Carsales.com – Approaching Resistance

Carsales.Com is under Algo Engine sell conditions and with the price approaching $14 we expect selling pressure to build.

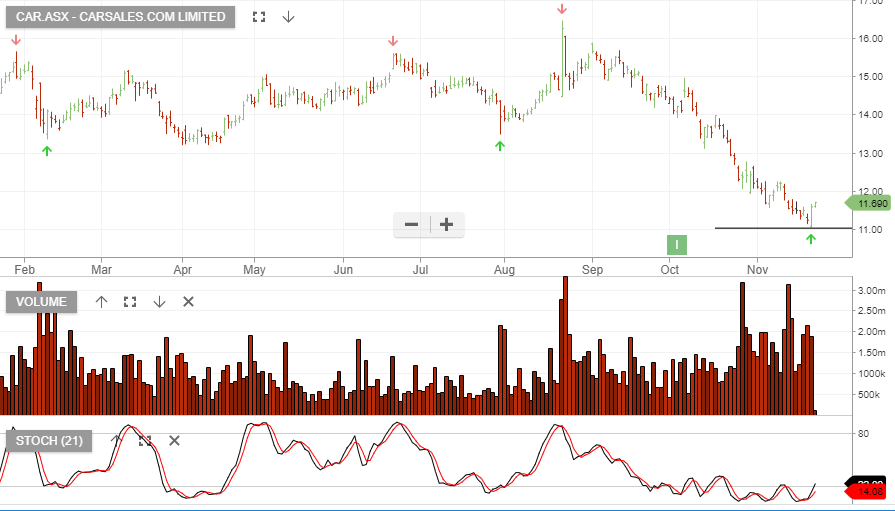

The chart below illustrates the range where selling is likely to increase.

Carsales.Com is under Algo Engine sell conditions and with the price approaching $14 we expect selling pressure to build.

The chart below illustrates the range where selling is likely to increase.

We consider the 2019 recovery rally in the below names, as now largely complete.

The post below is from the 14th of November.

GARP is an acronym which is referenced to “growth at a reasonable price”.

This is how we now view ALL, TWE, CAR and SEK.

CAR is one of the “GARP” (growth at a reasonable price), names that we’ve been tracking.

With the stock bouncing off the $11.00 price level, we suggest running a tight stop-loss below the recent “pivot low” and giving the upside momentum a chance to develop.

Within the back drop of market volatility, it is difficult to know how this trade plays out in the short-term. Therefore, we highlight the need to run a stop loss.

We consider ALL & TWE as similar technical opportunities.

Carsales.com

Our Algo Engine generated a buy signal in Seek and we’re now watching the $17.50 support level as a pick up in buying interest begins to occur.

CAR is another name to watch for increased buying activity following the recent sell-off.

TWE, SEK and CAR are all displaying current Algo Engine buy signals and are therefore a holdings within our ASX100 model portfolio.

We recommend accumulating TWE stock within the $14.50 – $15.50 price range.

‘

‘

Seek is another name where above average EPS growth is likely to be achieved in FY19 & FY20. We recommend accumulating the stock within the $17 – $18 price range.

CAR delivered a disappointing earnings update earlier this month, however, with the stock price correcting 25%, we now see value emerging.

CAR Reported 1H EPSg of 5%, is the current 22x P/E sustainable?

Assuming an acceleration from 5% EPS growth to 10% EPS (big ask) in the next 12 months it will place CAR on a 3.5% yield. We’ve seen other high PE stocks negatively rerate such as TPG and I think some caution and close watching of the earnings trend in CAR is required.

Global tech players such as eBay, gumtree, facebook etc are becoming more active in CAR’s business space. This may be part of the reason EPS growth is dropping off.

Or start a free thirty day trial for our full service, which includes our ASX Research.