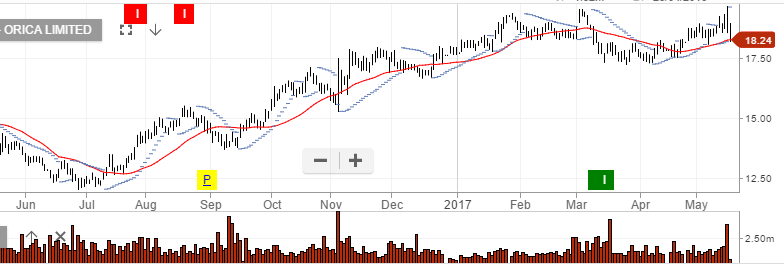

Algo Update – Orica Short

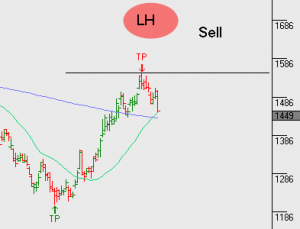

Last week on the blog we looked at the short signal on Orica leading into their earnings result.

1H18 earnings were announced yesterday and they disappointed, with a 37% drop on the same time last year.

NPAT of $124m where as consensus was looking for $149m.

The share price dropped over 5% and reached an intra-day low of $18.70 before recovering to $19.00.

This was a very popular “short” CFD trade on our SAXO Go trading platform; we suggest taking profits on the short ORI position near the $19.00 area.

Orica