BHP – Valuation & Technical Review

BHP FY17 revenue is expected to be $40b, EBIT of $12b and reported profit of $7.5b.

The earnings translate into EPS of $1.40 and DPS of $0.78 placing the stock on a 3.8% yield.

BHP FY17 revenue is expected to be $40b, EBIT of $12b and reported profit of $7.5b.

The earnings translate into EPS of $1.40 and DPS of $0.78 placing the stock on a 3.8% yield.

BHP’s recent production results were on the weak side, with lowered expectations in metallurgical coal, energy coal and copper.

The firm has cut its guidance for copper production by 2%, but has maintained their FY 2017 production guidance for other commodities. Copper and energy coal were the weakest spots, with those numbers missing analysis’ forecasts by 11% for both commodities.

Metallurgical coal output was 7% weaker than forecast, while Iron-ore and petroleum production was broadly inline with expectations.

Based on these numbers, BHP will need to deliver a significant uplift in production rates during the 2nd half of 2017 for copper and coal if the upper-end of their guidance is to be achieved.

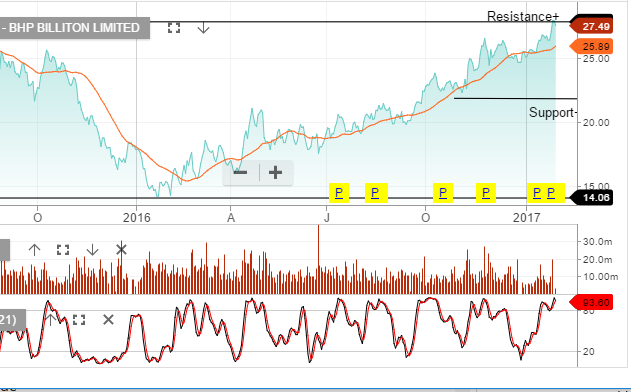

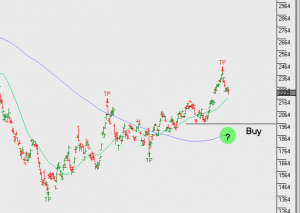

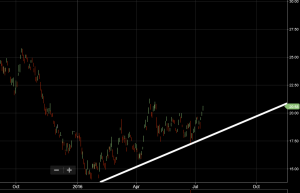

We believe that BHP is up for the task. At current prices, shares are trading on +11% free cash flow and have a positive chart pattern over the last 12 months. Despite the weaker production result, we see scope for a move to $28.00 in the medium-term.

BHP will release its 2Q FY17 production report tomorrow. We anticipate the strength in iron ore, coal and copper will likely see production tracking in-line with FY17 guidance.

The forecast for FY17 revenue of US$40b and net profit of $6.8b should generate an EPS of $1.25, which will place the stock on a 3.3% forward yield.

We remain long BHP with covered call options at or near $28 into April/May as our preferred strategy.

Copper prices jumped today as Chinese inflation data picked up last month, sending a reassuring signal about demand from the world’s largest consumer of industrial metals. China’s Producer Price Index rose 5.5% last month, which was better than the market expectation of 3.3%

The forward month red metal was up 2.9% at $2.60 per pound, posting its largest one-day gain in two months on the COMEX exchange in New York. A reduction in copper stocks at the LME will add short-term support to the upside for prices.

We expect to see firm resistance in the $2.74 area, which represents a “double top” chart pattern dating back to November.

A surprise jump in US inventory data extended the recent down move in crude oil prices. We now see solid support around the $50.00 level.

We still like the long side of oil names but feel investors should be adding covered call options to WPL and OSH to enhance the yield.

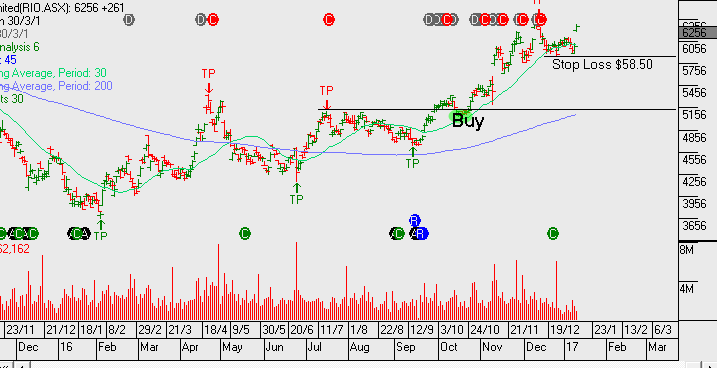

We’ve allowed upside to $27 in BHP and upside in RIO to $63 before capping out our short term gains.

