Yield Names Get A Boost From Lower US Rates

As US 10-year bond yields pull back from recent highs, shares in local yield sensitive names have been lifted off their recent lows.

The inverse correlation between US interest rates and GPT, SYD and TCL has been acute over the last 3-months.

Since January 1st, US 10-year yields have risen over 20%, climbing from 2.40% to reach a 4-year high of 2.95% last week.

During this same period, the share prices of GPT, SYD and TCL have all dropped by over 10%. However, both SYD and TCL gained over 2% on Friday.

It’s our base case that the US 10-yrs will find resistance at the 3% level and offer upside price action in the local yield names.

All three of the above names are included in our ASX Top 50 model portfolio.

We expect to see price appreciation in the 4% to 6% range over the near-term as US yields retrace lower.

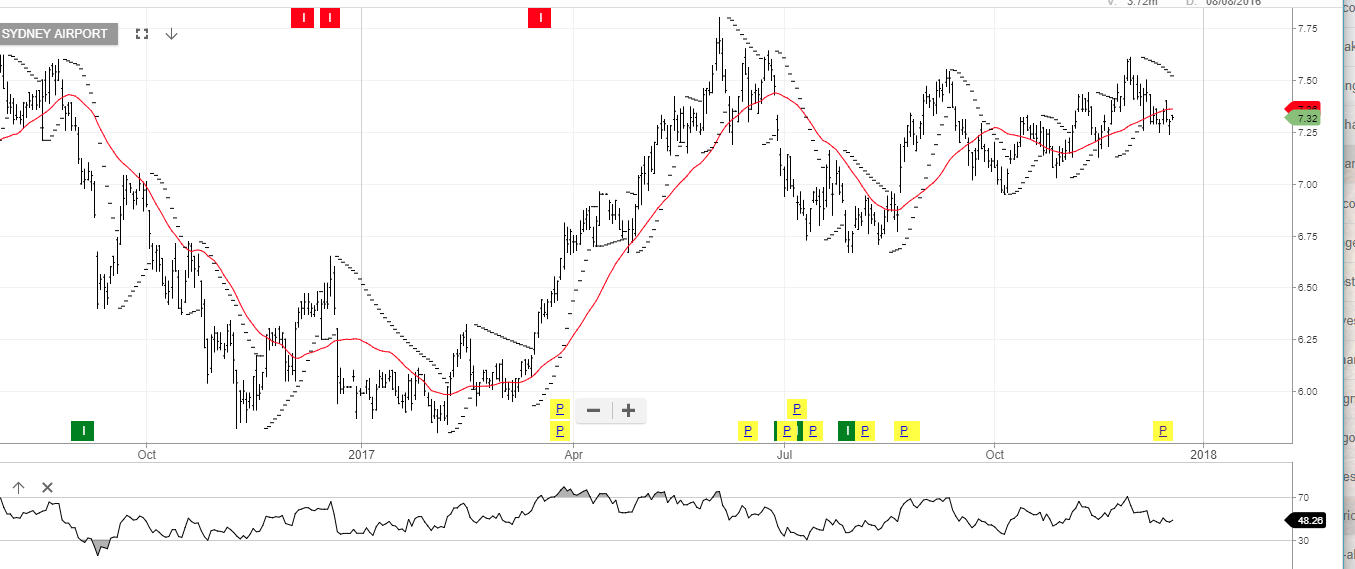

Sydney Airport

Sydney Airport

Transurban

Transurban

Sydney Airports

Sydney Airports