ALGO Short Signal On Flight Centre

The ALGO engine triggered a sell signal for Flight Centre (FLT) yesterday at $30.95.

After posting a high of $31.20 on February 15th, FLT fell to $28.00 over the following two weeks. We see the possibility of a similar price pattern emerging.

The ALGO engine has done a good job of picking the ranges on FLT.

As such, we will wait until the short-term momentum indicators confirm the direction before taking action on the trade.

Flight Centre

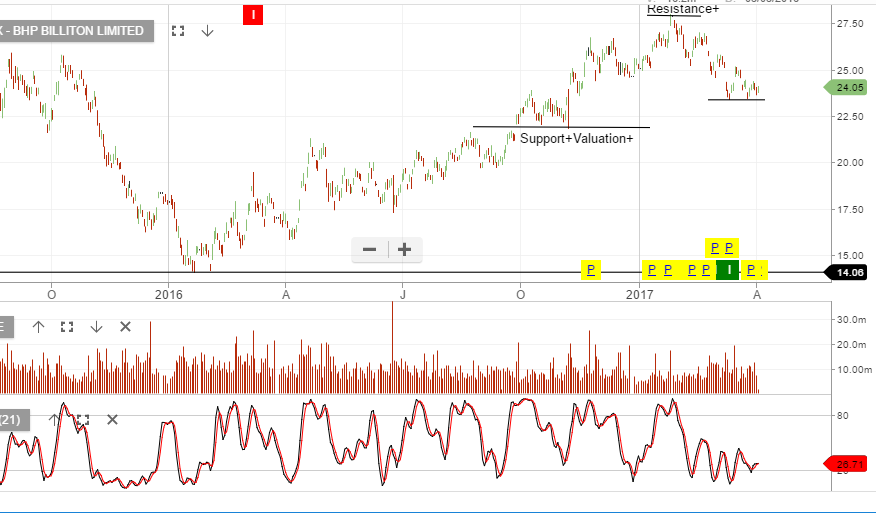

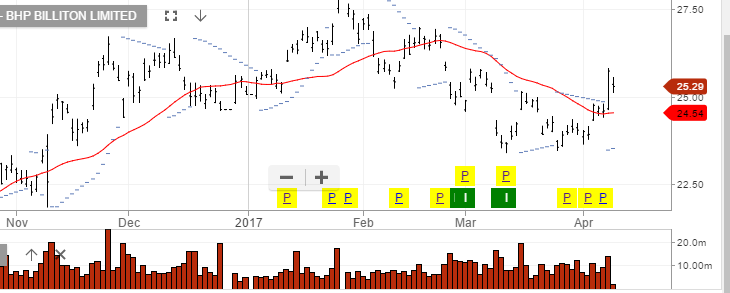

Chart BHP

Chart BHP

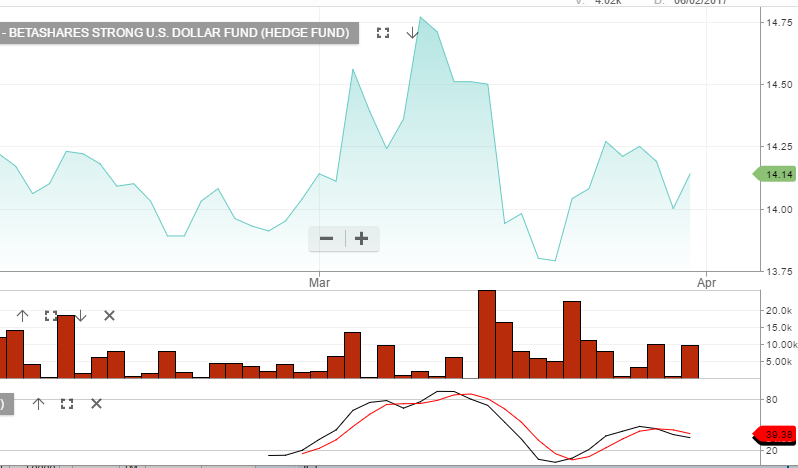

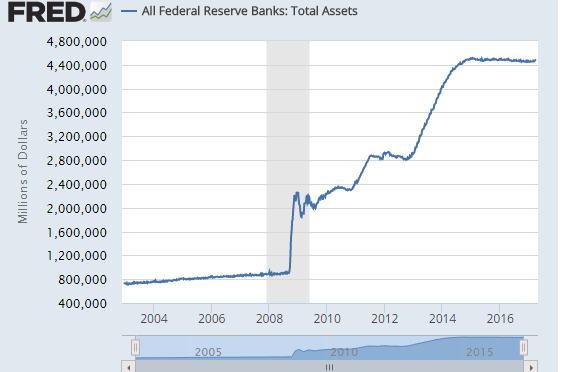

FED Balance Sheet

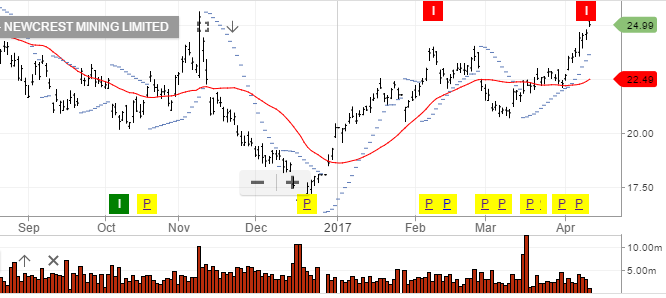

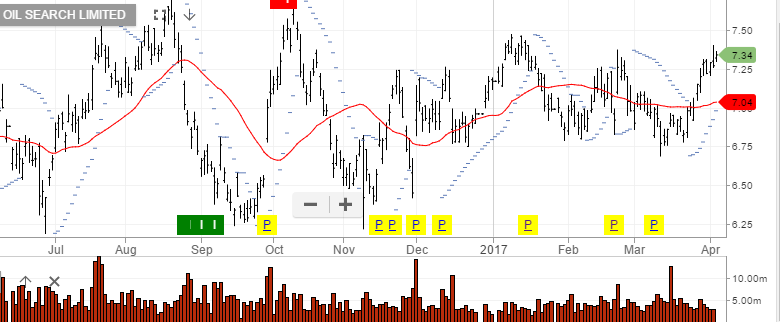

FED Balance Sheet Chart Oil Search

Chart Oil Search