Global Macro

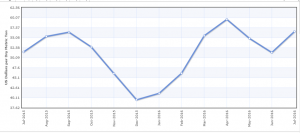

The USD has started the new week with a bid tone after last week’s steady hammering. Looking back to last week, the Greenback reached multi-week lows against the Euro, British Pound, Swiss Franc, Canadian Dollar and the Japanese Yen. On balance the losses averaged around 1.5% but what made the weakness so significant was its relentlessness.

For example, the USD/CAD and USD/JPY did not post one session of gains while the EUR/USD traded higher everyday except Friday.

However, the technical reversal pattern in the USD Index on Thursday and Friday suggests this week could be much better for the USD. The dominate technical pattern in the USD Index has been the retracement from the 91.80 low in early May to the .9760 level posted on July 25th. In this analysis, the 61.8% Fibonacci retracement at 94.10 held to the tick last Thursday and then rallied on Friday. As a result, the RSI and stochastics have turned higher suggesting a potential to reach the 95.60/80 range in the near-term.

Since the EUR/USD makes up close to 58% of the USD Index weighting, the technicals suggest the single currency should trade lower. Fundamentally, there’s quite a bit of market moving data from the Eurozone this week including the second quarter GDP revision on Wednesday and the German IFO report on Thursday. In addition, considering the UK PMIs all printed lower recently, FX investors will be watching Tuesday’s Eurozone PMIs for Brexit related weakness.

On balance, the EUR/USD picture is turning negative.