BHP – 1H17 Earnings

The rebound in Iron ore prices helped BHP post a first-half profit of AUD 4.2 billion. The resource giant announced its underlying profit for the six months to December 31st surged to USD 3.24 billion from USD 412 million during the same period a year ago.

The result was slightly better than the street’s forecast of USD 3.1 billion.

The company declared an interim dividend of 40 US cents per share, which is much better than the 16 US cents it paid a year ago. This takes into account the USD 155 million charge in relation to the Samarco dam failure in Brazil.

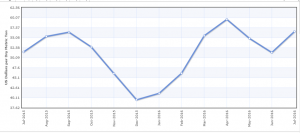

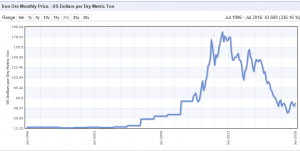

BHP’s bottom line has benefited from strong gains in commodity prices during H2 2016. Prices of Iron Ore more than doubled during 2016 on improved demand from China, while Crude Oil prices have recovered more than 40% from the multi-year lows hit in February last year.

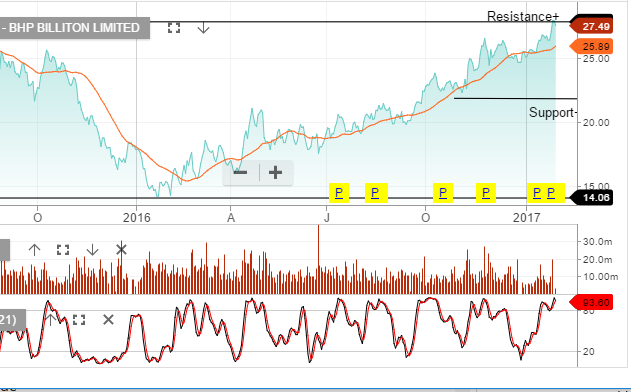

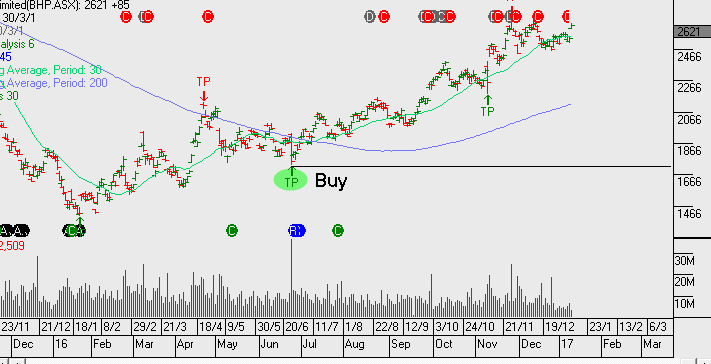

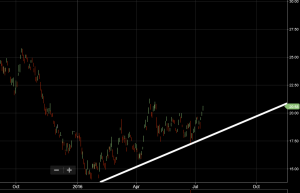

The price correlation between BHP and Iron ore is very strong. Since posting a low of $14.10 in late January 2016, the share price has followed Iron Ore higher and almost doubled; reaching a high of $27.50 on January 25th.

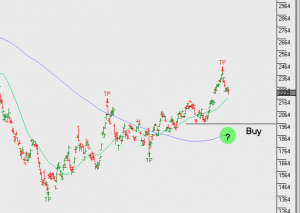

We’ve been selling $27 calls over BHP for an additional $1.00 credit per share.