Gold Jumps On North Korean Missile Launch

Earlier this morning, North Korea launched a ballistic missile that flew over the Northern part of Japan and landed in the Pacific near Hokkaido.

The missile was fired from the Sunan region around 7:30 am, Sydney time, and flew approximately 2,700 km at an altitude of about 550 km.

Both South Korea and Japan responded with a strong statement denouncing Pyongyang’s sharp escalation of tensions in the region.

Gold was already $12.00 higher after the US session and added another $8.00 after the news broke this morning. As illustrated on the chart below, spot Gold broke above a 7-year downtrend line and reached a high of $1324.50.

In an environment of global economic uncertainty and heighten geo-political tensions, we still prefer the long side of Gold and see the next resistance level at $1340.00

We still see scope for more upside in the local Gold names. Both Newcrest and Evolution are trading over 2.5% higher in early trade. We consider an upside target of $23.60 in NCM and $2.95 in EVN as reasonable price targets.

Spot Gold

Spot Gold

Newcrest Mining

Newcrest Mining

Evolution Mining

Evolution Mining

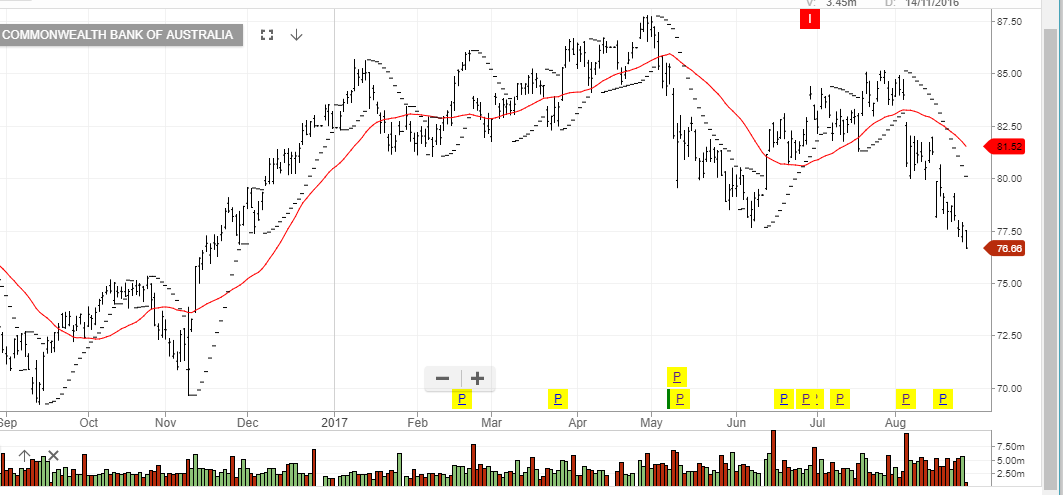

Commonwealth Bank

Commonwealth Bank

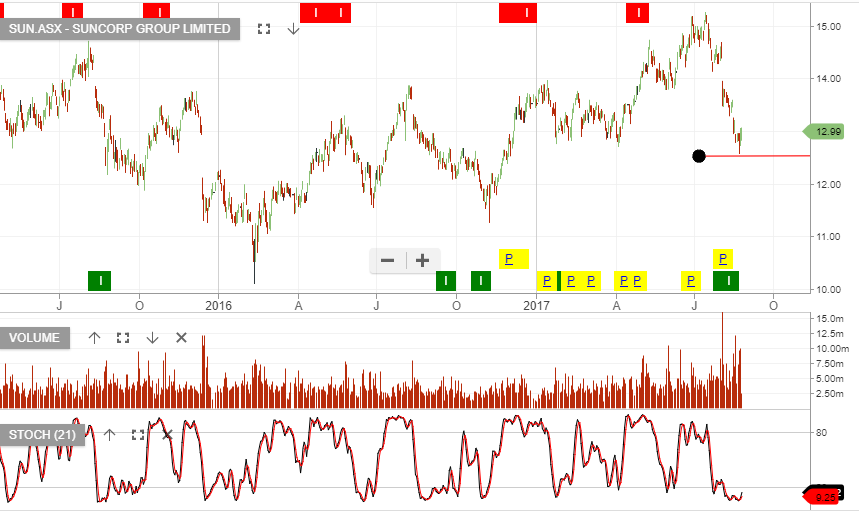

SUN

SUN

NYSE Breadth

NYSE Breadth