REA Group – Algo Buy Signal

REA Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support increasing at the $103 level.

REA Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support increasing at the $103 level.

For our next Live Webinar, I will review high conviction ASX buy and sell opportunities from the recent algo engine and model portfolio signals. This webinar is exclusive to our members.

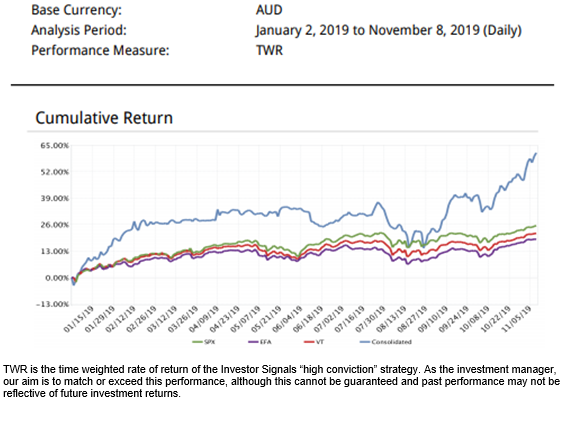

Learn the strategies and stock holdings that allowed us to generate 63% return in our new Interactive Brokers account model.

Boral is under Algo Engine sell conditions.

Boral disclosed that financial irregularities in its NAM Windows business will result in a US$20-30m EBITDA hit to its FY20 earnings. The announcement will weigh on Boral’s share price and we expect resistance to build at $5.00.

is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The short-term momentum indicators have turned positive and we see buying support increasing within the $11.50 – $12.00 price range.

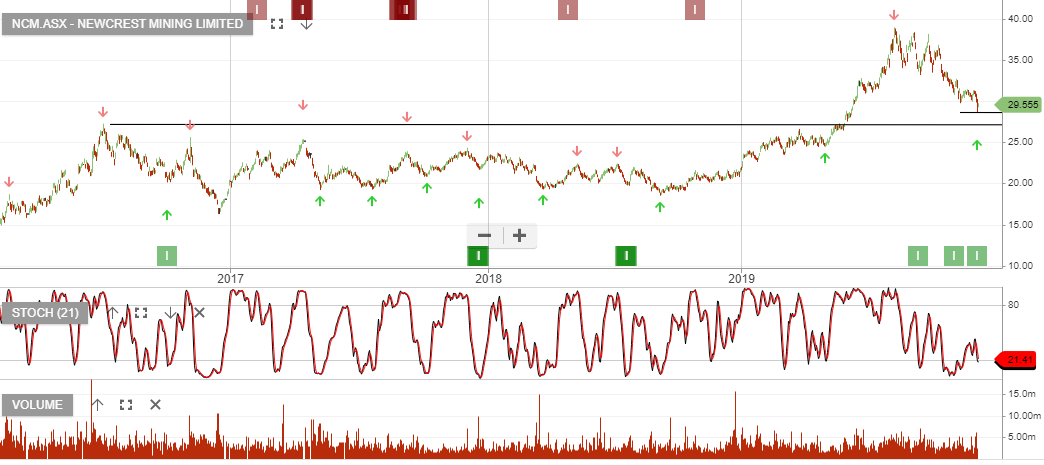

Newcrest Mining is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support building at the current price level of around $29.50

Domino’s Pizza Enterprises is under Algo Engine sell conditions and is a current “high conviction” short.

A combination of underperforming international stores and an eroding position within technological leadership across fast food means we struggle with the 30x PE multiple and low 2.5% yield.

Within 2 – 5 years we forecast the business trades at 14x earnings and 4% yield, meaning the fair value is closer to $20, not the current price of $52.

