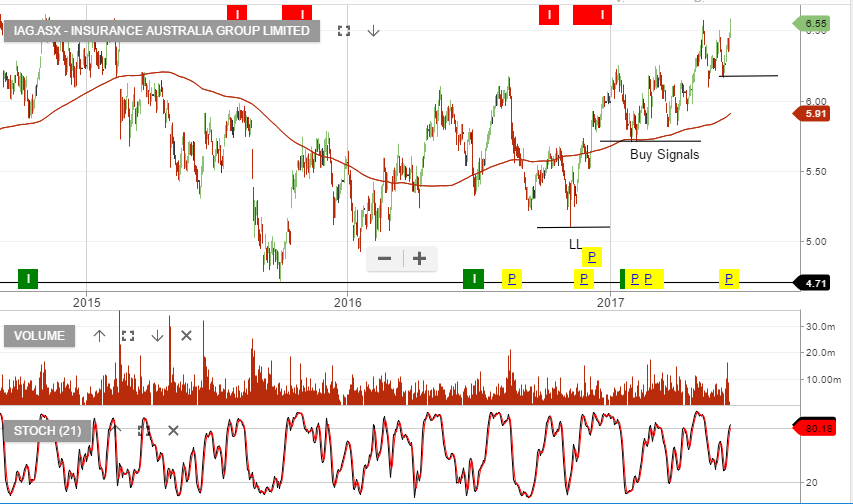

QBE & IAG

We’ve been buying QBE and IAG over the past few weeks. further upside is likely to be limited from the current level and therefore, taking profit or selling covered call options is advised.

We’ve been buying QBE and IAG over the past few weeks. further upside is likely to be limited from the current level and therefore, taking profit or selling covered call options is advised.

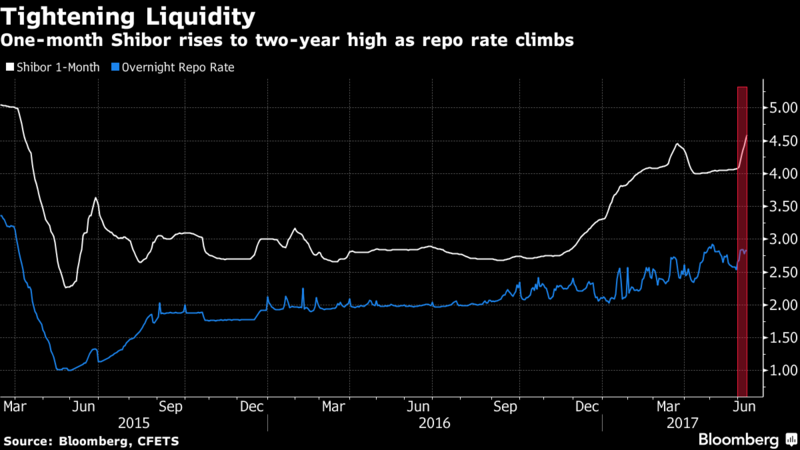

SHIBOR refers to the “Shanghai Interbank Offered Rate”. On Friday the one-month rate stood at 4.65%, the highest in over two years.

To put this in perspective, one-month rates in the US are at 0.85% and one-year rates in Australia stand at 1.63%.

And while Chinese central bank officials reject any suggestion that the tighter lending rates were a sign of instability or a source of increased financial risks, global financial markets have been acutely impacted by Chinese banking shocks in the past.

At this point, the one-month SHIBOR rate is now higher than the one-year Chinese Prime lending rate of 4.30%, which is unsustainable.

The knock-on effect is that a sharp contraction of Chinese capital flow will reduce Australian exports and could even distress local real estate markets.

We will watch this development with interest and how it could translate into the Australian share market.

Chinese SHIBOR

Chinese SHIBOR

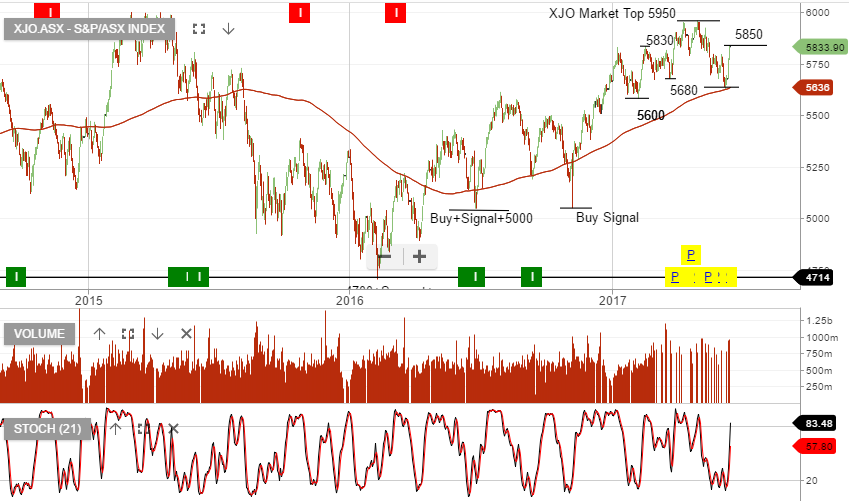

Recent price action in the local ASX market suggests we’ve entered a period of heightened volatility and potential for downside risk. Since posting the high for-the-year at 5945.00, the index for Australian shares has dropped almost 4%.

Looking across the spectrum of ASX top 100 stocks, we have found several names which can offer defensive value in a broadly sideways to lower share market.

These include: IPL, MPL, WOW, CTX, QBE, SHL, SYD, TCL, AMC, and IAG.

We consider these stocks to have the potential for moderate capital growth and, combined with a buy/write strategy, will offer 10 to 12% cash flow on an annualized basis.

