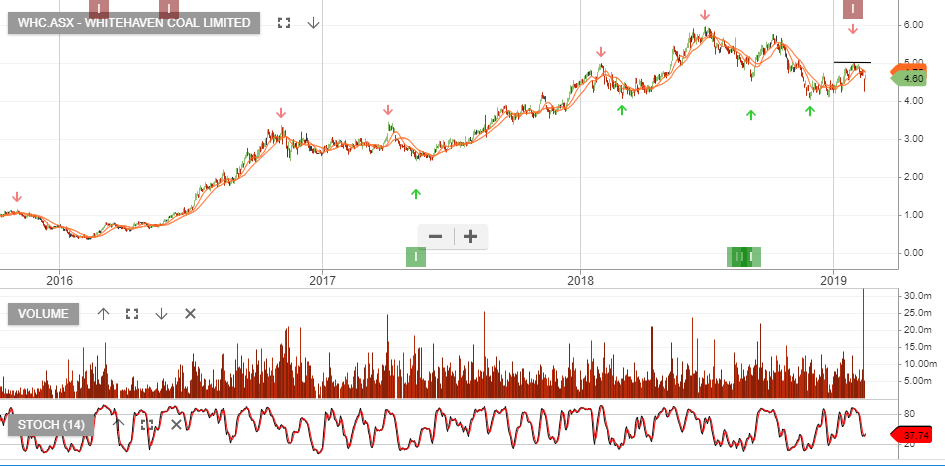

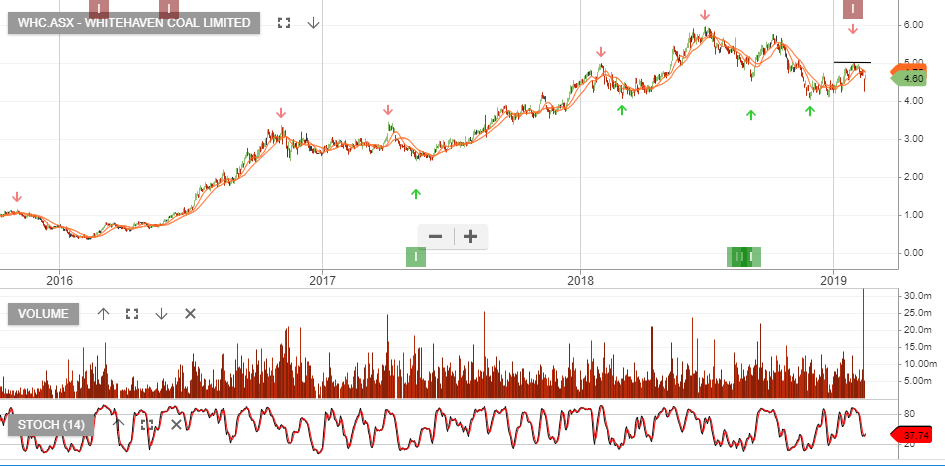

Whitehaven WHC Coal was removed from our ASX100 model portfolio on the 31st January following the Algo Engine sell signal at $4.99

The company announced last Friday, net profit after tax increased 19% to $306m for the six months ended December 31.

The market reacted negatively to the higher production costs and the lower production guidance for the remainder of the financial year.

The stock price has now sold off over 10%, since being removed from the model.

Whitehaven WHC announced a special dividend of 5¢, in addition to the 15¢ interim dividend. This is up slightly on the same time last year.