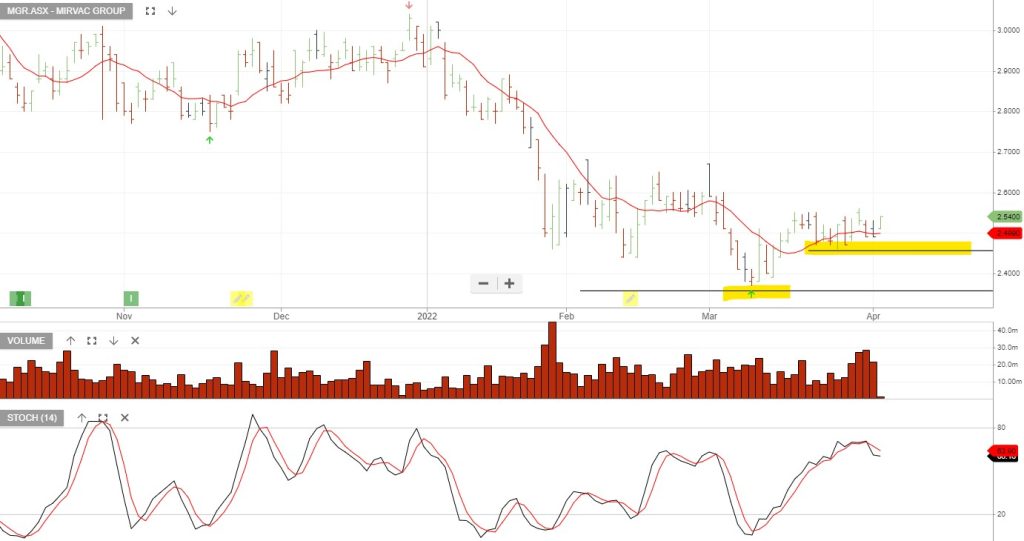

Mirvac 1H22 Earnings

Mirvac reported 1H22 operating EPS of $0.075. FY22 guidance was reaffirmed at $0.15, aided by higher commercial development profits.

We continue to view the apartment and commercial pipeline as a key driver of growth following a softer-than anticipated 1H22 update.

MGR is now trading on a forward yield of 4%.