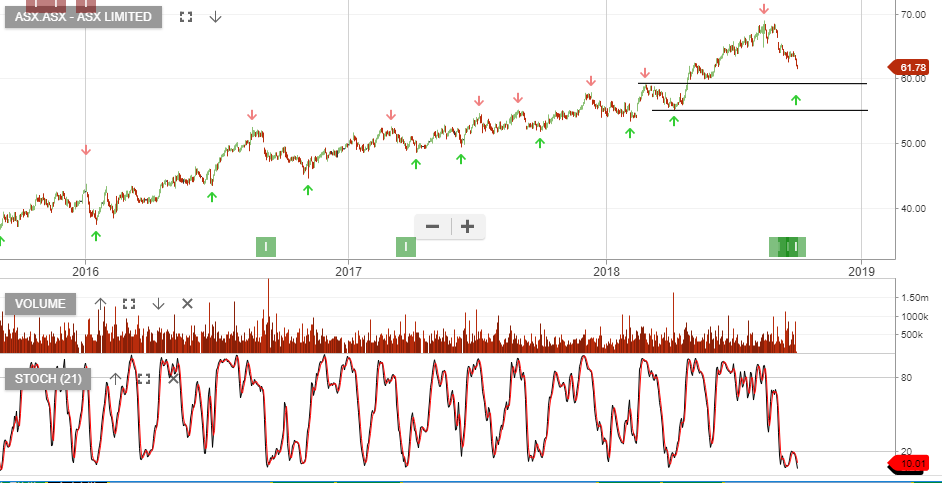

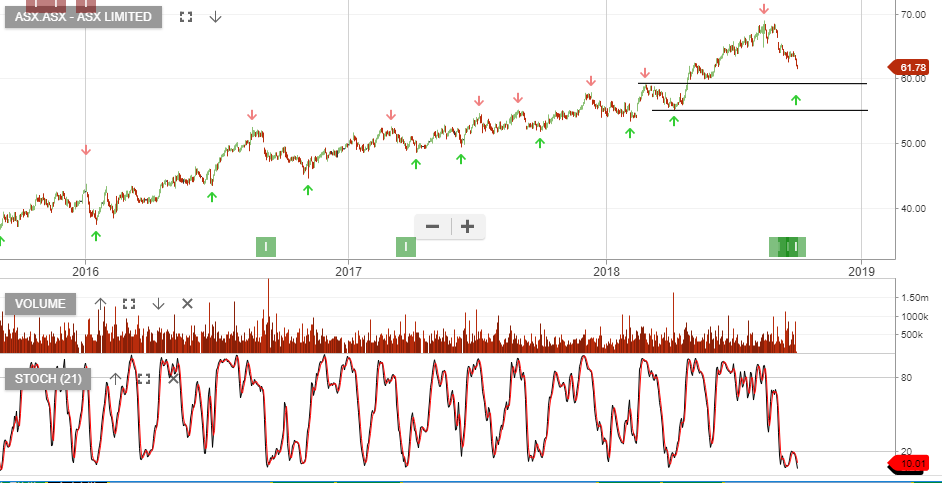

ASX – nearing support at $60

Our Algo Engine generated a buy signal in ASX and we’ve identified $60 as price support.

ASX provides a defensive 3.5% dividend yield and EPS growth is tracking at 5%+.

Look to accumulate near the $60 support level.

Our Algo Engine generated a buy signal in ASX and we’ve identified $60 as price support.

ASX provides a defensive 3.5% dividend yield and EPS growth is tracking at 5%+.

Look to accumulate near the $60 support level.

Our ALGO engine triggered a buy signal for ASX Ltd into yesterday’s close at $62.57.

This “higher low” pattern is referenced to the intra-day low of $61.90 posted on June 14th.

Since reaching an all-time high of $68.90 on August 17th, the share price has slipped close to 8% lower.

We see solid technical support for the stock at $62.00 and initial chart resistance in the $66.20 area.

ASX Limited

ASX announced 1H18 core earnings of A$230m, which is ahead of market expectations.

Revenue grew by 6% and we have the stock now trading on a forward dividend yield into FY19 of 4.1%.

Underlying EPS growth has been upgraded to 5 -6% and full year dividend is $2.15, fully franked.

