These are our Recent Model Changes

For our Members, please find below the list of our latest Model Portfolio changes.

For our Members, please find below the list of our latest Model Portfolio changes.

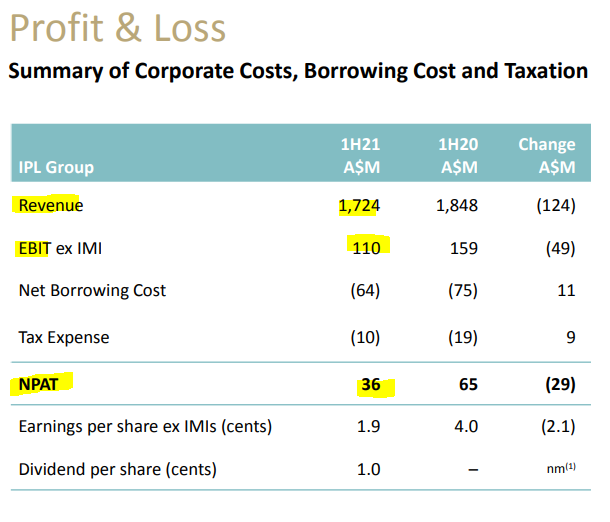

Incitec Pivot is now under Algo Engine buy conditions.

The company reported 1H21 Sales of $1.72m with underlying EBITDA of $286m. The EBIT miss was primarily driven by Fertilizers and Dyno Americas, with Dyno APAC largely in-line.

Our Option Lab AI technology suggests looking at the following call.

Northern Star Resources is under Algo Engine buy conditions. The expected rally from sub $10 is now underway.

4/5 We again highlight Northern Star as our preferred gold play.

7/5

17/5 Buy NST within the $10.50 to $11.00 support range.

21/5 Buy NST

26/5 Buy NST

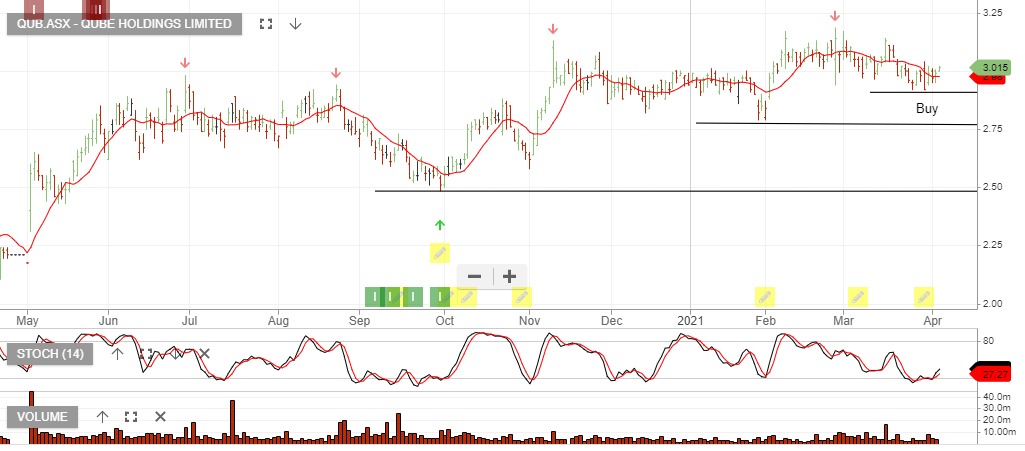

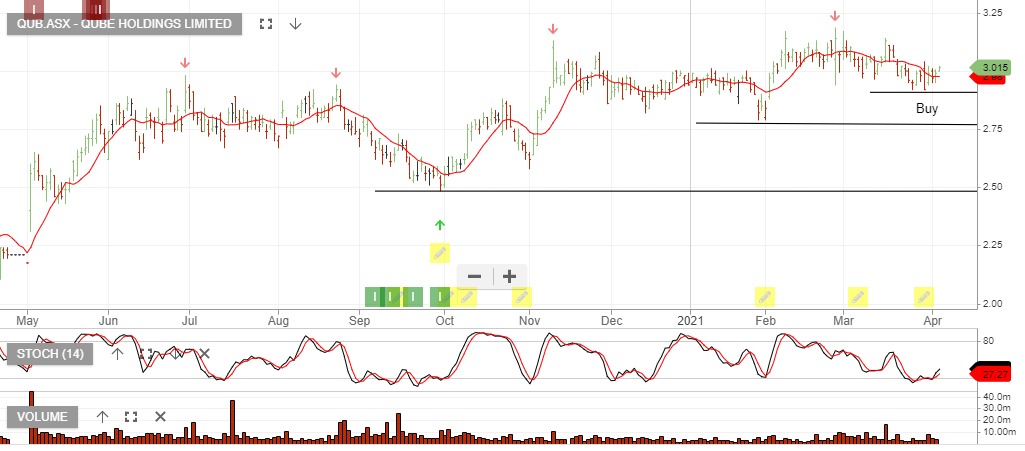

Qube Holdings is under Algo Engine buy conditions, with price support at $2.90. Consider a stop-loss on a break below the support.

