Algo Update – Invocare

Our Algo Engine triggered a buy signal on Invocare and it now appears that the stock is finding buying support. The share price is pivoting higher after making a low at $13.60 on August 3rd.

Our Algo Engine triggered a buy signal on Invocare and it now appears that the stock is finding buying support. The share price is pivoting higher after making a low at $13.60 on August 3rd.

Diversified financials – Wealth management firm IOOF Holdings Limited (IFL.ASX) yesterday released its profit results for the six-months ending June 30, 2017.

Underlying NPAT was reported at $90m, which is up 15% on the same time last year and full year FY17 profit at $169m.

IOOF declared a final dividend of 27c per share, fully franked, bringing the Full year dividend to 53c and placing the stock on a 5% yield.

A surge of net inflows from it’s expanding FUM business and strategic cost control are likely to help underpin 10%+ EPS growth into FY18, with forward revenue increasing from $566m to $590m, EBIT increasing from $240m to $270m and DPS to increase to 0.56 per share.

Our Algo Engine last signalled a BUY at just over $8 on 15/03/2017.

Following yesterday’s result, IOOF posted a new 52-week high of $10.86 on expanded volume.

IFL is now trading at 18x underlying EPS, we view this is full value and we feel the stock is likely to begin a new consolidate range.

Shares of JHX have dropped over 3% in early trade as the building materials supplier announced Q1 profits fell 34% to $USD 57 million.

JHX reported that net sales for the three months to June 30 have grown 6% to $USD 507 million, compared to the same period last year.

However, it said earnings margins were under pressure from higher production costs and increased competition in the construction materials sector.

At 26x forward earnings with a 2.7% forward yield , we’ve been advising clients about the risks of the low dividend, high P/E posture of the stock since it traded in the $22.50 area in early May.

We now see the next downside target for JHX in the $17.60 area.

James Hardie

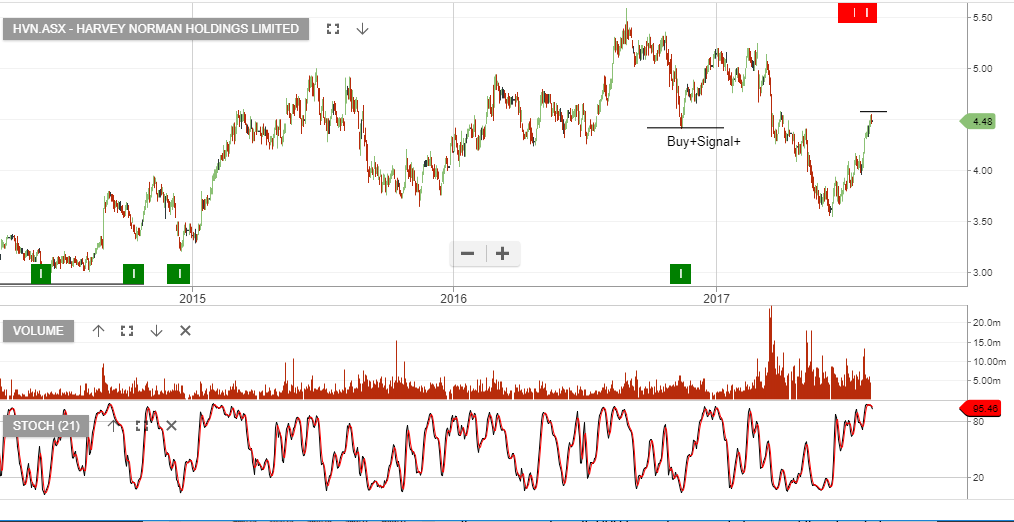

The technical pattern for Harvey Norman started to break-down early this year when the price action traded through the $4.50 support level.

Since then, HVN made a low in June at $3.55 and has now had a counter-trend rally back to $4.50.

Our Algo Engine is now flagging the “lower high” structure and we’ve added HVN to the short trade list with a stop loss above the $4.75 area.