ASX is in the ASX Top 50 model portfolio.

ASX:ASX

ASX:ASX

ASX reports its half-year earnings on the 15th of February.

The consensus expectations are for NPAT to increase by 4% to $220 million and the company to declare a interim dividend of $1.03.

This places ASX on a forward yield of 3.7% and we see upside potential in the stock.

Weaker than expected activity trends in June led to small earnings downgrades by most analysts.

We are now forecasting flat year over year revenue growth.

ASX is trading on 24x forward earnings which seems excessive considering the low growth outlook.

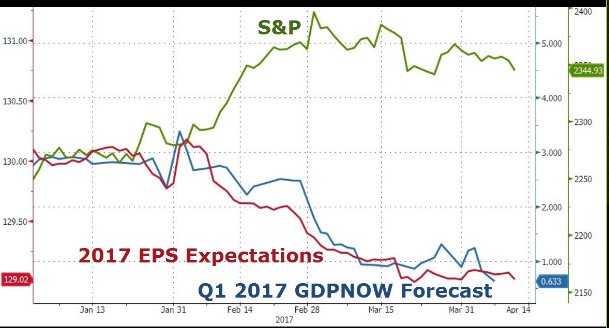

US earnings season will go into full swing next week with several DOW components and high-capitalization S&P 500 companies reporting Q1 earnings.

Thus far, the results have been mixed with IBM missing badly and forward guidance on the major US banks showing concerns for future revenue growth.

The chart below shows that the expectations of S&P earnings, relative to the current pricing of the S&P 500 index, are very much out of line.

If next week’s earnings reports don’t exceed expectations, we could see further downside range extension on the SP 500 index, which could pressure the XJO index lower.

We have been looking at the May 5800 XJO puts as a short-term portfolio hedging instrument for a move lower in the local market.

We have also been buying the BetaShare BBOZ inverse exchange traded fund. Shares in BBOZ gain value as the local market trades lower.

The ALGO engine generated a buy signal for shares of ASX at $49.00.

Many investors were able to write covered calls or exit long positions of ASX around the $52.50 level, last traded in early February.

We are cautious of the general market sentiment , but still like the longer-term growth prospects and a move back at least to the 30-day moving average near $51.10.

A tight stop-loss metric should be employed on long positions of ASX at, or near, the January 2nd low of $49.15.

Following the recent 1H17 earnings update, we will take a look at establishing fair value for the ASX.

1H17 NPAT of A$219m represented 3% underlying earnings growth. Moderate revenue growth occurred across most major ASX activities.

Here is the issue: the stock trades at 22x forward earnings on a 3.9% dividend yield. The earnings are stable but the stock is expensive. And whilst ASX delivered 3% revenue growth in 1H17, this is down on the 6% average level achieved over the last 3 years.

Our conclusion on fair value is; buy ASX on a pullback to $47 or a 4.5% dividend yield.

ASX Limited reported continued profit growth for H1 2017, up 3% to $219 million. Earnings per share was posted at $1.13 per share, which is 2.9% higher than a year ago.

The exchange operator declared a fully franked dividend of $1.02 per share, which pencils out to a 90% pay out ratio.

ASX also announced a 2.8% increase in operating revenue to $386.6 million, which is a 10.4 million increase from the previous reporting period.

Solid growth in Derivatives, OTC products and the sharp increase in ETF interest has underpinned the company’s forward guidance.

However, we see a potential “double top” pattern on the daily charts dating back to the August highs of $52.40 and would look for a pull back in the share price.

Shares in ASX have performed well since the Algo buy signal in early November. If we look out 12 months, ASX should deliver revenue in FY18 of $850m and EBIT of $600m. The business is growing at around 5% p/a and management are remaining disciplined on cost control.

From an earnings per shares basis, FY18 EPS will increase from $2.30 in FY17 to $2.45 in FY18, and DPS will increase from $2.10 in FY17 to $2.20 in FY18. This places ASX on a forward yield of 4.3%.

We think ASX shares are trading at the top end of the valuation range given the compressed yield and moderate EPS growth. The upside still remains the potential of a take-over bid as global exchanges look to consolidate.

Or start a free thirty day trial for our full service, which includes our ASX Research.