Up until last week, US Stocks had spent the last five months gradually moving higher, without many big daily gains or losses.

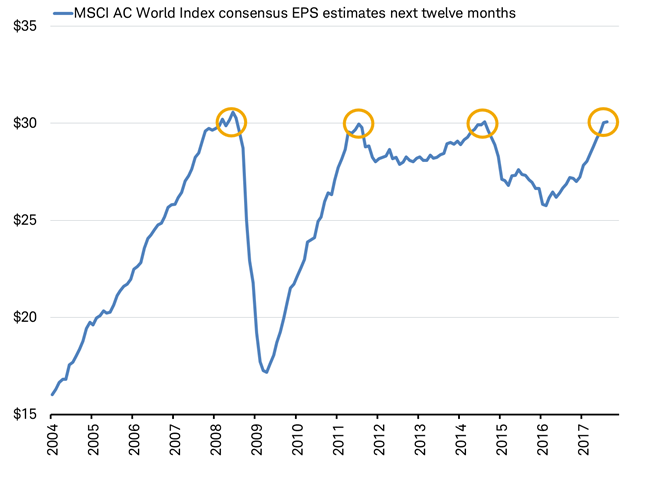

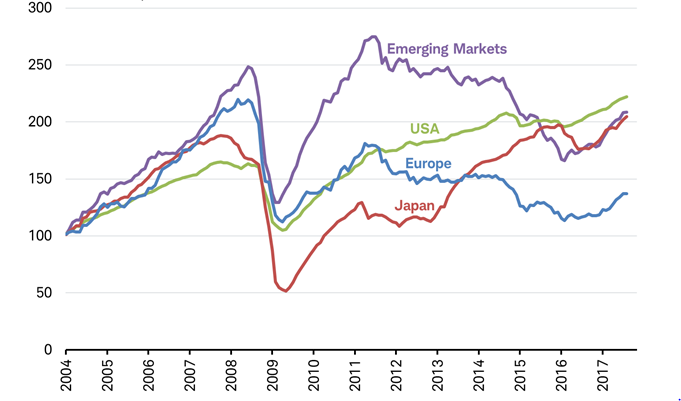

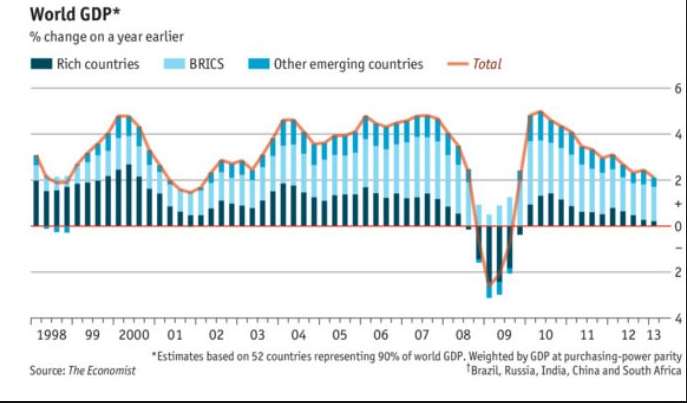

They had drawn strength from rising U.S. corporate profits and continued growth in the economy, along with recoveries in Europe and other EM regions.

It’s clear that investors still believe that if the global economy or equity markets ran into serious trouble, G-7 central banks would step in to help, just as they did after the 2008-09 global financial crisis.

Given the historically low volatility measures in the markets, it’s not surprising that on August 7th, a small 52 point rally (essentially all from Apple Inc) brought the Dow Jones 30 Index to its newest milestone of 22,062.

But this new record high belies the growing unevenness of the index.

Shares of Boeing, McDonald’s and health insurer United Health have contributed more than 700 points of the 1,000 points the Dow has gained since March 1, when the index topped 21,000 points for the first time.

This means that 10% of the components of the Dow index have been responsible for 70% of the overall gains over the last five months.

