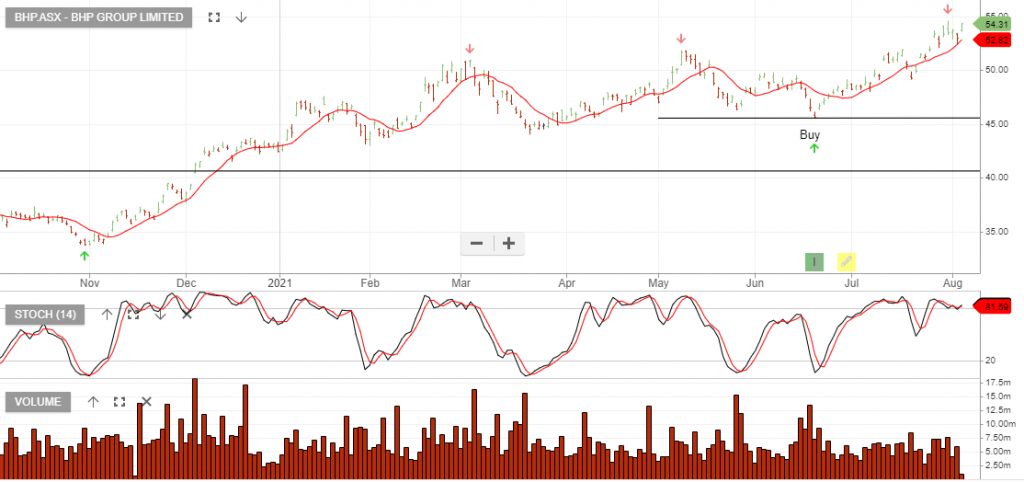

BHP – Algo Buy Signal

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Declining port stocks and concerns over Brazil supply support a positive outlook for iron ore prices. A combination of strong iron ore prices and the recovery in the energy complex should continue to support the BHP share price.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy BHP at $39.00

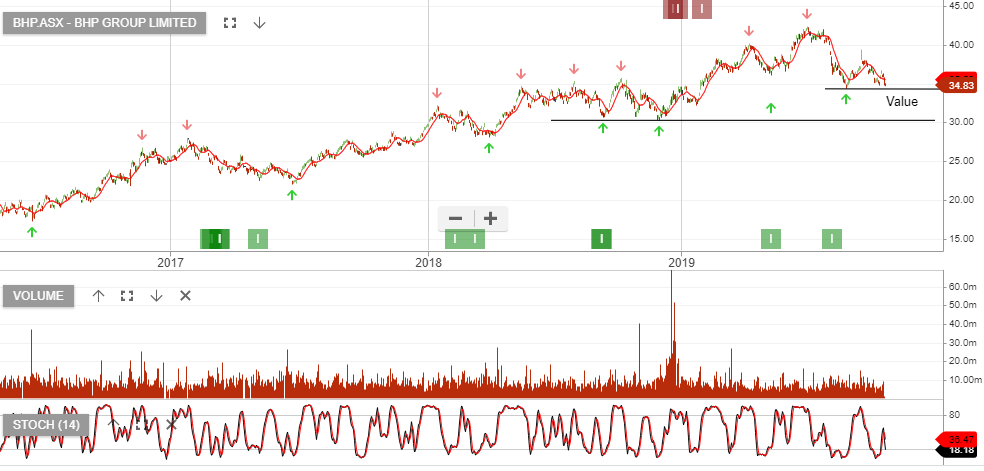

BHP Group is under Algo Engine buy conditions following a switch in May 2019.

Strong cash flow should allow BHP to lift its dividend payout ratio or consider a new off-market buyback.

BHP goes ex-div $0.80 on the 7th March.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

BHP outlined earlier this week its outlook for the Petroleum business, which includes an increase in capital spending and plans to double production by 2025.

FY21 revenue remains flat, EBIT the same as FY20 at $19bn, which supports DPS of $1.55 per share placing the stock on a forward yield of 5%.

The market is negative on the outlook for Iron Ore prices, with extra supply hitting the market in 2021, however, if spot prices stay where they are analysts will have to upgrade the earnings outlook. 10 to 20% upgrade in earnings will support BHP trading back over $40 per share.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We recommend buying BHP.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The company reported Q1 production that was below analyst forecasts. The impact was most significant in copper where production was down 9%. Iron production was down 2% and thermal coal was also lower.

Despite the soft quarter, BHP reiterated its full-year production guidance.

Based on FY20 revenue of $43bn, EBITDA $25bn, net income $11bn, we have BHP trading 15x forward earnings and 4.5% yield.

Accumulate BHP within the $30 – $34.50 price range.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The company announced its FY19 earnings, which were in line with consensus expectations. Operating costs are slightly elevated but high iron ore prices will offset this in FY20.

FY19 reported EBITDA US$23.2bn and underlying attributable profit of $9.1bn. The market was disappointed that no buyback was announced but BHP did declare a final div of US$0.78 per share.

Total dividends for the year were US$1.33 per share, based on 74% payout ratio.

FY20 revenue is forecast to be $48bn, EBIT $19bn, net profit $11.5bn, which will place the stock on a 10x PE multiple and a forward yield of 6.5%.

We see value support for BHP & RIO near the current price range.

Or start a free thirty day trial for our full service, which includes our ASX Research.