The price of Gold posted a low of $1208.00 on July 10th.

Since then, the yellow metal has rallied over 3% hitting a high of $1247.00 in last night’s New York trade.

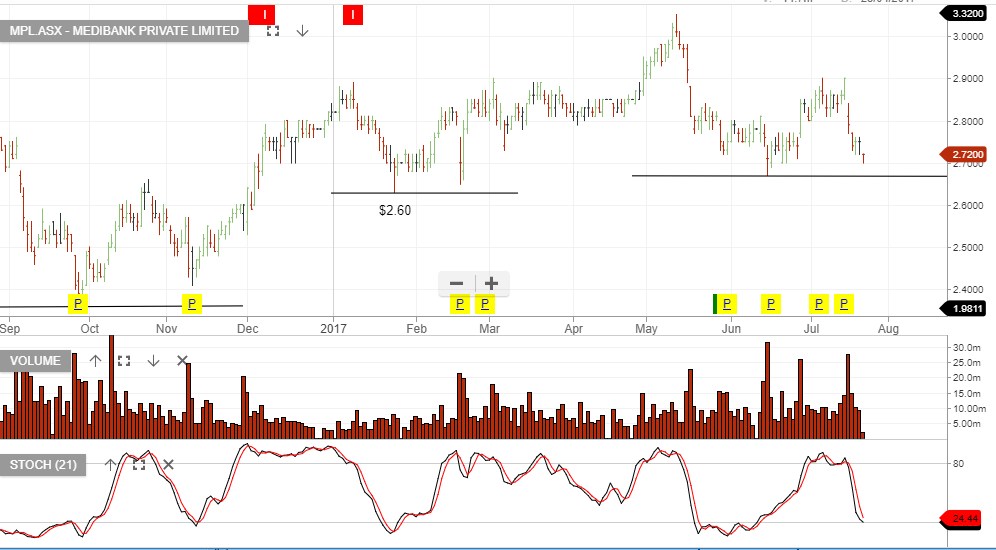

However, shares of NCM have not participated in this recent upswing in Gold and have been trading in a range between $19.50 and $20.00 for the last two weeks.

That could change on Monday after NCM announces their quarterly production report.

Much of the negative sentiment in the stock has centered on the impact of the seismic event and subsequent shutdown of the Cadia mine in April.

And while production numbers from Cadia are expected to fall from forecasts made earlier in the year, it’s also expected that other company assets have been worked harder to make up some of the gap.

On balance, we see the price risk asymmetrically skewed to the upside as the market should be able to look through the one off cost of getting Cadia back in production.

As such, we would expect a neutral-to-positive report to support a move in NCM back into the mid-June price range of $21.50 to $21.75.

Newcrest Mining

Newcrest Mining

VIX Index

VIX Index

Newcrest Mining

Newcrest Mining