Short term traders may prefer to use the momentum indicators to compliment the entry and stop loss rule.

HVN reports on the the 31st August. The market is looking for NPAT to increase to $377m, (from $337m last year), and DPS up 1 cent to $0.18.

Overly optimistic property revaluations, along with weak consumer trends, concern us and support our bearish view.

Following the recent Algo Engine buy signal, Sonic Healthcare looks like it is finding support at or near $22.50.

We continue to like RMD, SHL, CSL, MPL & RHC in the healthcare sector.

Both SYD and TCL are core investor holdings where we’ve applied “buy-write” strategies to enhance the cash flow. A combination of the December dividend and the call option income is generating 10 – 12% annualised cash flow.

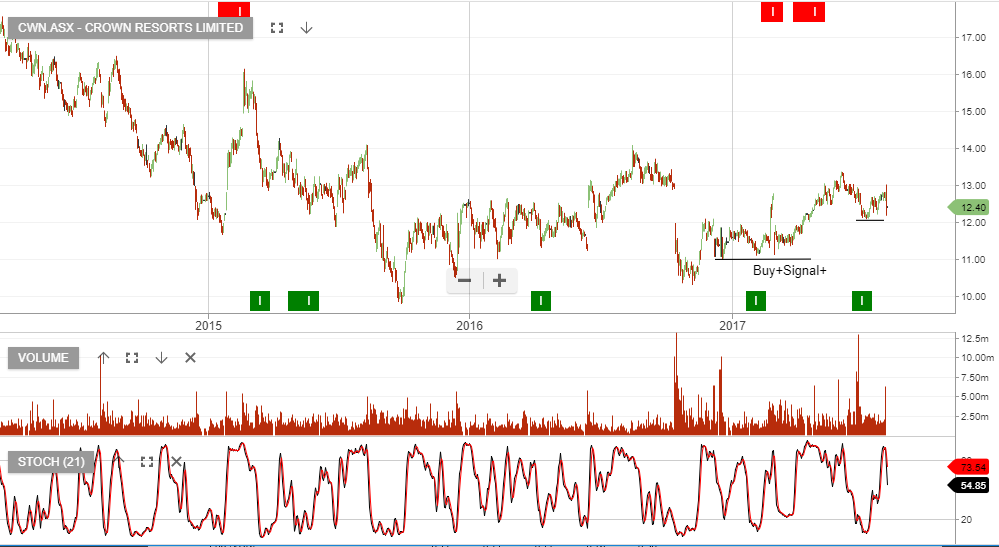

Crown Resorts reported their FY17 earnings on Friday, and the result showed a 13% decline in revenue and 11% fall in EBITDA. Helping to offset this was a further $375m share buyback.

Based on $0.60 of DPS in FY18, Crown trades on a forward yield of 4.8%.

