Copper Miners ETF

Global X Copper Miners is under Algo Engine buy conditions.

Global X Copper Miners is under Algo Engine buy conditions.

Global X S&P Biotech offers a great buying opportunity at $38.50

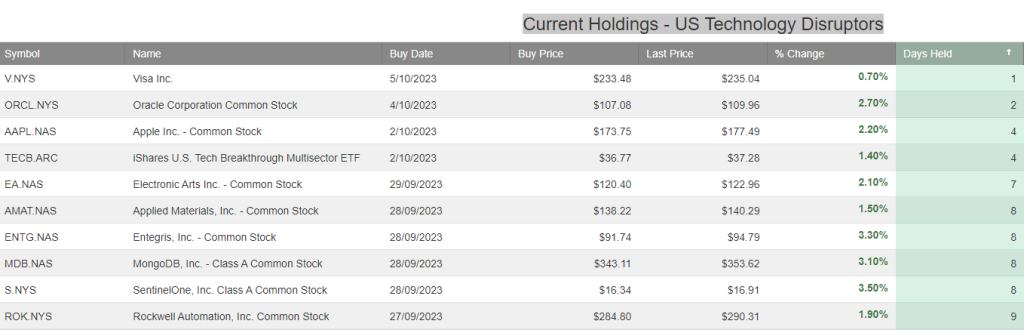

Our current holdings in the US Technology Disruptors Trade Table now include a number of new positions.

To access this, you’ll need US data turned on. It’s free, just ask!

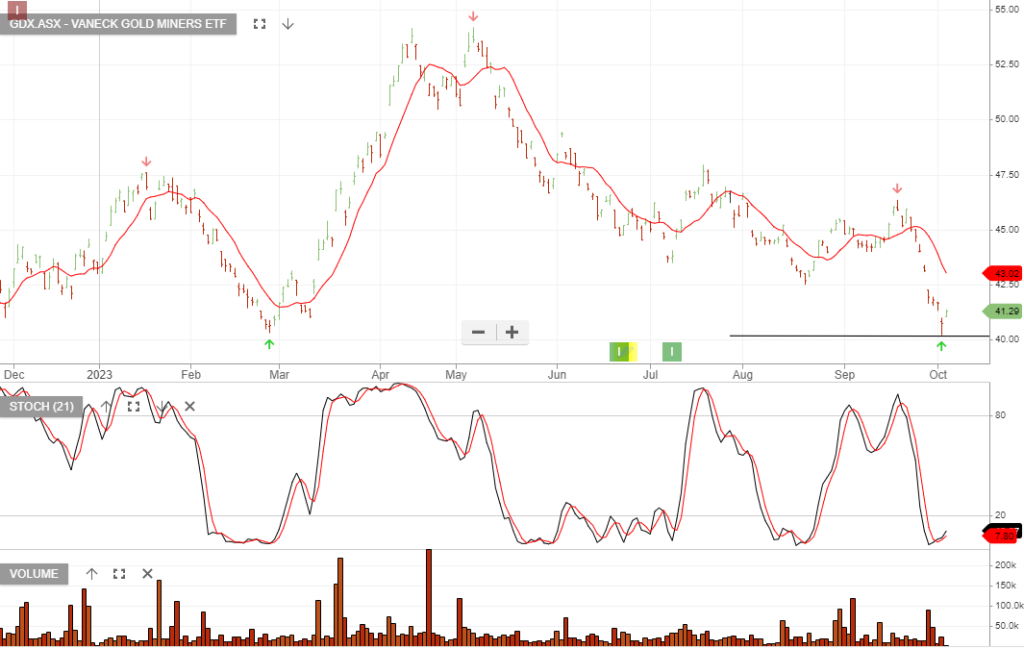

VanEck Gold Miners – Gold is trading at $1,822 per ounce. A strong U.S. dollar and elevated bond yields have pushed gold prices to a 7-month low as the likelihood of U.S. interest rates staying higher for longer dominates sentiment.

GDX is down from $55 earlier this year and we’re accumulating the ETF at $41 along with NST & GOR.

Aurizon Holdings is under Algo Engine buy conditions. Watch for this to drop into the Trade Table on a close above the 10-day average.

Cleanaway Waste Management is under Algo Engine buy conditions. We’re accumulating the stock in our investor portfolio within the $2 – $2.35 price range.

Cleanaway Waste Management is under Algo Engine buy conditions. We’re accumulating the stock in our investor portfolio within the $2 – $2.35 price range.

Aurizon Holdings is under Algo Engine buy conditions. Watch for this to drop into the Trade Table on a close above the 10-day average.

Treasury Wine Estates closed at 11.77

VanEck Australian Banks closed at 27.99