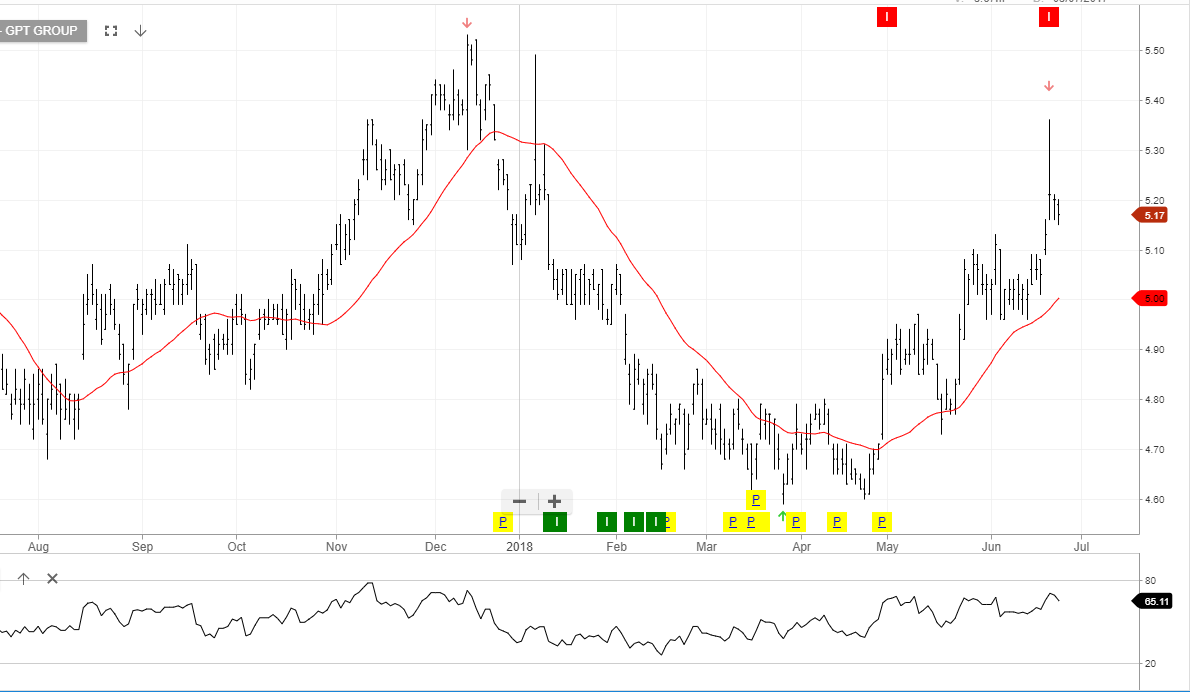

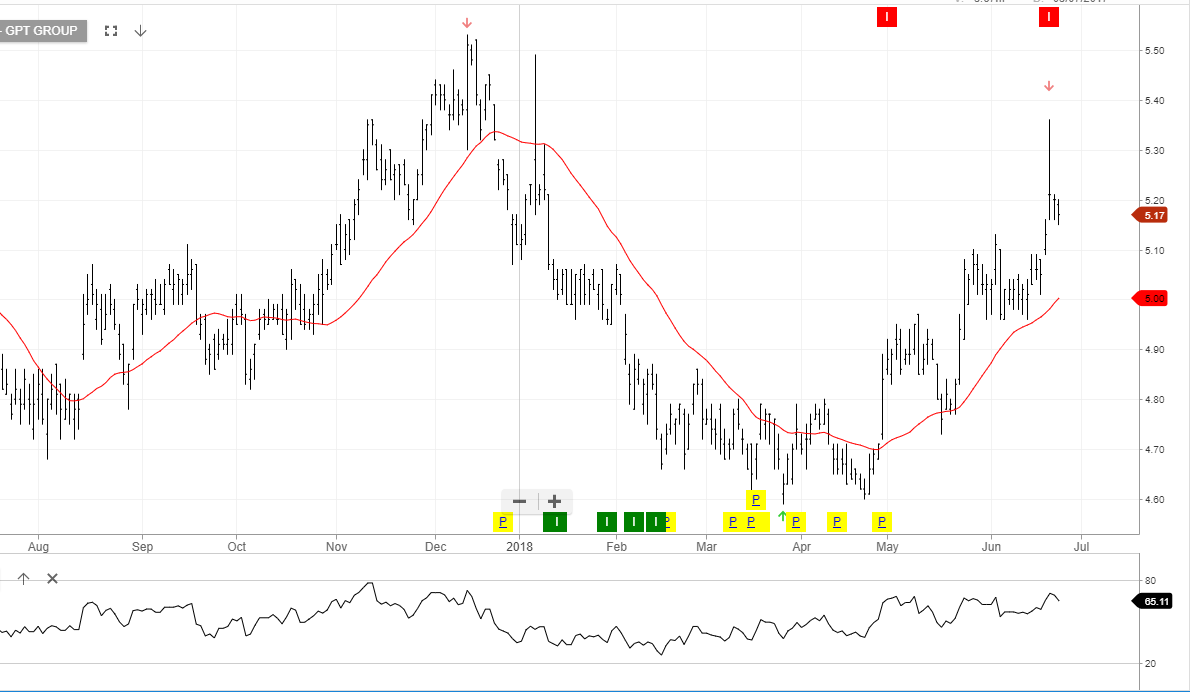

Our ALGO engine triggered a sell signal on GPT on June 21st at $5.36.

This “lower high” pattern is referenced to the high of $5.49 posted earlier this year on January 5th.

It’s worth noting that two other yield sensitive names, TCL and SYD also triggered ALGO sell signals last week. Furthermore, all three of these stocks will go ex-dividend on Thursday, June 28th.

As illustrated in the charts below, all three of these stocks have been in an uptrend since March. We expect this pull back into their dividend should allow for better entry points for medium-term investors.

We see initial support for GPT at $4.70, with a stronger chart point at $4.50.

GPT

Transurban

Sydney Airport

South 32

South 32 Northern Star

Northern Star