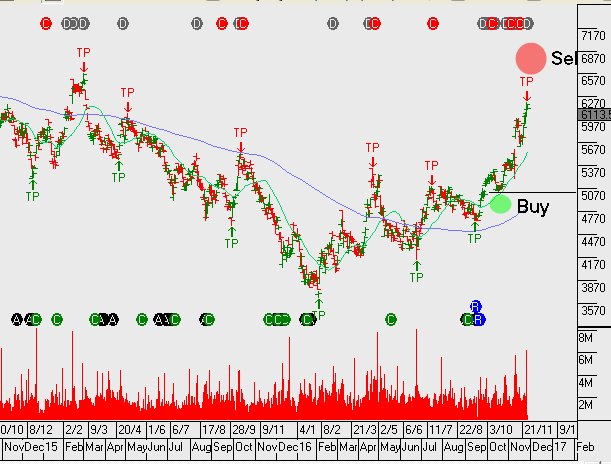

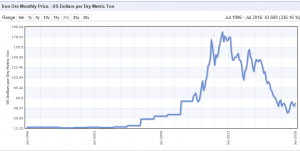

Iron Ore prices continued its two month rally last Friday and trading close to the $80.00 per ton level for the first time in over two years. According to spot metals pricing, the benchmark 62% fine rose another 3.5% to 79.60 on Friday, extending its four-day rally to an impressive 13.2%.

The benchmark price has now gained over 82% so far in 2016, and has risen 108% from the all-time low of $38.30 per ton posted on December 11, 2015. The rally corresponds to the news that Chinese policymakers had managed to remove 88 million tons of steelmaking capacity across the country since the beginning of the year.

This has help trigger gains in steel prices, along with Iron Ore.

BHP and RIO have performed well, we look to keep exposure to these names and add to the cash flow through selling covered call options.

The 1QFY17 production result for BHP was weaker than the market had expected. Weather related issues were mainly the cause.

BHP maintained FY17 shipping guidance for Iron Ore at 265-275mt. Petroleum volumes are anticipated to improve in the year ahead following recent issues with weak production from the Gulf of Mexico assets and lower shale volumes.

Forecast FY17 revenue to be in the range of $35b, EBIT of $7b, DPS of $0.50, which places the stock on a forward yield of 3%.

Many analysts have a bearish outlook for commodity prices in Fy18 and as a consequence, lower forecast EPS and DPS for the majors. Our view differs slightly and we think any pullback early next year will most likely create a solid “buy on the dip” opportunity for both BHP and RIO.

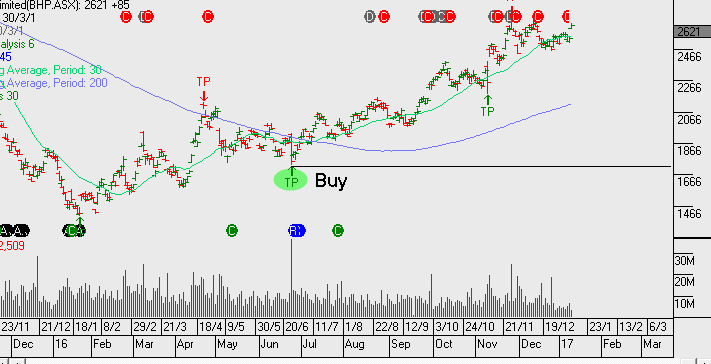

Our algorithm engines will track these and other major resource names for potential entry conditions.

BHP.ASX

In summary, BHP posted a solid result with both NPAT and EBIT beating consensus. With the final dividend coming in at US14cps, FY16 total dividends of US30cps, the total dividends for the year are below expectations. In FY17 we remain hopeful we’ve seen the bottom of the cycle for BHP earnings.

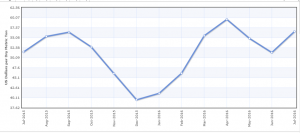

If you don’t review the graph of iron ore very often, you may appreciate the images below.

12 month close $56

20-year history.

BHP.ASX announced FY16 EBITDA $12b and underlying EBIT $3.5b. There was over $7b in impairments and management’s cost out performance in Copper, Coal and Petroleum will help to improve BHP’s earnings and cash flow into FY17 and FY18.

On forward basis we have BHP in FY17 paying out $0.35 DPS, placing the stock on a 2.2% yield.

No signal present: We currently hold BHP in the model and have sold Nov $22.50 calls to enhance the return.

Rally in Resources

As discussed in the July video market update report, I forecast that money was in the early stages of rotating back towards the banks and resources. We’re now seeing this reflected in strong momentum within BHP and RIO. It’s likely that this trend will help lift the energy names as well.

Or start a free thirty day trial for our full service, which includes our ASX Research.