Coles Buy + Call Option

Coles Group is under Algo Engine buy conditions. November $18 call option adds $0.35 of income.

For more detail on the covered call strategy, please call 1300 614 002.

Coles Group is under Algo Engine buy conditions. November $18 call option adds $0.35 of income.

For more detail on the covered call strategy, please call 1300 614 002.

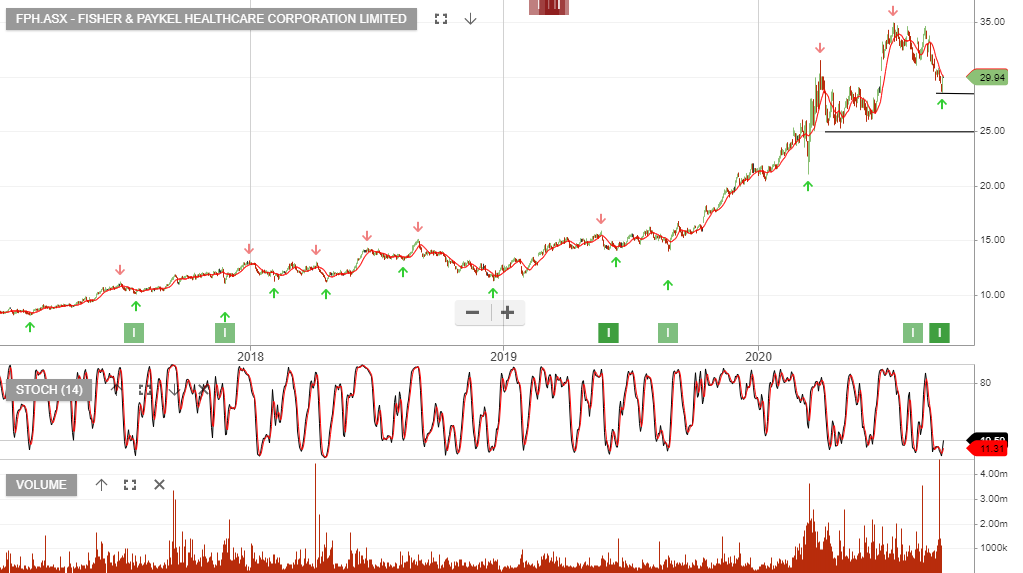

Fisher & Paykel Healthcare Corporation has again created an Algo Engine buy signal on the recent higher low formation at $28.50.

The share price has fallen over 20% from the July high and we’re beginning to see buying interest rebuild.

Buy CSL

APA is likely to find increased buying support at $10 and trade higher.

Accumulate Ansell within the support range indicated on the below chart.

We suggest running a covered call strategy to enhance the income return. For more detail, please call our office on 1300 614 002.

If you missed it, then you can watch last night’s webinar here.

ASX is now under Algo Engine buy conditions and we highlight the expected buying support range of $77 – $82.

WES delivered stronger than expected 2H20 sales growth with Bunnings up almost 20% on the same time last year and Officeworks up 28%.

Total online sales growth across the retail businesses was very strong, up 89%. Full-year FY20 underlying EBIT A$2.9bn.

WES has been too expensive and our patience is now paying off. The stock has corrected 10% but could have further to go, given the overall selling we’re now experiencing in global markets.

WES trades on a forward yield of 3.65%. The chart below shows the wide range where we expect buying support to build.

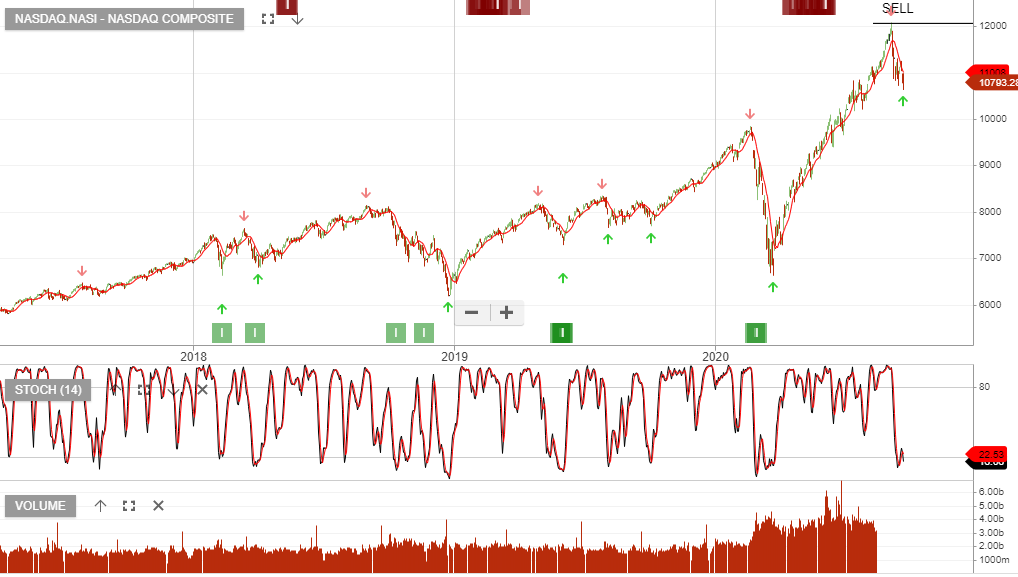

Stay short the NASDAQ or other related hedges, as long as the index continues to trade below the 10-day average.

Our hedge basket includes; BBUS, BBOZ, SNAS, YANK and GDX.

For more detail on our portfolio strategies, please call 1300 614 002.

Coles Group is under Algo Engine buy conditions. November $18 call option adds $0.35 of income.

For more detail on the covered call strategy, please call 1300 614 002.

Or start a free thirty day trial for our full service, which includes our ASX Research.