Meanwhile, Goldman Sachs and IBM, which helped lead the Dow’s surge in late 2016 and early 2017, have come crashing back to earth and are currently the worst performers in the Dow index this year.

A 1,000-point rally in the Dow 30 isn’t what is used to be a few years ago. As the index trades higher, each round-number milestone represents a smaller percentage move.

When the Dow advanced from 10,000 points to 11,000 points in early 1999, it was a 10% rally. By contrast, the move from 21,000 to 22,000 translates to a gain of just 4.8%.

The Dow index is more than 120 years old, and experts and market-watchers constantly debate how accurately it represents the overall health of the market. With only 30 companies in the index, the Dow reflects much less of the broad economy than the Standard & Poor’s 500 index, the NASDAQ or the Russell 2000, which institutional investors pay more attention to.

From a technical perspective, Dow points are also based on the individual stock price instead of the relative value of the company.

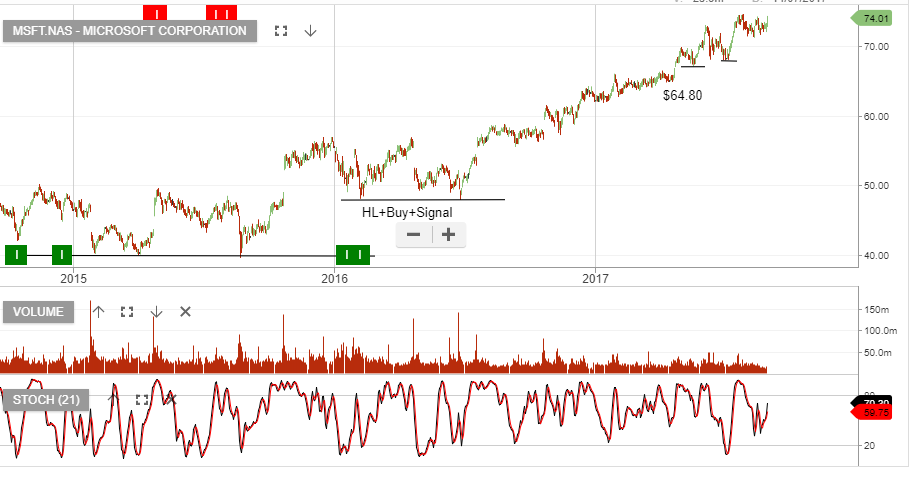

So a 1% move for an expensive stock like Boeing or Goldman Sachs, both priced well above $200 per share, will move the Dow Index more than Microsoft, worth around $70 per share, even though Microsoft has a capitalization of more than $550 billion compared to about $90 billion for Goldman Sachs.

