ALGO Update: Sell Signal In STO

Our ALGO engine triggered a sell signal for Santos into the close of trade yesterday at $3.81.

Recently, Santos reported solid earnings growth and have paid down a higher percentage of debt than the market expected earlier in the year.

In addition, the current rebound in Crude Oil prices has been a factor in the stock rising from $3.25 to $3.80 over the last two weeks.

With the US refineries based in Houston still preparing to come back online, and hurricane Irma now targeting Southern Florida, Santos shares could could firm into the the $4.00 resistance level, near-term.

Over a longer time-frame, we expect both Crude Oil prices and shares of Santos to trade lower.

We will watch these two markets closely and give specific trade levels once a clear trade signal emerges.

Santos

Santos

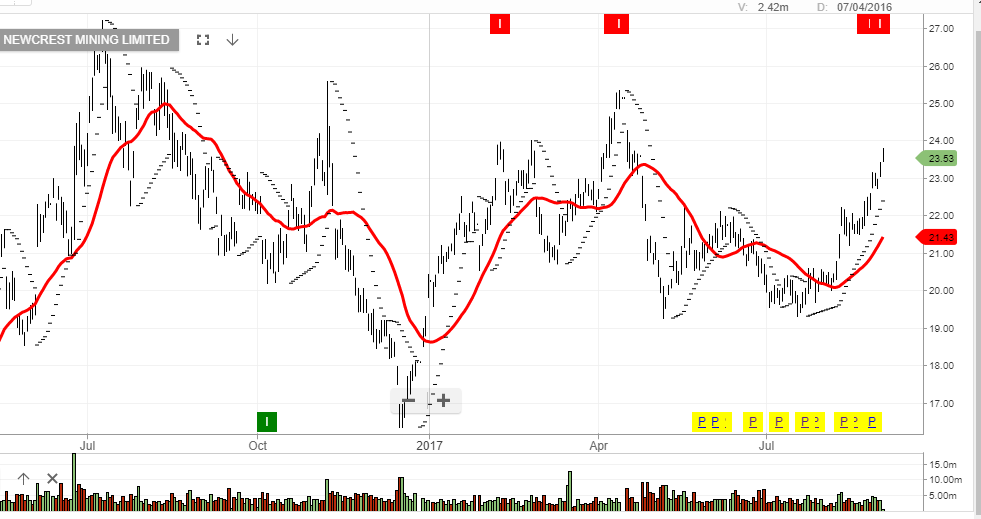

Newcrest

Newcrest Evolution Mining

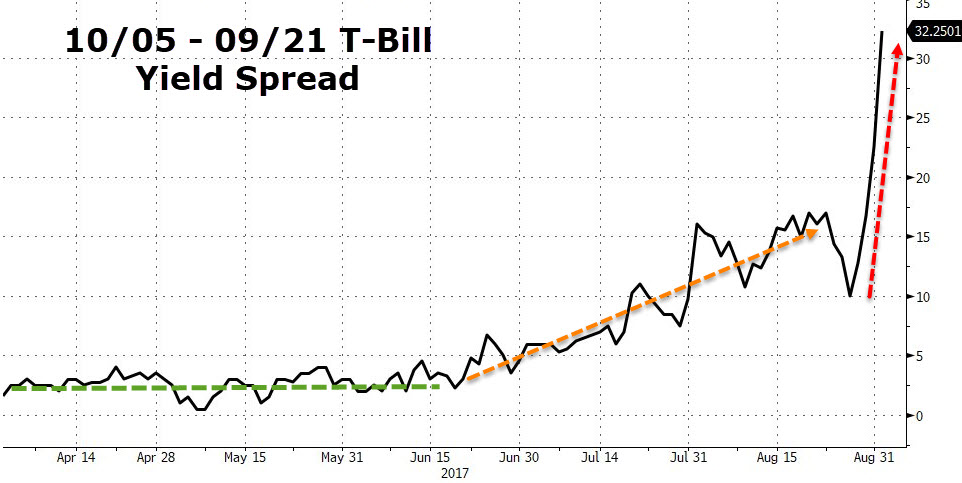

Evolution Mining September 21st versus October 5th T-Bill yield spread

September 21st versus October 5th T-Bill yield spread

Spot Gold

Spot Gold Newcrest Mining

Newcrest Mining Evolution Mining

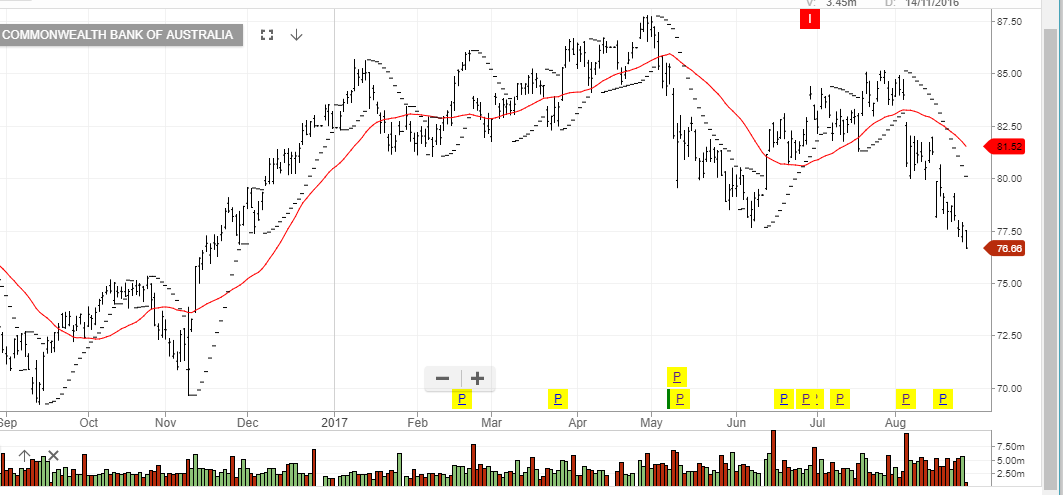

Evolution Mining Commonwealth Bank

Commonwealth Bank NYSE Breadth

NYSE Breadth