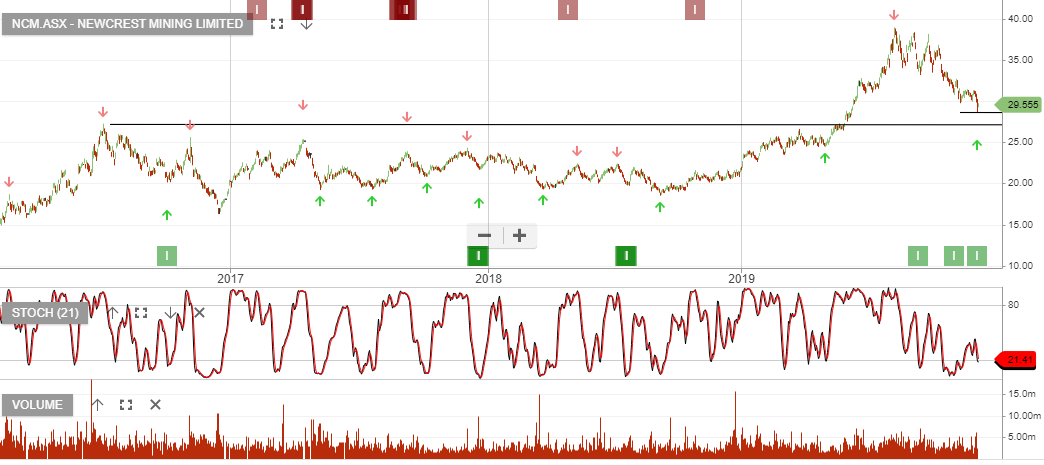

Treasury Wines – Sellers are in Control

Treasury Wine Estates is under Algo Engine sell conditions and we highlight the recent softness in US sales data as a concern.

Sales within Asia continue to offset the US related weakness, however, we expect the TWE share price to remain under pressure.

Based on FY20 & FY21 EPS growth remaining in the 10 – 15% range, we have TWE EBIT growing from $660mn in FY19 to $850mn in FY21. This supports a forward yield of 3%.

We’re not holding TWE in our portfolio at present and we prepared today’s post on TWE as a reminder of the opportunity that lies ahead when the stock switches to buy conditions. We expect to see this in the first quarter of the New Year.

Downside target $15.50 – $16.50