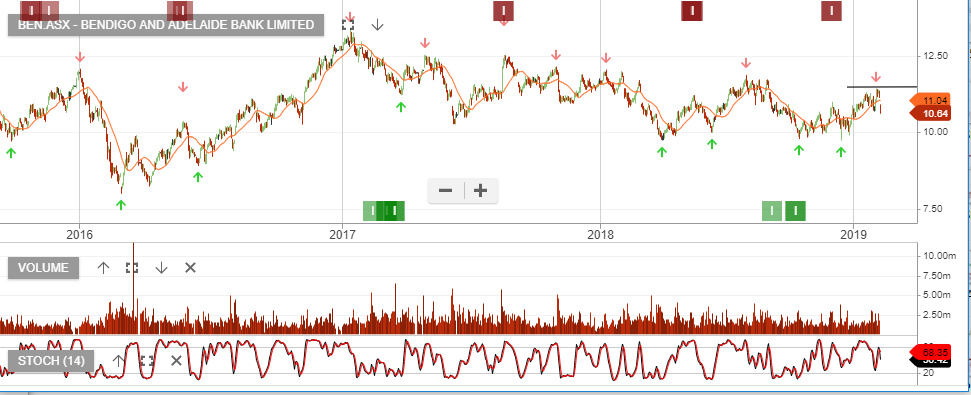

Bendigo Bank – 1H19

Bendigo reported earnings slightly below market consensus.

1H19 cash profit came in at $220m, however, we continue to see challenging conditions for the regional banks.

BEN and BOQ both display lower high formations and are under Algo Engine sell signals.