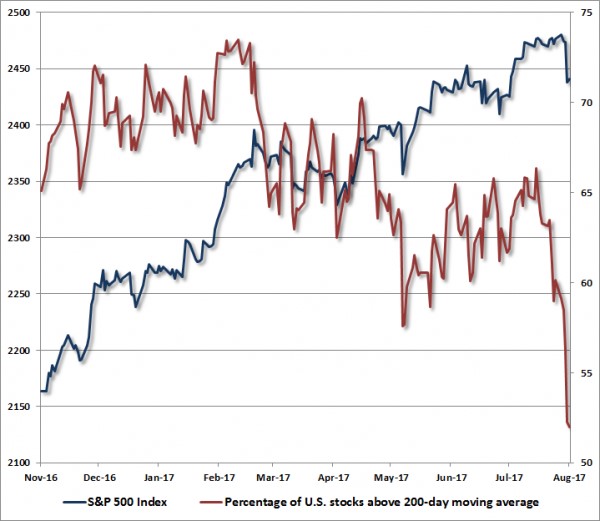

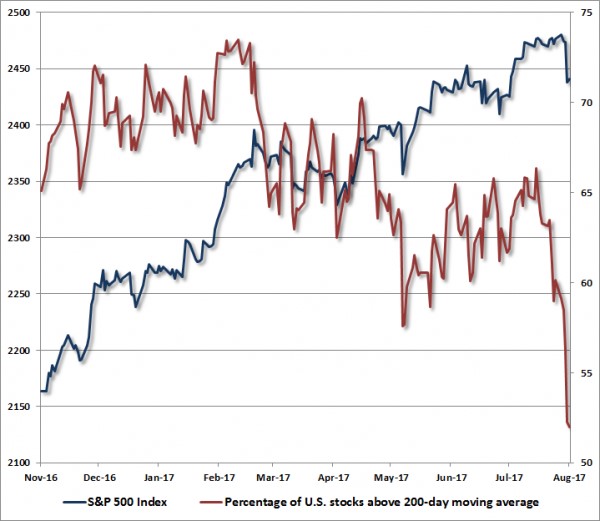

This type of internal price dispersion is not limited to the narrow Dow 30 Index. Internal price dispersion has now become apparent in the SP 500 Index, which, as a much broader index, has much more significant ramifications for future share price valuations.

For example, a growing proportion of individual stocks in the SP 500 are now priced below their respective 200-day moving averages, with just a handful of names carrying the index higher over the last few months.

This widening divergence in leadership, (as measured by the proportion of individual stocks hitting new highs versus new lows), is not a bullish indicator for US stocks going forward.

The chart below illustrates the percentage of U.S. stocks above their respective 200-day moving averages, compared with the S&P 500 Index. The deterioration and widening dispersion in market internals is no longer subtle and points to price momentum turning lower.

Further, this degree of dispersion suggests that not only is risk-aversion rising, it is also picking up pace.

Across history, this sort of shift in individual share prices, coupled with extreme overvalued P/E’s and over-bullish sentiment, has been the hallmark of major price peaks and subsequent market corrections.

Looking across the financial landscape, we see several other potential triggering events which could signal a material correction in global equity markets. Of these potential market inflection points, five stand out as troubling and worth noting.

- Debt Ceiling

- Bubble level PE’s

- Maximum Financial Engineering

- China Asset withdrawal and structured product issues

- US credit cycle deteriorating – credit cards, autos.

Within this list, the most severe market event would be the failure of the US Congress to raise the debt ceiling in time to prevent a shutdown of the US Government: this event caused 16% drop in the US SP 500 in 2011, as referenced in our August 14th blog report titled “Black Monday 2011, revisited.”

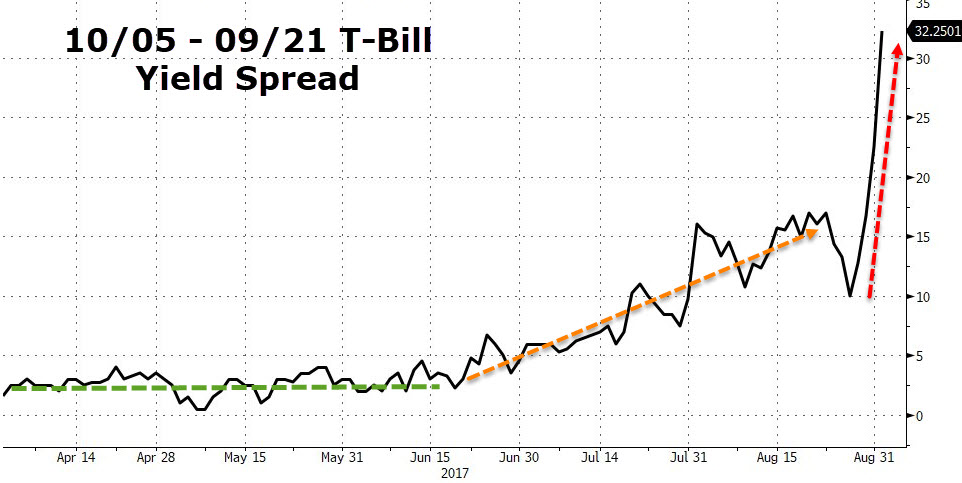

On August 1st, the US Treasury Department announced that the debt ceiling, (the statutory limit of outstanding debt obligations that the federal government can hold), must be raised by September 29th. After lawmakers return from their summer break, that will give Congress 12 working days to pass legislation to get to President Donald Trump’s desk.

