SEEK – Valuation Review

SEEK provided a trading update at its AGM yesterday, upping its guidance for

EBITDA growth to 13% and reaffirming NPAT guidance of $220-230m.

FY18 Revenue $1.3b, EBIT $340m, EPS $0.63, DPS $0.44, placing the stock on a forward yield of 2.4%.

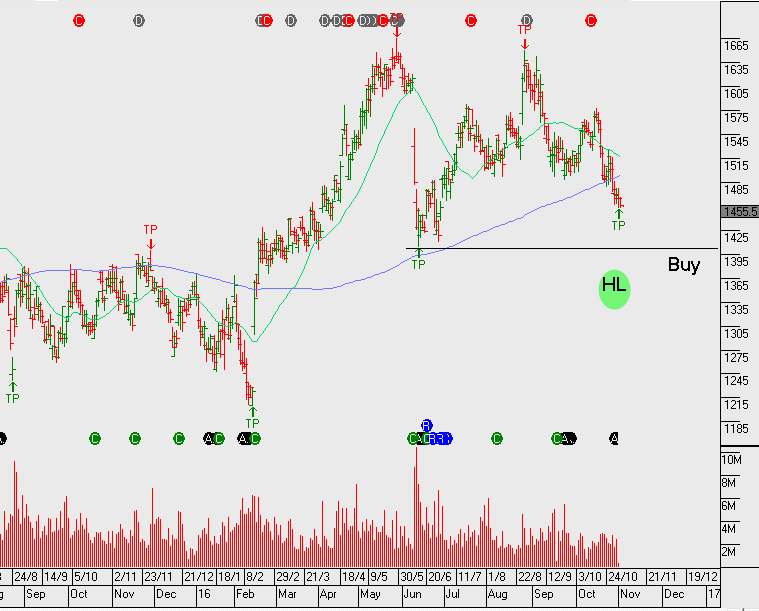

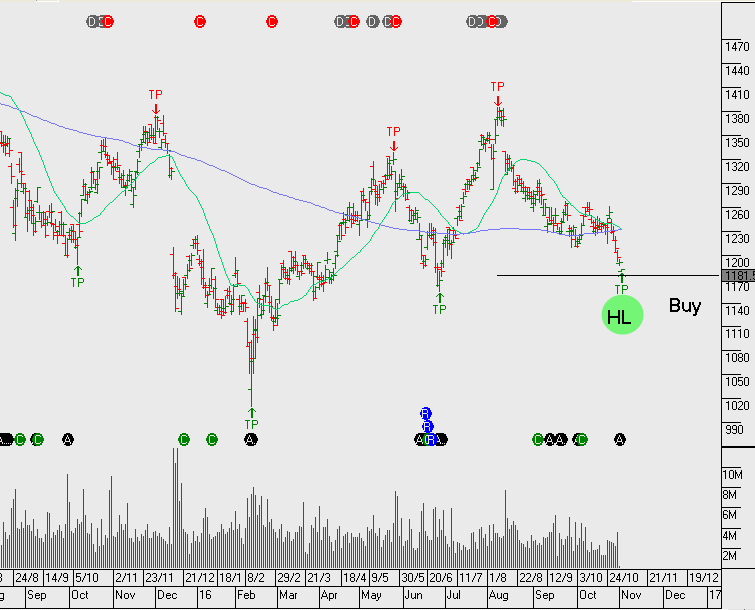

Our Algo Engine last triggered a buy signal back in June, when SEEK was trading at $16.40. A pullback to $17 will provide a lower risk entry level.

SEEK