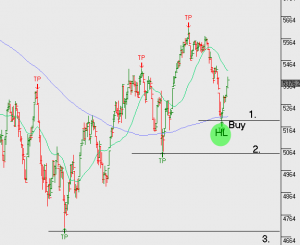

Below, I’ve identified key technical levels to watch in both the XJO and the S&P500 as a mechanism for remaining long the market with a bias toward buy side opportunities. Should the indexes reverse and trade below these levels, we shift our thinking to a more balanced view and begin identifying short trades to help balance the risk in client portfolios.

I’ve used simple numbering 1, 2 & 3, (in charts below), to identify the key breakdown levels that warrant a shift in strategy. To recap, we remain almost exclusively exposed to long positions, with a balanced allocation across asset classes, and hold around 20 preferred names within the ASX top 50 index. In some cases we’ve allowed 5 – 10% capital growth in certain names over coming months. In other names we’ve sold tight covered calls to maximise the income from dividends and call option income.

If the market reverses through the first of our levels, (indicated by 1), we will start shifting our focus to short signals identified by our algorithm engines; which will then start to neutralise the long portfolio bias. When and if this happens, I’ll update you via the blog, otherwise, we continue to hold our “buy on the dip” position.

For more details you may wish to revisit the monthly strategy video posted earlier this week.

XJO 200 Index

S&P500 Index