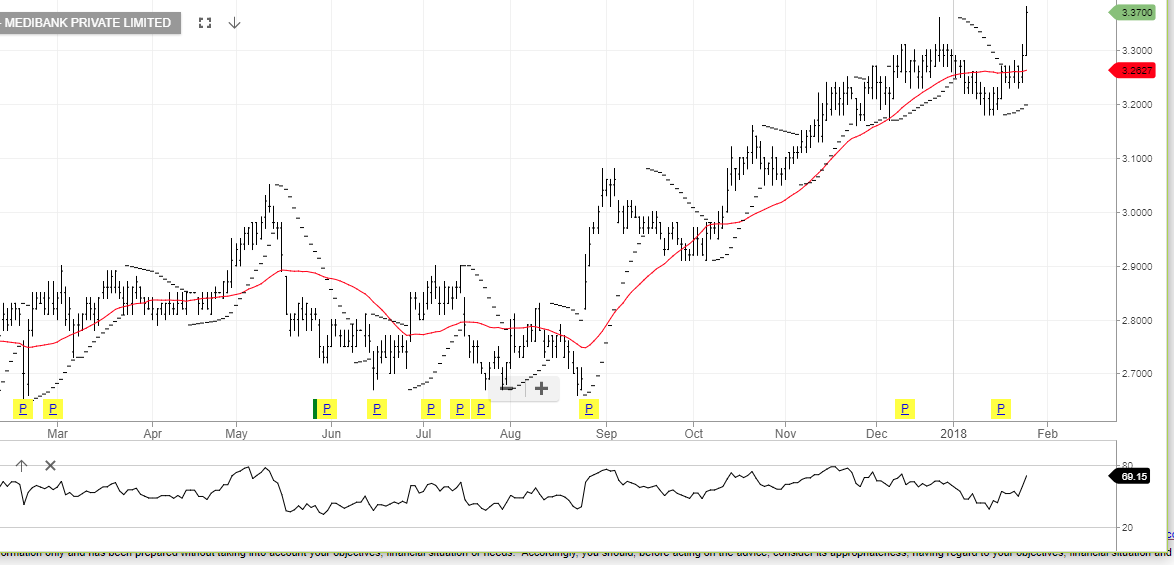

Medibank Delivered 1H18 earnings

Medibank delivered 1H18 NPAT of $245 million, which is an increase of 6% versus the same time last year.

Operating conditions are expected to remain largely unchanged and we expect revenue and underlying profit to remain flat in FY19.

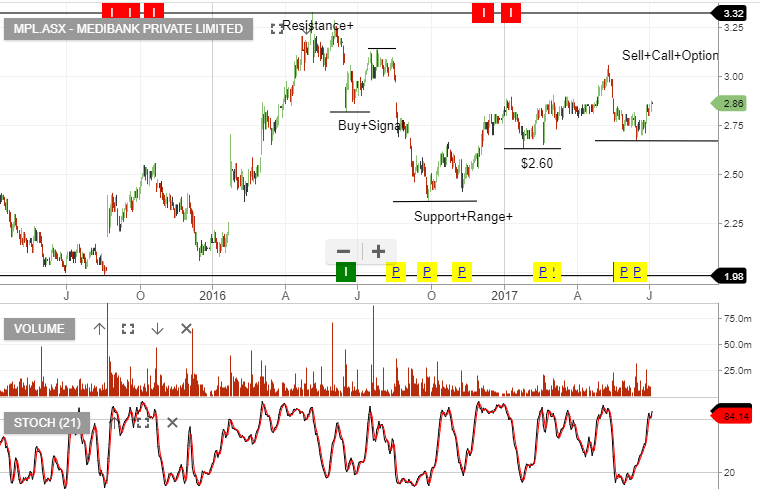

With the stock trading 20x earnings and 4.1% yield, investors should add an at-the-money-call option to strip out the maximum cash flow from dividends, call option premium and franking credits.

Medibank