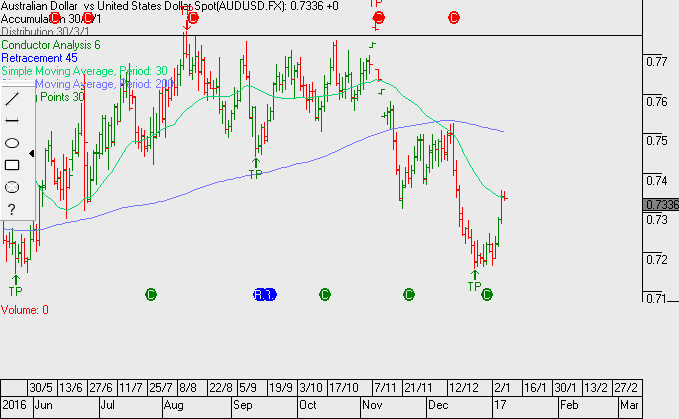

Export Surge – First Trade Surplus in 3 Years

Last Friday, Australia posted its first trade surplus in nearly three years.

The surplus of international goods and services was $1.2 billion for the month of November, which was much better than the market forecast of a $500 million deficit.

The Australian Bureau of Statistics said exports surged 8% in November, while imports were flat. The main drivers for the gain in exports were iron ore and coal, which rose 11% and 25%, respectively.

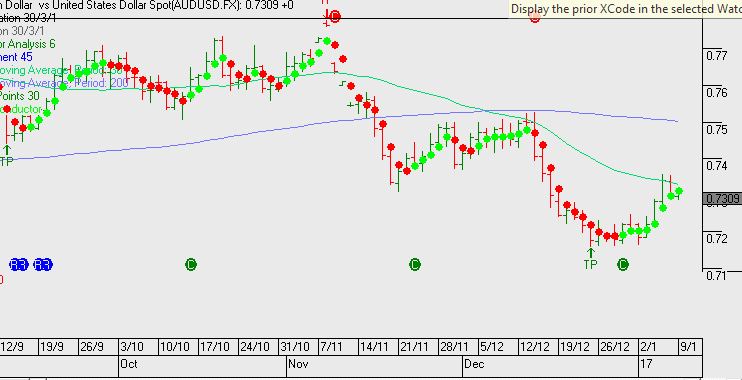

This is positive for the fundamental picture in the Aussie Dollar. We see solid support in the .7290 area with the scope for a move up to the .7430 level in the near-term

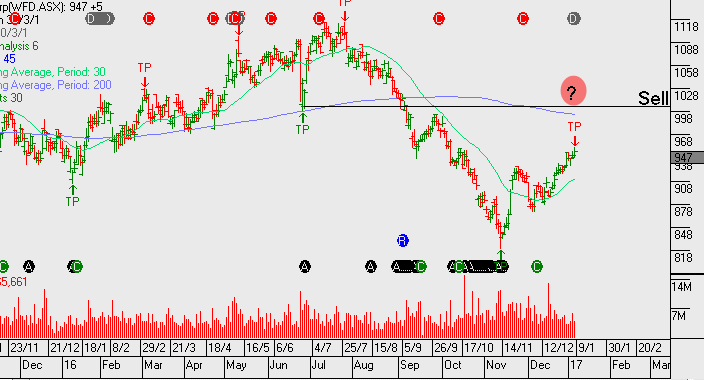

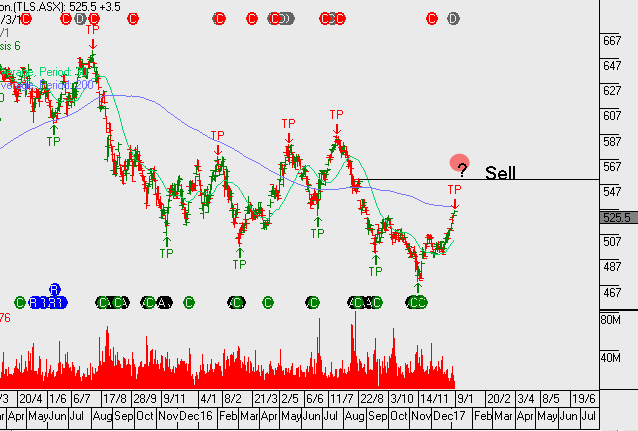

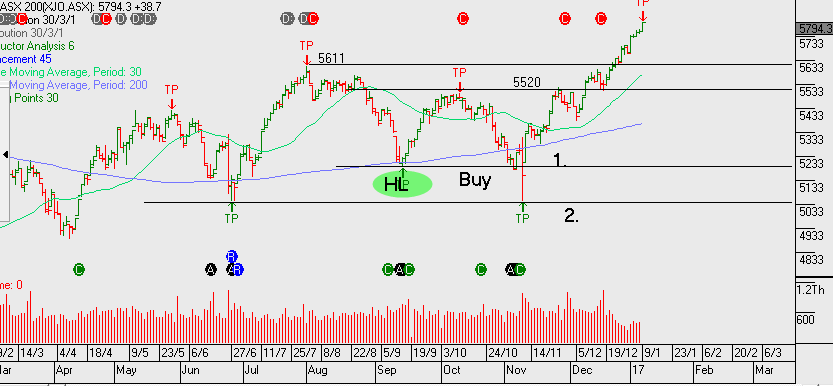

Chart – XJO