US Stock Indexes finished the week mixed as many investors were focused on how the House of Representatives would vote on the administration’s bill to repeal major parts of the current health care program, referred to as Obamacare.

As the day progressed, the DOW and SP 500 swung between positive and negative territory as news reports gave conflicting stories about whether the bill would pass, or even be voted upon.

In the end, after Mr Trump’s ultimatum failed to yield more “yes” votes , the embattled bill seeking to start the healthcare reform process, and free up almost a trillion dollars in tax dollars, was pulled from the floor.

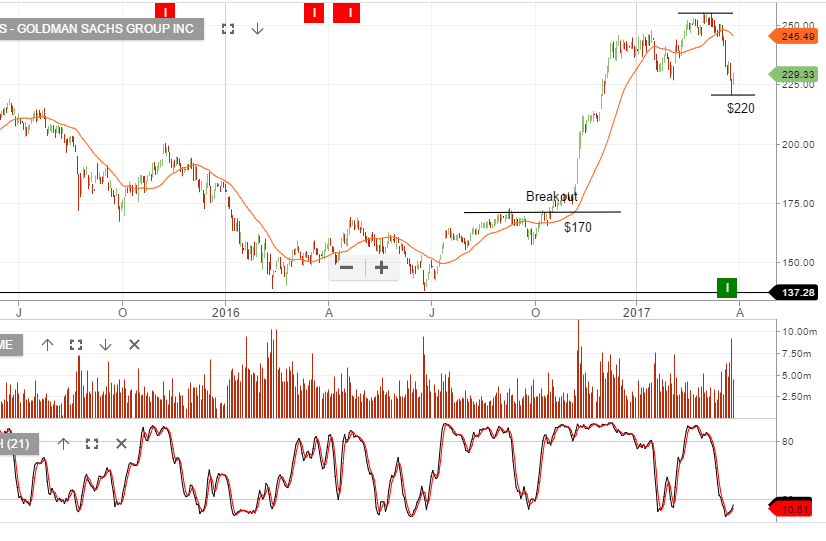

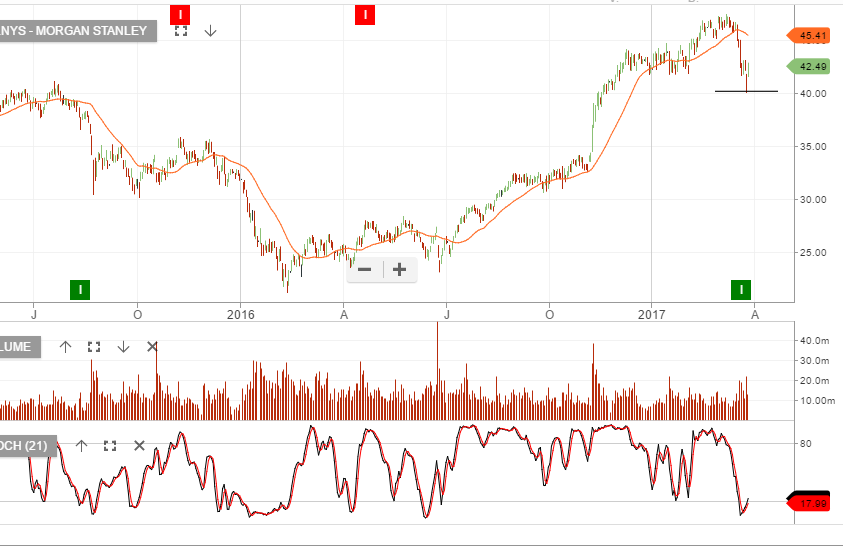

As a result, Mr Trump suffered a second consecutive blow from within his own Republican party. This party dissension will likely cast doubts on the President’s ability to deliver on other policy measures including; tax reform, infrastructure spending and the debt ceiling legislation.

The announcement that the vote was cancelled happened too late in the day to have any material impact on today’s trade.

However, going into next week, investors will have to address the question of how Mr Trump can now unify his own party behind his administration; and whether this legislative defeat will “deflate” the “reflation” trade, which was triggered after he was elected?