Shares of Macquarie Group posted an all-time high at $98.28 in early trade on a solid half-yearly result and the announcement of a $1 billion share buyback scheme.

The bank’s net profit for the six months to September 30th was up 19% at $1.25 billion, while net operating income was up 3.4% to $5.4 billion.

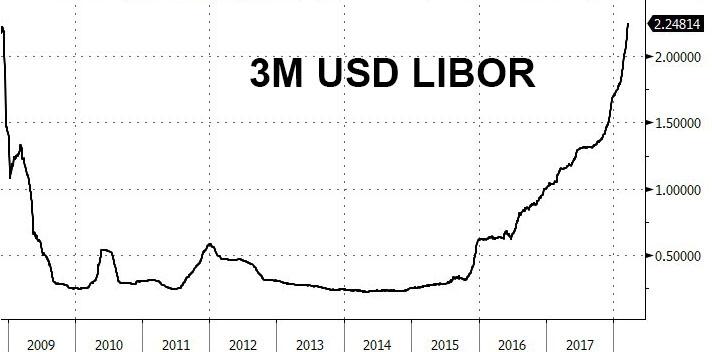

A key driver of the report was a 17% rise in fees and commission income from their US debt capital markets business.

It’s expected that the bank’s full-year results will be inline with last year’s $2.2 billion result, which means second-half could be slightly lower.

The interim dividend was lifted by 15 cents to $2.05 per share, 45% franked.

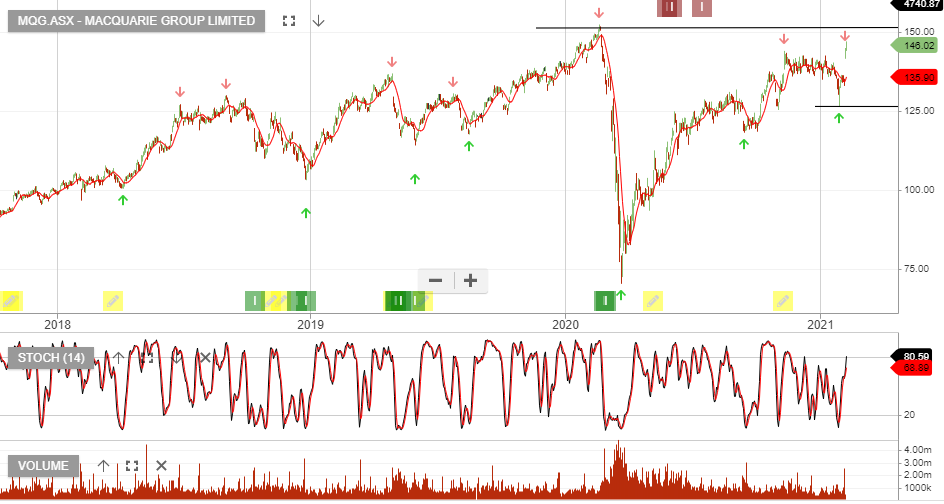

From a technical perspective, the sharply higher open has left a $2.00 gap from yesterday’s high of $94.39 to today’s low at $96.53. Typically, price gaps are filled but we don’t expect that to happen during today’s session.

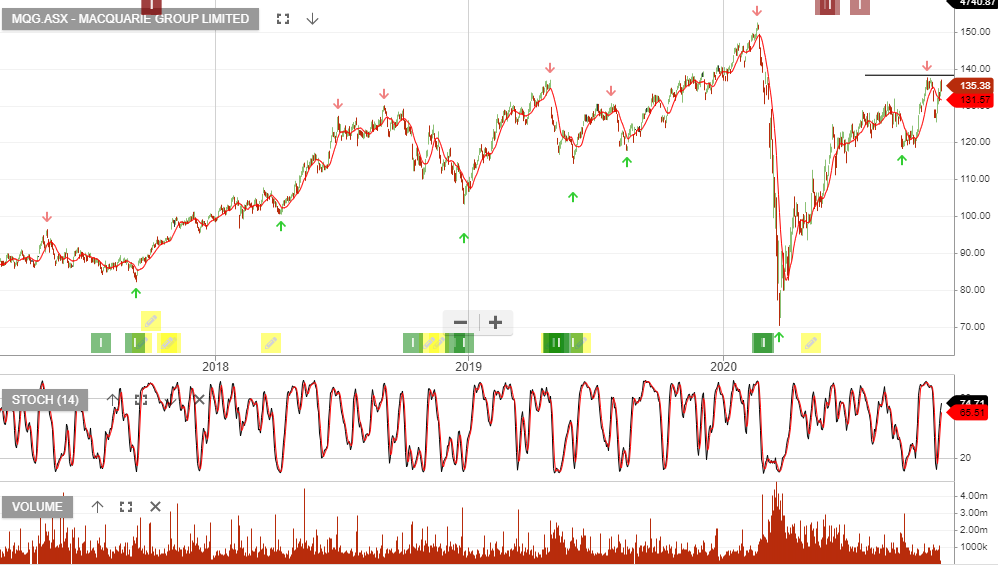

Macquarie Group