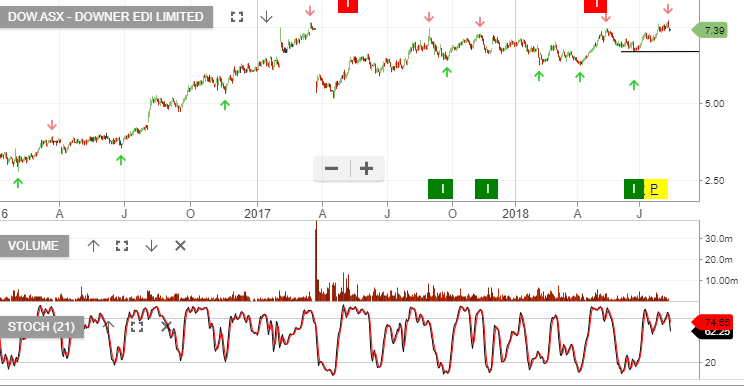

Our ALGO engine triggered a buy signal in Downer EDI on June 25th at $6.74.

Since then, the stock has reached an intra-day high of $7.30 on July 10th.

Recent broker notes have been bullish on the Engineering and Construction sector citing a high backlog of domestic infrastructure work.

The strong results for Cimic Group last week underscore this uptick in construction activity, in general.

More specifically, DOW got a lift last week after announcing it had won a 5-year support and maintenance contract with Chevron Australia.

We believe DOW is well placed to benefit from the dual tailwinds of increased infrastructure spending and a ramp up in capital spending from the mining sector.

DOW will report full-year results on August 16th. The forecast is for NPAT to increase to $295 million and the dividend per share to rise to 14.4 cents.

We see solid chart support in the $6.90 area and initial upside resistance just over $7.65.

Downer EDI

ASX:DOW

ASX:DOW