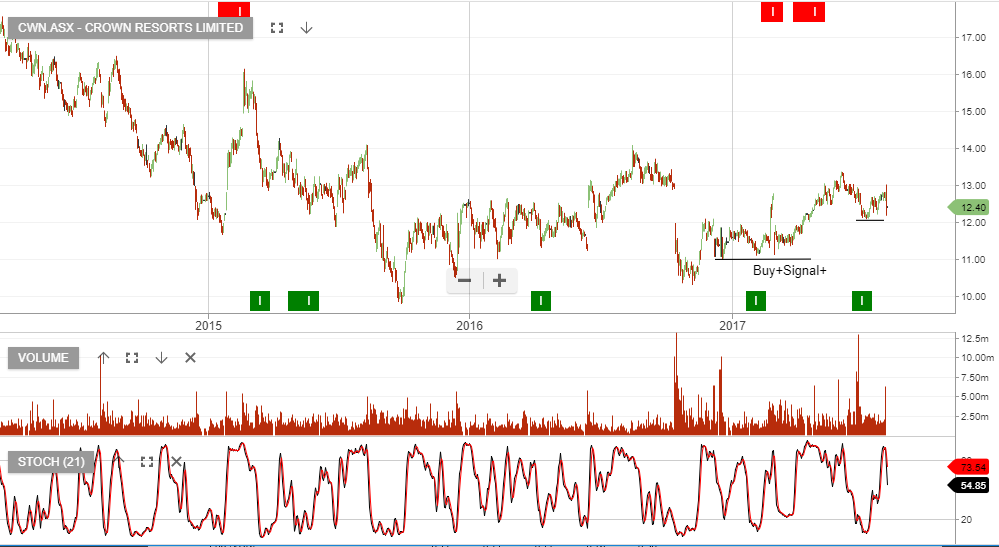

Crown Resorts reported their FY17 earnings on Friday, and the result showed a 13% decline in revenue and 11% fall in EBITDA. Helping to offset this was a further $375m share buyback.

Based on $0.60 of DPS in FY18, Crown trades on a forward yield of 4.8%.

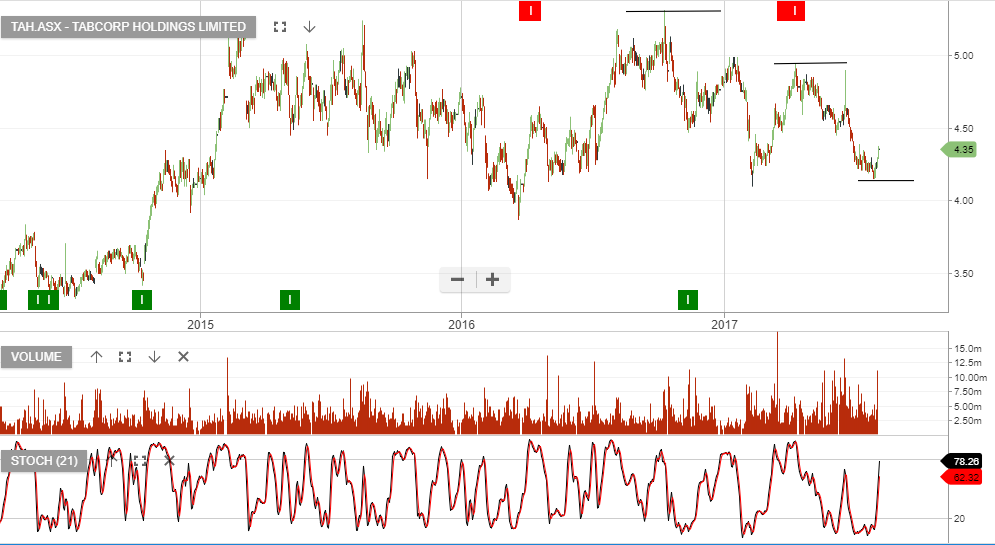

TabCorp Holdings reported FY17 earnings on Friday with underlying net profit of $179m, down 4% on the same time last year. We see encouraging trends within the core wagering business with digital turnover up 14% and fixed odds revenue growth of 15%.

We expect the Tatts merger to be completed by the end of the year and with the FY18 dividend yield at 6%, we see upside potential to $4.50 – $5.00.