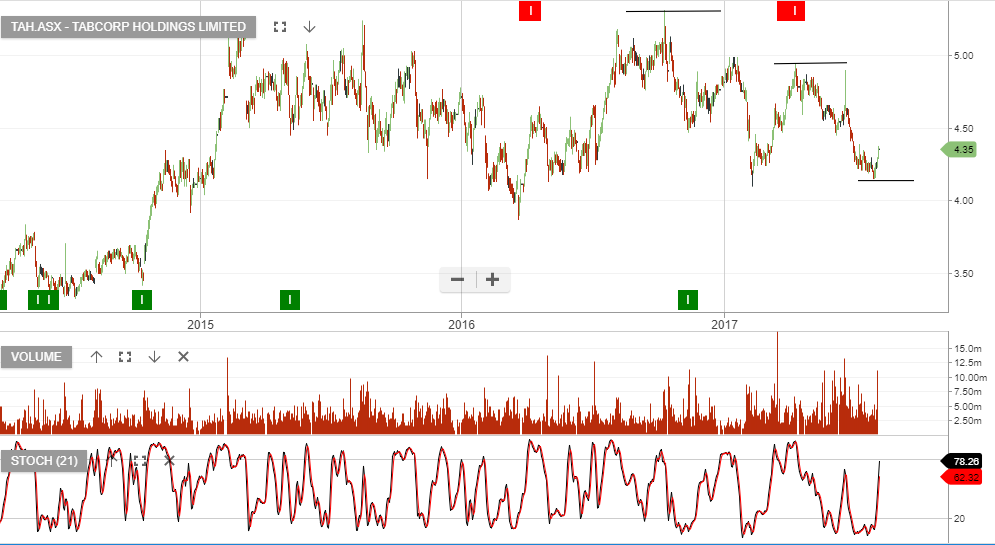

TabCorp Holdings reported FY17 earnings on Friday with underlying net profit of $179m, down 4% on the same time last year. We see encouraging trends within the core wagering business with digital turnover up 14% and fixed odds revenue growth of 15%.

We expect the Tatts merger to be completed by the end of the year and with the FY18 dividend yield at 6%, we see upside potential to $4.50 – $5.00.

The Aussie Dollar posted a high on July 27th against the US Dollar at .8065.

It tested that level again just before the RBA announcement last Tuesday but failed to advance and slipped briefly below .7900 going into the weekend.

Comments in the RBA statement about the strength of the AUD/USD combined with a weaker Trade Balance report on Thursday pressured the pair lower.

A break of the .7875 level will confirm that a formidable top is in place, and will likely spur another cent correction lower to the next support price of .7780.

Investors looking to profit from the AUD/USD trading lower can look to buy the BetaShare ETF with the symbol: YANK.

YANK is an inverse ETF, which means the unit price increases as the price of the AUD/USD decreases. YANK also has a 2.5% weighting, which means a 1% change in the AUD/USD will correspond to a 2.5% move in the unit price.

The current price of YANK is $12.60. We calculate that when the AUD/USD trades back to the January low near .7300, the unit price will trade at $16.75.

BetaShare ETF: YANK

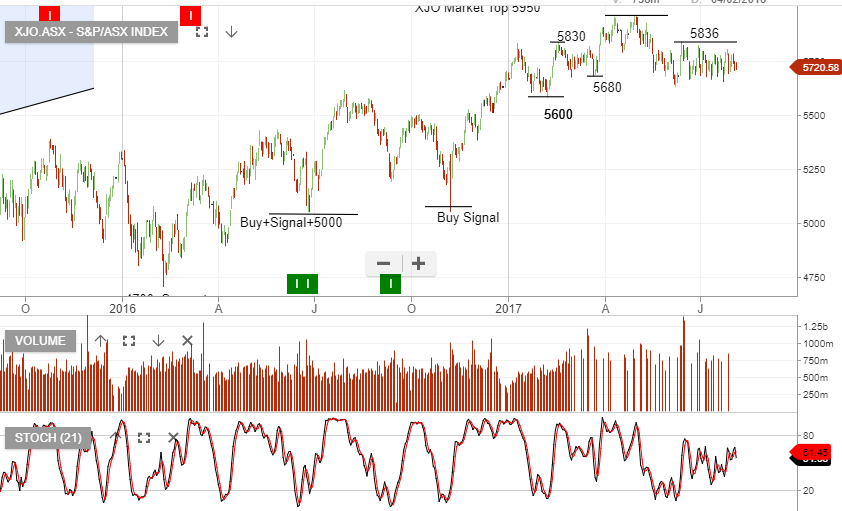

The S&P/ASX 200 Index finished the week up 0.31%

The best performer was the Utilities sector, up 3.6% and the worst performer was the Financials ex-Property sector, down 1.1%.

The XJO remains in a “lower high” pattern, as illustrated on the chart below.

On June 29th, when CBA was trading at $84, our Algo Engine generated a sell signal, as CBA formed a “lower high” structure.

Since then, selling pressure has gradually increased with the $84 to $85 range forming the resistance of the bearish pattern.