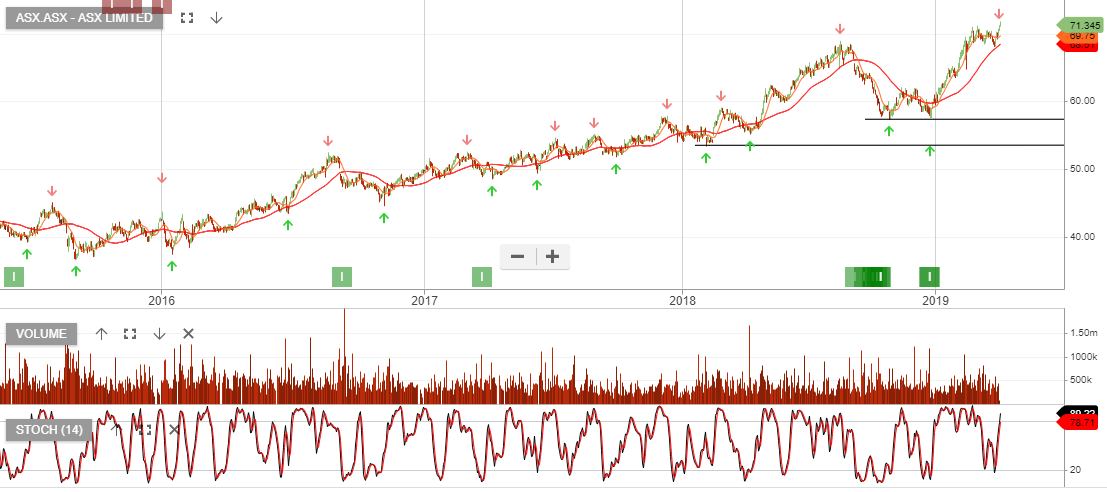

Woodside – Buy Signal

{ASX:WPL) is under an Algo Engine buy signal and we consider the stock a suitable buy-write.

Buying the stock and selling a long dated covered call will deliver 10% cash flow on an annualised basis and provide for a moderate level of capital growth.