If this deadline is breached, it could lead to disastrous consequences for the Federal government, the US economy, and the global financial system. If the debt ceiling is not raised, the US government would lose the ability to pay bills it already owes in the form of US Treasury bills and could lead the US to default on some of that debt.

The possible fallout from a default, according to a recent study by the Treasury Department, would include a meltdown in the stock and bond markets, a downgrade of the US’s credit rating and the undermining of the full faith and credit of the country.

It’s our base case that despite the potentially dire consequences, there is some confidence but no guarantee that factions in Congress, with a variety of competing interests, will be able to come together on a deal to raise the limit.

And even though the US Government has raised the debt ceiling 78 times over the last 57 years, the political uncertainty in Washington is making investors realize that the chances of successfully negotiating the debt ceiling legislation without a Government shutdown are dwindling.

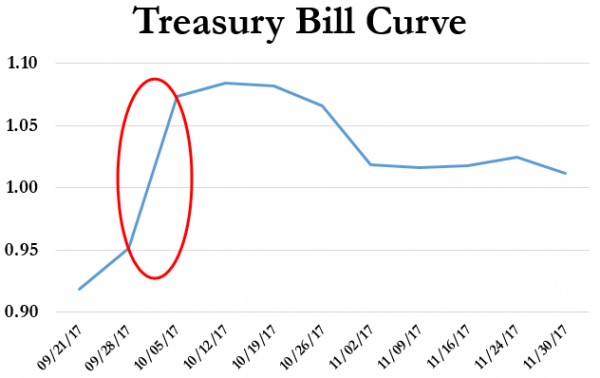

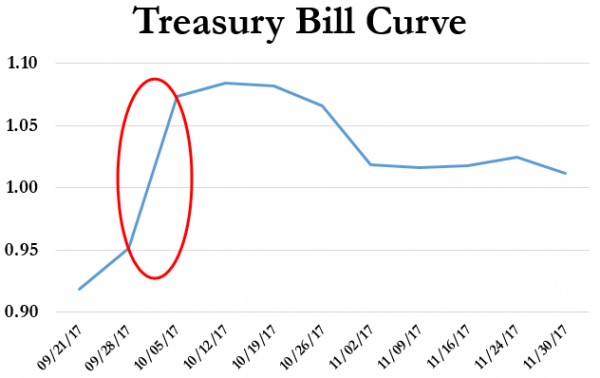

Institutional investors in the US Credit markets have already started pricing in a Government financial disruption as illustrated in the spike in US credit default risk and the inversion in the US T-Bill curve.

Unfortunately, based on recent negotiations for Health Care and Tax reforms, the Congress has not proven that it’s lawmakers are motivated to do what’s best for the American people, or that it can get anything done.

What’s more, the debt ceiling debate is likely to become ultra-politicized with special interest spending provisions attached to the final legislation.

This confluence of internal share price dispersion, combined with the backing up of risk aversion in the short-term credit markets, alerts us to a market condition which could lead to profound disappointment for investors.

All of our key metrics of expected market risk/return prospects are unfavorable at current market levels.

Some market commentators have projected that the SP 500 will complete the current re-pricing cycle at an index level up to 60% lower, or in the low 1000 handle. Our research doesn’t point to a level that low, but we do believe the market has scope for a 20% correction over the next three months.

As such, we strongly urge our clients and subscribers to examine all of your investment exposures, and ensure that they are consistent with your actual investment horizon and tolerance for risk.

September 21st versus October 5th T-Bill yield spread

September 21st versus October 5th T-Bill yield spread

NYSE Breadth

NYSE Breadth