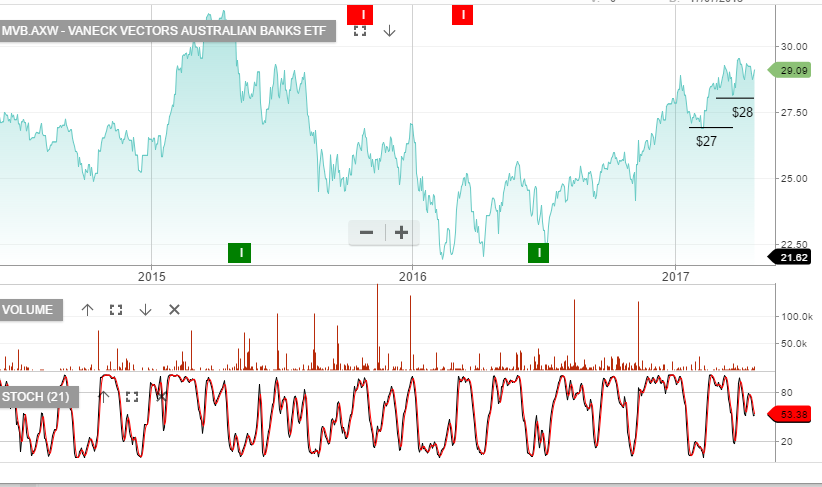

Australian Bank Earnings

On 2nd May, ANZ will report their half-year earnings. The market is expecting a net profit of around $3.7b and DPS for the half year of $0.80.

4th May, NAB will report their half-year earnings. Net profit should be around $3.4b and DPS of $1.00.

5th May, Macquarie Bank reports. Net profit is expected to be similar to last year at $2.15b and DPS of $2.52

8th May, WBC report their half-year result. Net profit should be $4b and DPS $0.95

On average, the market is looking for approximately 3% underlying EPS growth among the banks and dividends to remain steady, or the same as the previous 12 months.