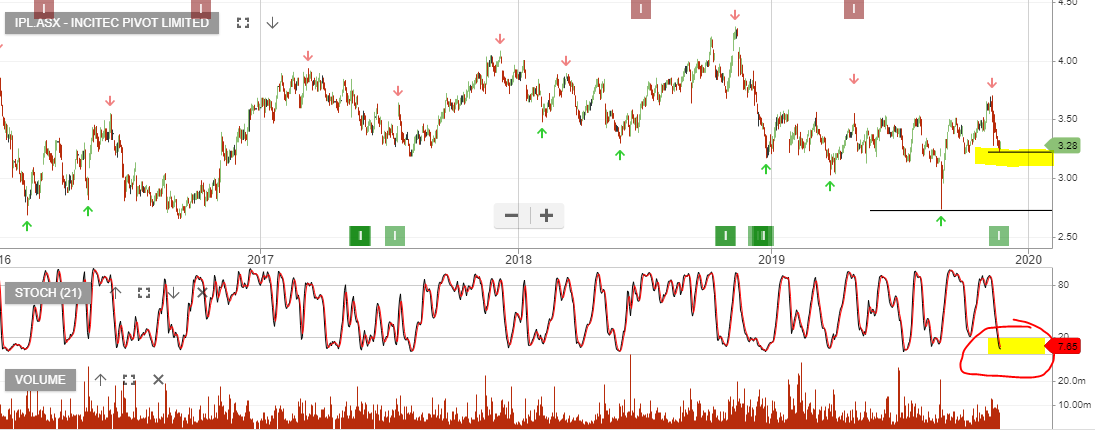

Incitec Pivot was triggered as an Algo Engine buy signal on Thursday 21st November. With an improving outlook for earnings in FY20 & 21 we’re willing to take a closer look at the upside potential.

The short-term technical indicators are about to turn positive and we’re likely to see buying interest pick-up near the $3.20 support level.

We’ll revisit this opportunity as the entry conditions playout next week.

Iluka Resources is under Algo Engine sell conditions and we’re watching the price action for selling pressure to build near the $10 level.

ILU is now on our radar as a potential short.

Telstra Corporation is under Algo Engine buy conditions and has now been added into the ASX 100 model portfolio.

We see price support developing near the $3.50 price level.

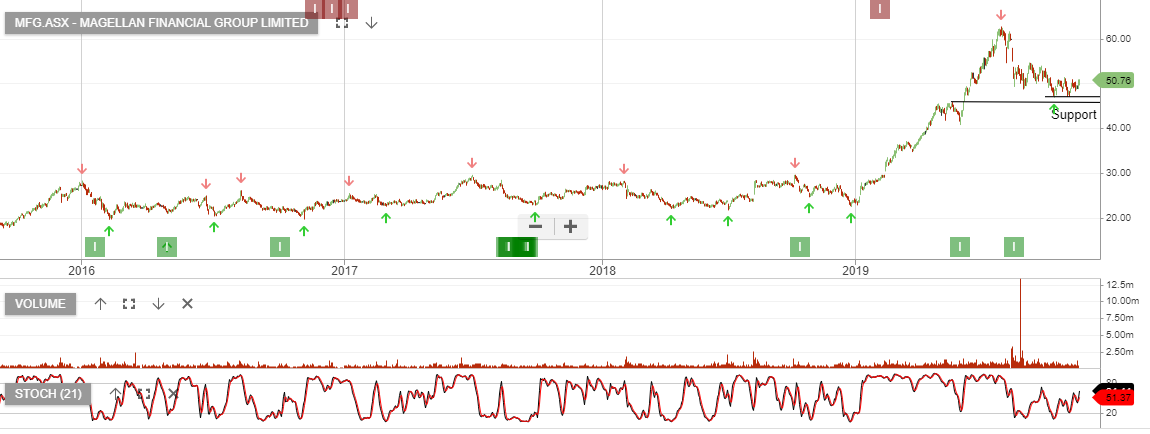

Magellan Financial Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Following a sell-off that started in late July, MFG has now corrected 20% and we see buying support building near the $48 – $50 price level.

Or start a free thirty day trial for our full service, which includes our ASX Research.