ASX: XJO Index

The XJO has now created a “lower low and a lower high” formation. We remain cautious on the index unless the price action can trade back above 5850.

The FOMC announcement to raise the target Fed Funds rate by 25 basis points to 1.25% was largely priced into the market.

However, the “hawkish” guidance about further upward adjustments and the specific plans to reduce the FED’s $4.5 trillion balance sheet have raised concerns about current stock market valuations and the impact of tighter monetary conditions.

The major US indexes were mixed with the NASDAQ down .50%, THE Dow Jones 30 up .25% and the SP 500 down .10%.

US Energy stocks were all lower as Crude Oil prices slumped on a downbeat assessment from the IEA and increased production from both the US and OPEC nations.

The front month WTI Crude contract closed down over 3% to $44.65, which is the lowest closing price in over 18 months.

As a result, shares in both BHP and Oil Search have opened more than 2.5% lower.

The NASDAQ stocks rebounded last night with Facebook, Google and Amazon all trading over 1% higher after the two day sell-off over the weekend.

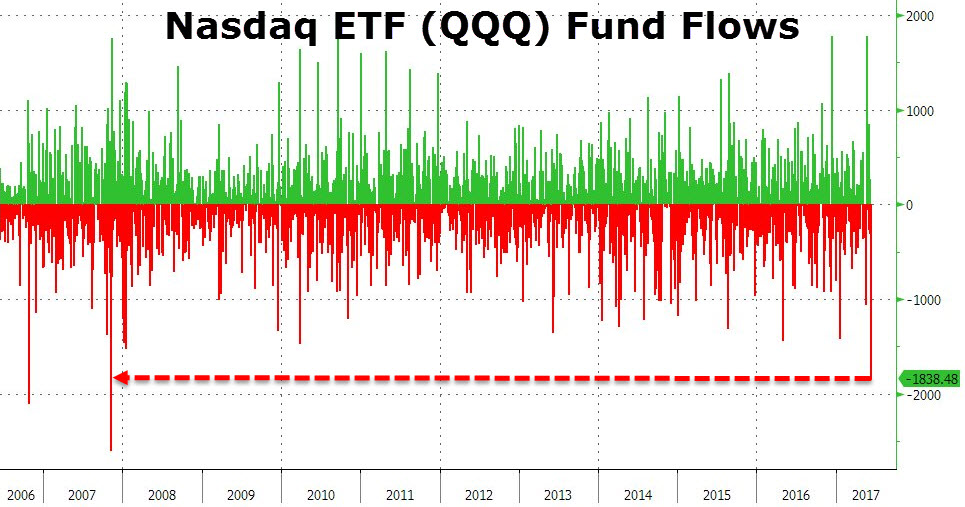

According to several “high frequency” analytical reports, it’s too early to step back into the FANG stocks. Of the four times that a similar high volume sell-off has occurred since 1999, tech shares have needed several weeks to find a bottom.

In addition, as shown in the chart below, the last few days have seen the largest capital outflow since 2007 from the QQQ: the NASDAQ based ETF.

Our ALGO engine created a buy signal on the ASX BetaShare NASDAQ ETF on February 8th, 2016.

That ETF, with the symbol: NDQ has gained over 32% since then. Should the recent sell-off in the NASDAQ turn into a deeper correction, we will watch for the next ALGO buy signal.

QQQ ETF

BetaShare ETF: NDQ

We’ve recently been buying RMD, AMC, ANN, CIM, RHC and TWE.

In particular, RHC is worth holding with a reasonable upside target to $75.00.

The other names mentioned are now at a price point where either taking profit or selling tight covered call options is recommended.

The sell-off in oil back to US$45 per barrel has seen WPL, OSH, STO, and ORG all come under selling pressure.

Origin remains one of our preferred exposures among the energy names and after taking profit recently at $8.00, we’ve been buyers again on last weeks pullback to $7.30.

We now add WPL to our buy-list; we believe it’s back within a price range where buying interest is likely to start picking up.

The Algo Engine triggered a buy signal on Friday in WPL, at or near $30.00

Our Algo Engine triggered a buy signal recently in Seek at $16.30. We’ve been holding back on buying this name but now it’s entering the centre of our radar.

After looking at the price action, we’re inclined to believe it’s now approaching a support range where buying interest is likely to pickup.

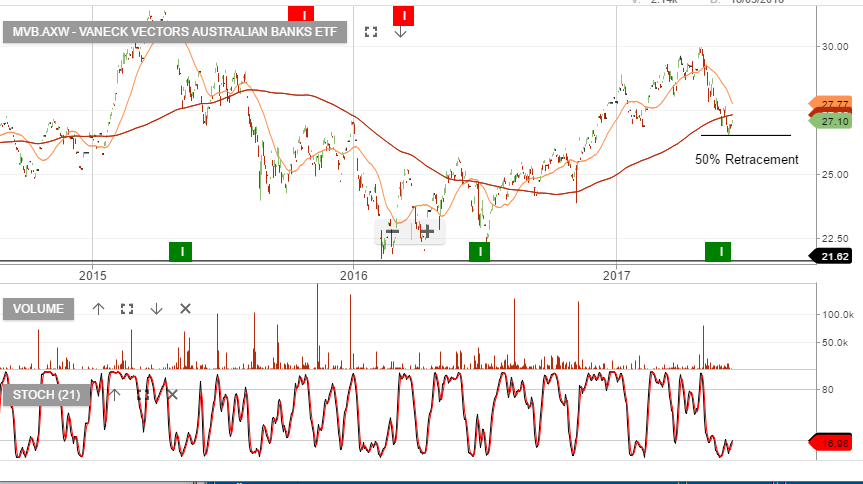

We’ve built minor long exposure in MVB following the recent Algo Engine buy signal at $26.90.