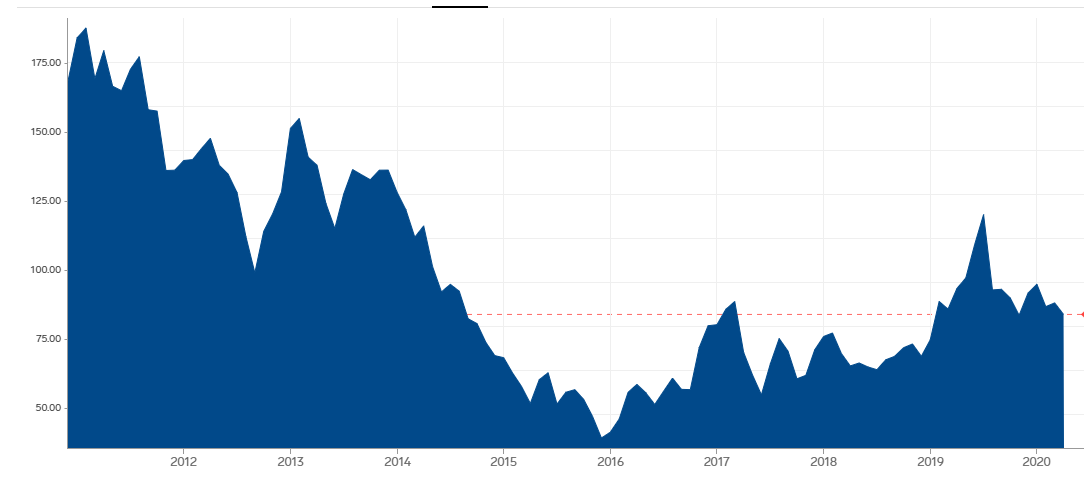

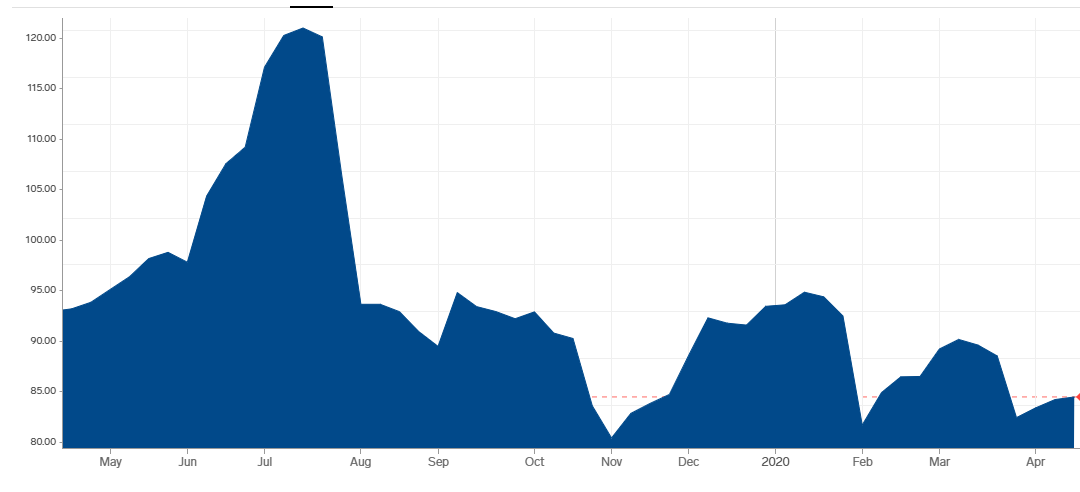

NAB – Warning Plays Out

National Australia Bank 1H2020 profit falls by 51%.

The company also moved quickly to shore its balance sheet following the initial impact of COVID-19 related business provisions. NAB will raise $3.5bn via an institutional placement at $14.15 per share.

The placement will be done at a 10.5% discount.

Our bearish warnings on NAB are still yet to play out completely, as we see further raisings likely in the Sept quarter.