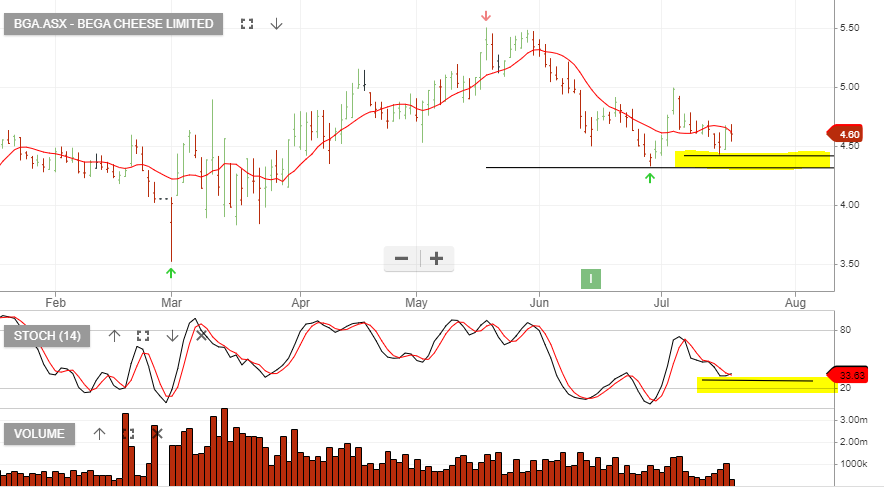

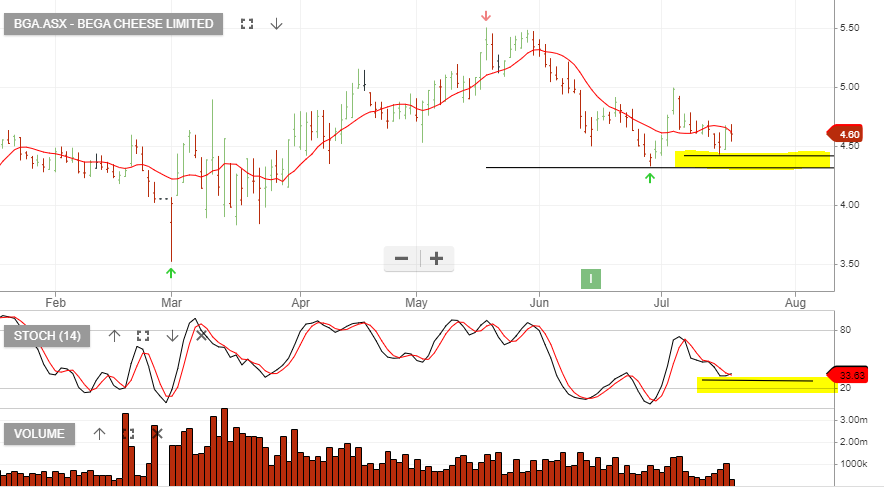

BGA – Back on Support

Bega Cheese is a recent Algo Engine buy signal and we revisit the opportunity as the price action builds support near $4.40.

Bega Cheese is a recent Algo Engine buy signal and we revisit the opportunity as the price action builds support near $4.40.

Brambles Our recent buy advice on BXB is playing out favourably. The stock is now up 5 percent + from our entry-level.

The chart below displays the technical support.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Alumina is under Algo Engine buy conditions and we flagged the recent entry off the $1.55 support.

The stock has now rallied 15% and is trading at $1.81 today.

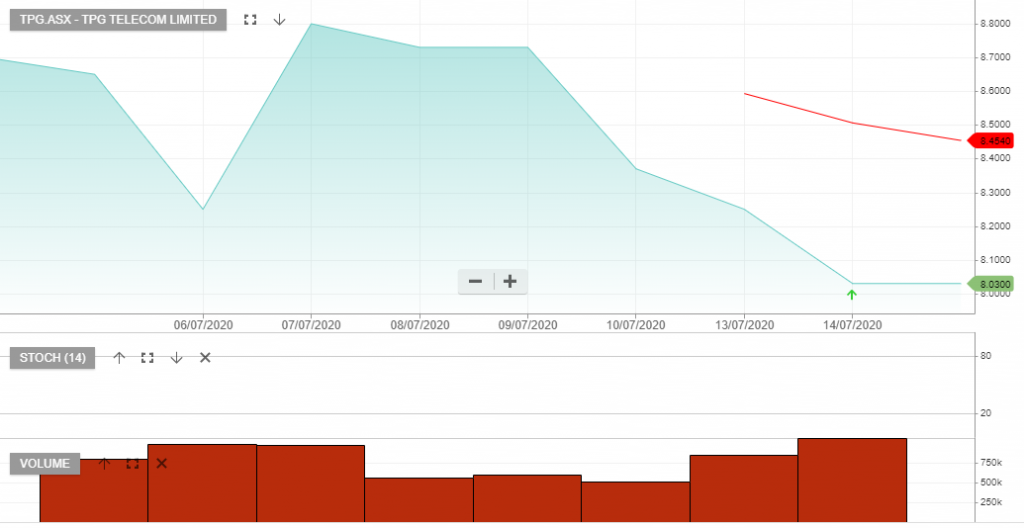

TPG Telecom offers value at around $8.00 and we suggest investors accumulate the stock.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Goldman Sachs Group remains under Algo Engine sell conditions.

Goldman reported Q2 revenue of $13.3bn & $2.4bn in profit. Estimates were for $3.78 in EPS and the number came in much higher at $6.26 earnings per share.

The report came out before the bell last night and GS was up 5.5% yet at the close, up only 1.3%.

Banks with exposure to trading revenue have seen strong market conditions in the June quarter, however, it’s likely that trading revenue will slow down in the back half of 2020.

Goldman set aside a higher than expected, $1.59bn for potential credit losses.

We continue to have a cautious outlook on the sector as we head into the remainder of 2020, downside risks remain from the economic uncertainty and the significant pressure from low-interest rates.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

JP Morgan posted a record $33.8 billion in second-quarter revenue and $4.69 billion in profit for the period.

The firm set aside $8.9 billion for expected loan defaults across its operations.

Jamie Dimon told analysts, If a relatively benign scenario emerges, JP Morgan will have too much capital saved and could resume stock buybacks as early as the fourth quarter. If a more severe recession happens, caused by a second wave of infections in the fall, the bank could be forced to cut its dividend.

Federal stimulus programs have supported individuals and small businesses in the second quarter, masking the true impact of the pandemic. It, therefore, seems reasonable to expect further deterioration in bad loan provisions.

A break below $90 in JPM will be seen as a loss of upside momentum.

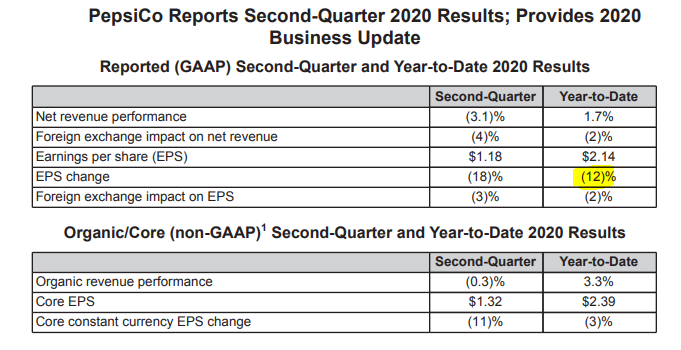

PepsiCo reported 2Q 2020 earnings and whilst EPS was ahead of consensus estimates, it still shows YTD down 12%.

Or start a free thirty day trial for our full service, which includes our ASX Research.