In 2021, container port freight volumes are up on average 10 to 20% per month compared to last year.

25/5 Since writing the above post, QUB has found steady buying interest above the $2.90 support and the momentum indicators continue to trend higher.

A number of institutions have upgraded their price targets into the $3.40 to $3.60 range.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

For our Members, please find below the list of our latest Model Portfolio changes.

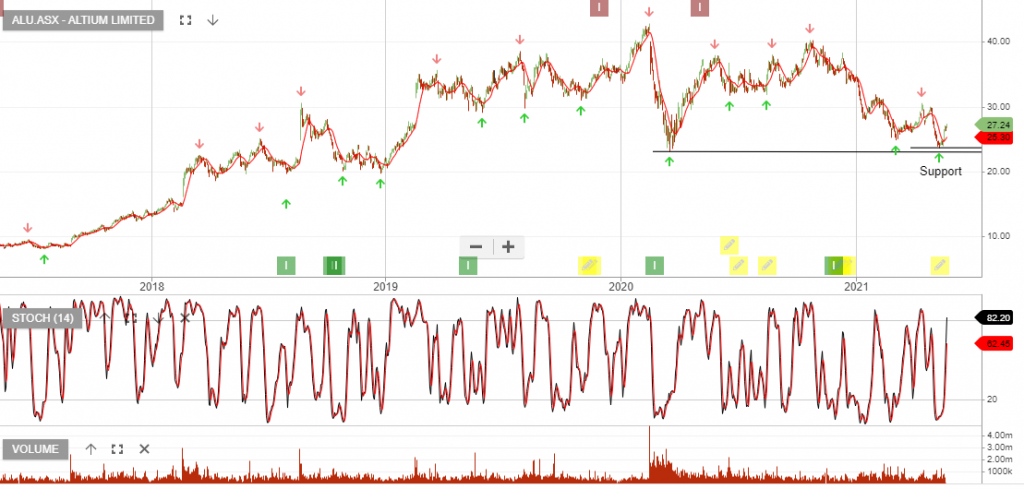

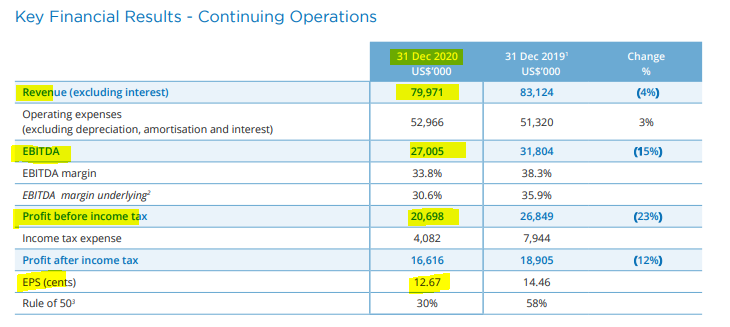

Altium is under Algo Engine buy conditions. The share price is oversold and likely to rally from the current level.

A more conservative entry strategy will be to wait for the stochastic to turn higher or the price action to cross up through the 10-day average.

25/5 Since writing the above post in mid-May, ALU has rallied 20%. We anticipate a pick-up in earnings for the 6 month period ending June 30 and will be looking for confirmation that 2020 was an anomaly in the company’s growth trajectory.

Buy ALU with stops below $24.00

Qube Holdings is under Algo Engine buy conditions, with price support at $2.90. Consider a stop-loss on a break below the support.

In 2021, container port freight volumes are up on average 10 to 20% per month compared to last year.

25/5 Since writing the above post, QUB has found steady buying interest above the $2.90 support and the momentum indicators continue to trend higher.

A number of institutions have upgraded their price targets into the $3.40 to $3.60 range.

Or start a free thirty day trial for our full service, which includes our ASX Research.